(Last updated on January 9th, 2023)

Xero or QuickBooks, which software should you choose in 2023?

Read this ultimate Xero vs. QuickBooks comparison to make a smart decision.

This is a tough comparison to make. Xero and QuickBooks are the two gorillas in the online accounting software sector. Both of them are web-based, specifically designed for the needs of small businesses, and offer similar functionality as well as similarly stepped pricing packages and access to mobile apps on both Android and iOS devices.

Either of these programs would be the right choice for a small or growing business. Both provide invoicing, connection to your bank, inventory, sales tax, and asset management modules, as well as a bank of reports. Both access business accounts through a dashboard to give you a quick and easy-to-understand view of how your business is doing.

But while either could do the job, we’ve set out to assess which one of the two is the best. We’ve run the software, we’ve looked at reviews, and we’ve looked at user comments, and we’ve broken our assessment down across various headings so you can clearly see how we arrived at our verdict.

Note: Remember that QuickBooks Online is not the full desktop version of QuickBooks. It doesn’t have all the features. For instance, the desktop has lead management functionality, a significantly larger bank of standard reports, and sales orders.

QuickBooks Online also doesn’t have the industry-specific versions you can get with the desktop version. Whenever we refer to ‘QuickBooks’ in this article, we’re talking about the QuickBooks Online.

Comparison At a Glance

1. Features

Winner: Tie. Both have top-notch feature sets. QuickBooks offers a bit more in some areas, for instance, with e-commerce support, budgeting and multi-currency functions while Xero has better features for project management and time tracking.

2. Pricing

Winner: Tie. QuickBooks costs in for business with complex accounting needs and relatively few users while Xero offers unlimited users but has functionality limitations on its lower-priced packages.

3. Ease of use

Winner: Tie. QuickBooks has a steeper learning curve, but many functions can be invoked in fewer keystrokes. Xero has a more straightforward and less cluttered interface, but some advanced features are tricky to find and use.

4. Mobile Apps

Winner: QuickBooks. Both packages have mobile apps, but QuickBooks is reportedly more reliable. We particularly like the ability to file expenses on the go.

5. Integrations

Winner: Xero. Both packages support multiple integrations with apps such as CRM and direct mail, but Xero supports integration with significantly more third-party apps.

6. Customer Support

Winner: Tie. Both Xero and QuickBooks offer responsive customer support with a plethora of online training and reference materials.

7. Setup

Winner: Tie. QuickBooks allows you to set up only functionality that you need and add other functionality later. Xero has to be set up as a complete system from day one. Pick the approach that works for you. Both are equally easy to set up.

8. Reports

Winner: QuickBooks. This is the category where QuickBooks shows its worth. It has more standard reports, and they are easier to customize.

Short Verdict

QuickBooks Online just edges out Xero as our winner. But it’s a very close competition. In fact, Xero does better for some types of business – it’s strong in support for consulting and IT, for instance.

Both QuickBooks and Xero are made for small business owners, not for accountants. Accounting jargon and double-entry book-keeping are pushed firmly into the background, and the presentation is user-friendly and businesslike. Both offer a seamless online experience, are available through a number of different browsers, and have mobile apps helping road warriors file expenses and keep on top of the business while on the move.

Both connect automatically to your business bank account, and also integrate with literally hundreds of other apps for payroll, inventory management, CRM and other business functions.

We found Xero a little easier to use for basic needs – the layout is less cluttered and clearer. Where it falls short is complex accounting and reporting; for instance, QuickBooks supports lending, and lets you run advanced reports on aged receivables by customer. The more sophisticated your requirements, the more difficult it becomes to service them with Xero.

1. Features

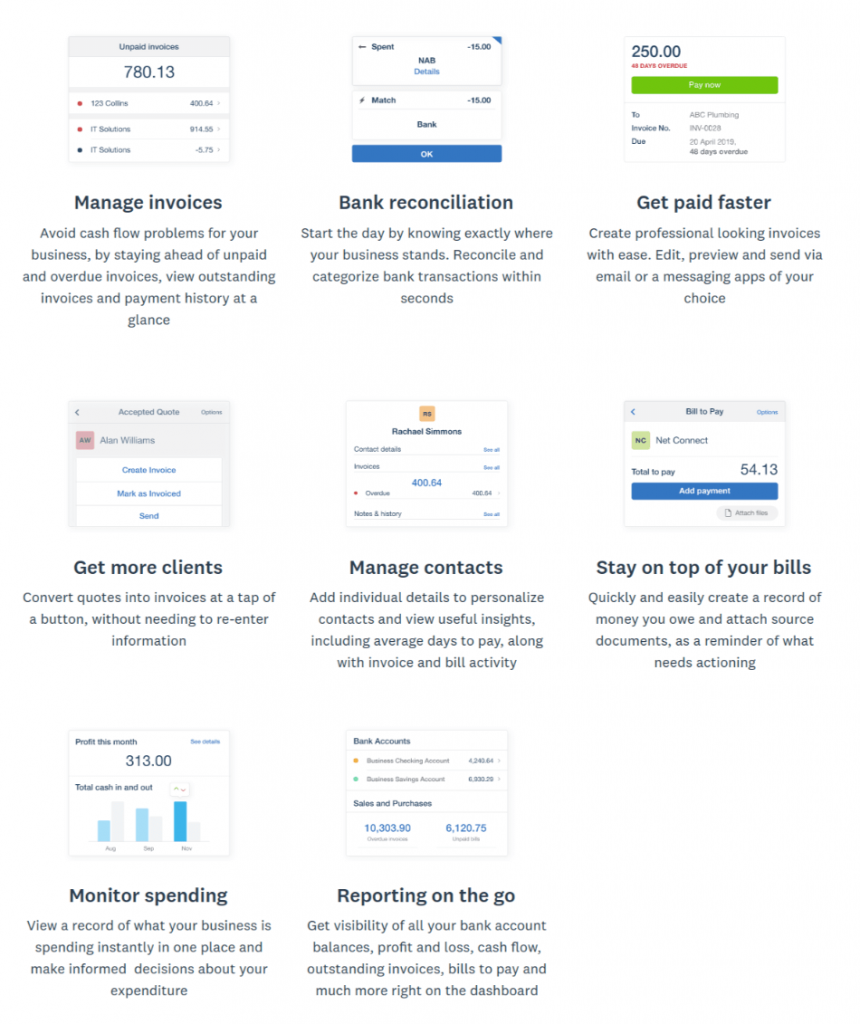

The basic features set is similar across both systems: they both support

- invoicing

- expenses payment

- bank reconciliation

- budgeting

- contact management

- inventory

- time tracking

- budgeting

- check printing

- multi-currency support

- import/export capability to/from spreadsheets and CSV files

- sales taxes.

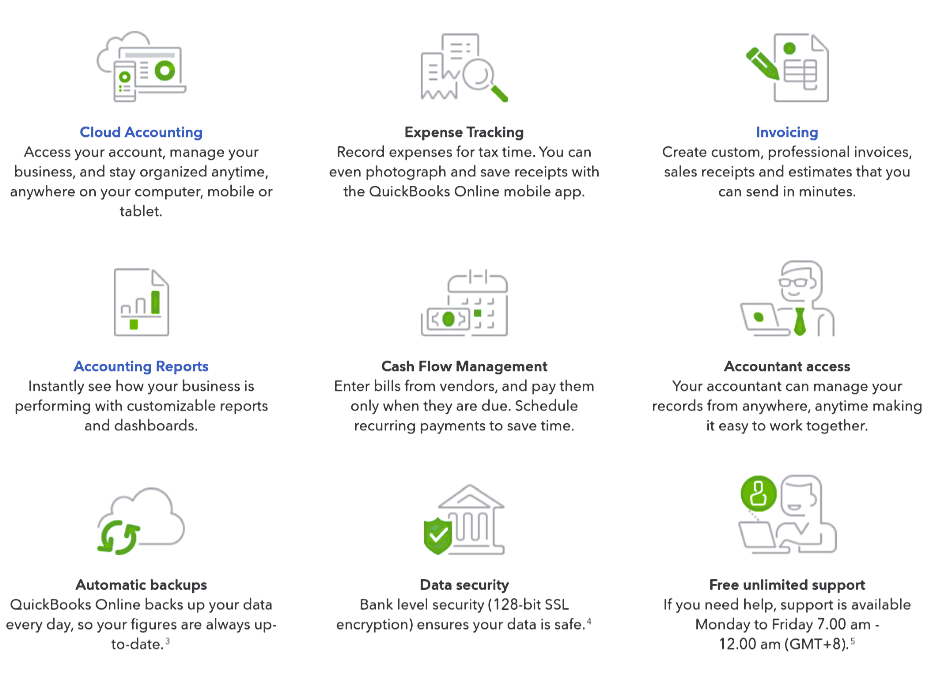

The feature set is very similar. Neither offers payroll – you’ll need to add a payroll module to your accounts if you have employees. For QuickBooks, that will probably be Intuit Payroll (budget another $18-$40 a month), and for Xero, it’s Gusto at another $40 a month.

QuickBooks has a couple of features that Xero doesn’t. While both cover sales taxes, only QuickBooks offers full support for taxation on your profits, including help for you to maximize your tax deductions, and tax reports for your accountant. It also has a little more flexibility on invoicing, enabling you to add notes or terms on the invoice – particularly useful for B2B businesses. (Xero lets you add notes, but for some reason doesn’t print them out.)

QuickBooks can also track workers and contractors. If you use a mixture of employees and contractors or outsourcing, this is a powerful feature, available in all the plans except Simple Start.

QuickBooks has a robust budgeting feature which is accessed through the Tools menu. It allows you to make monthly budgets for up to five years, and to track performance. Multi-currency support is another strength; you have to choose one ‘home’ currency, but you can associate a currency with each customer, bank, and vendor. For instance, you have one European supplier and have already associated it with the Euro, and all your payments will automatically be in euros without your needing to take any further action. For businesses with international sales or supply chains, this top-notch feature can significantly save time.

Xero also offers multi-currency support, but this feature isn’t automated in the same way. Its budgeting feature, rather awkwardly, sits in Reporting; overall budgets, as well as departmental and project budgets, can be imported/exported from Excel or as CSV files.

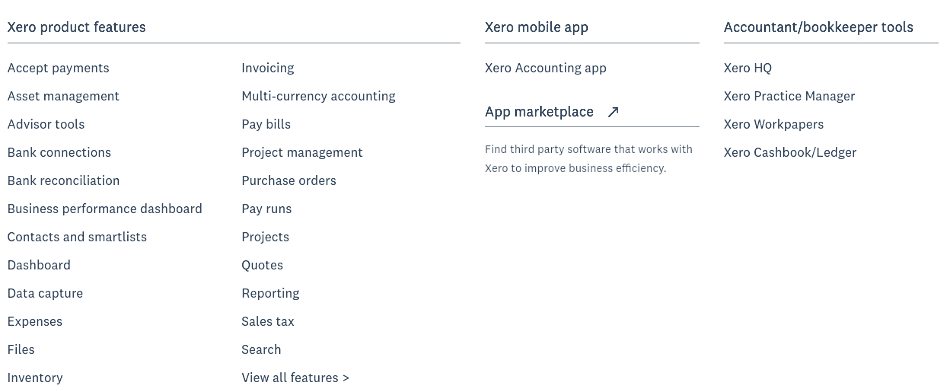

Its strengths are its project management capability, together with some great features for specific verticals including IT, retail, e-commerce and legal businesses. Its expense tracking is another strength – expenses can be assigned directly to customers, again useful for consultants and professional businesses – but this functionality is only available in the higher-priced packages. And time tracking, vital for businesses running on the billable-hours model, is only served in the ‘Established’ package.

Bill payment is easy in both QuickBooks and Xero. We find it slightly more intuitive in Xero, particularly for recurring payments such as rent, insurance, utilities and even your Xero subscription. These are standard in Xero, and you can set up a payment as recurring from the get-go.

In QuickBooks, recurring payments only come in the higher-priced packages, and you can’t create a recurring payment – you have to make a one-off payment and then mark it as recurring, which is a bit clunky.

Xero also wins on asset tracking – it will handle depreciation automatically, and processes disposals, whereas in QuickBooks you’ll have to do it all by hand.

E-commerce businesses are supported, but while QuickBooks includes credit card payment functionality, Xero doesn’t. Instead, it supports PayPal and other online payment providers. Depending on your customer base and the way you sell (for instance, through Etsy or eBay) that might work well for you, or not.

Winner: A tie

2. Pricing

Both QuickBooks and Xero are available as monthly plans with a tiered series of packages.

QuickBooks tiers its four different plans primarily by the number of users, from a single user plan to a maximum 25-user for the top-priced plan. Additionally, some of the more advanced features are only available with more expensive suites. There are no limits on the number of transactions, though the ‘simple start’ plan is limited to 250 accounts.

| Plan | Price per month | Users |

| Simple start | $25 | Single user |

| Essentials | $40 | Up to three users |

| Plus | $70 | Up to five users |

| Advanced | $150 | Up to 25 users |

The table shows the basic price per month. However, discounts of 50% for the first three months are available to new users. There is also a 30-day free trial, which includes an already installed sample company’s accounts so you can try the various features without having to enter all of your data.

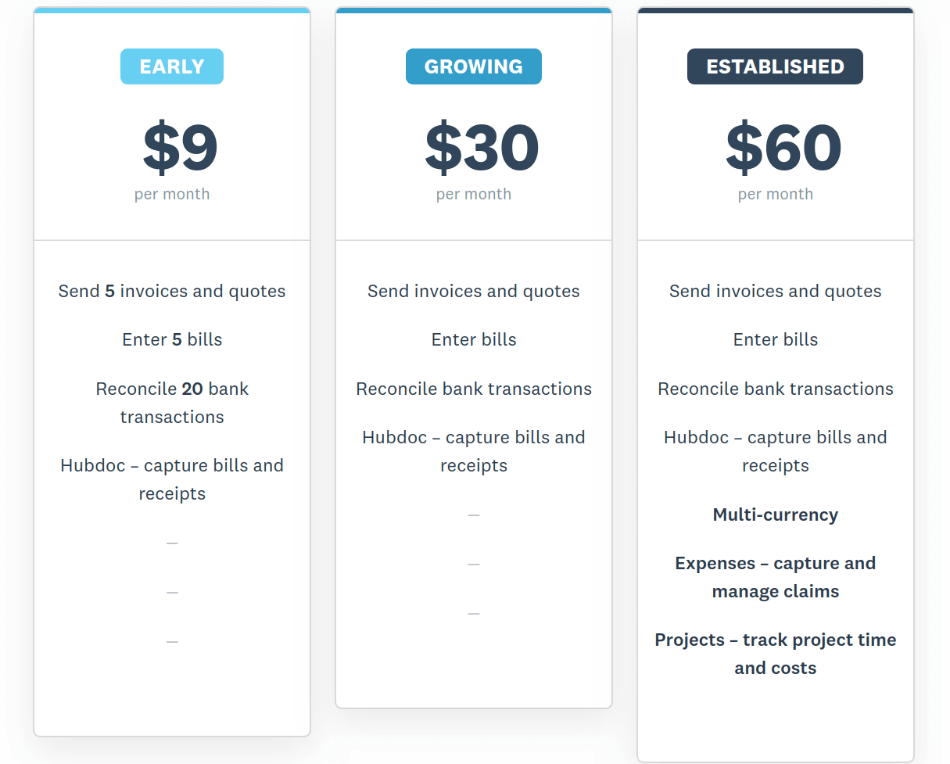

Xero has three plans; all of them support unlimited users. That’s a significant difference from QuickBooks, so if you want access for multiple dispersed workers or salespeople, or your accountants and tax advisors, Xero might cost in for you. On the other hand, the limits on transactions and functionality in the most basic package are severe.

| Plan | Price per month | Limits |

| Early | $9 | 5 invoices/quotes 5 bills 2 banking transactions |

| Growing | $30 | No multi-currency no expenses tracking no project tracking |

| Established | $60 | All-in |

Again, significant discounts on the first three months’ subscriptions are available for new users, and there is a 30-day free trial with pre-populated data.

Frankly, the ‘Early’ plan is not worthwhile for most businesses owing to the tight limits. For unlimited invoicing, you’ll need to go to ‘Growing’, which is the minimum package we’d recommend.

Winner: A tie. QuickBooks is good for up to 5 users, particularly where businesses are employee-light but have advanced accounting needs such as multi-currency, but if you have a larger number of users, Xero costs in.

3. Ease of Use

Both these programs were developed specifically for small business customers, and they relegate accounting processes and ledgers to a behind the scenes function. You won’t need to do journal entries or double-entry accounting yourself. They use plain English, not accounting jargon, and the layout is clear and easy to grasp.

Both let you set up products and services and map them to appropriate headings in the chart of accounts – which sounds more complicated than it actually is. By mapping them across, you keep your accounts tidy and easy to read, but you’re still able to run reports on detailed sales breakdowns and drill down and see which products are doing best.

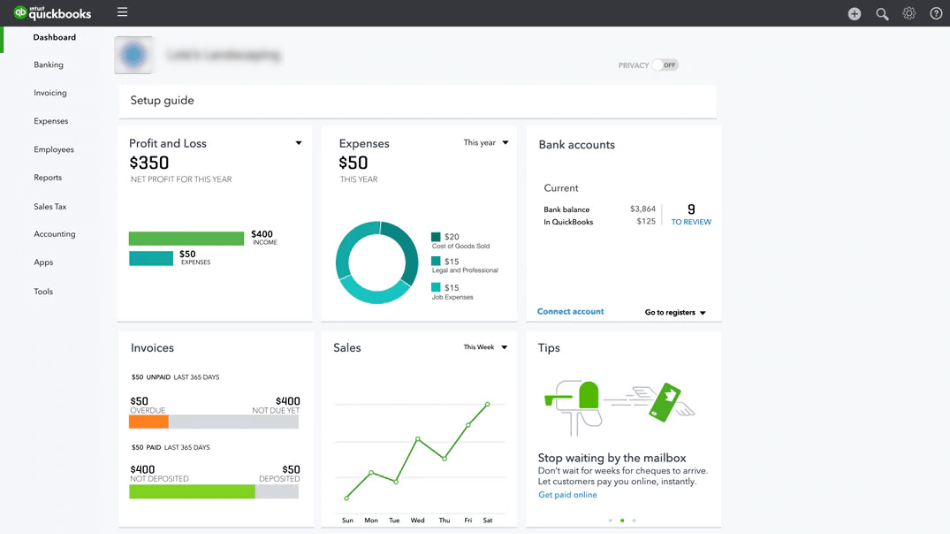

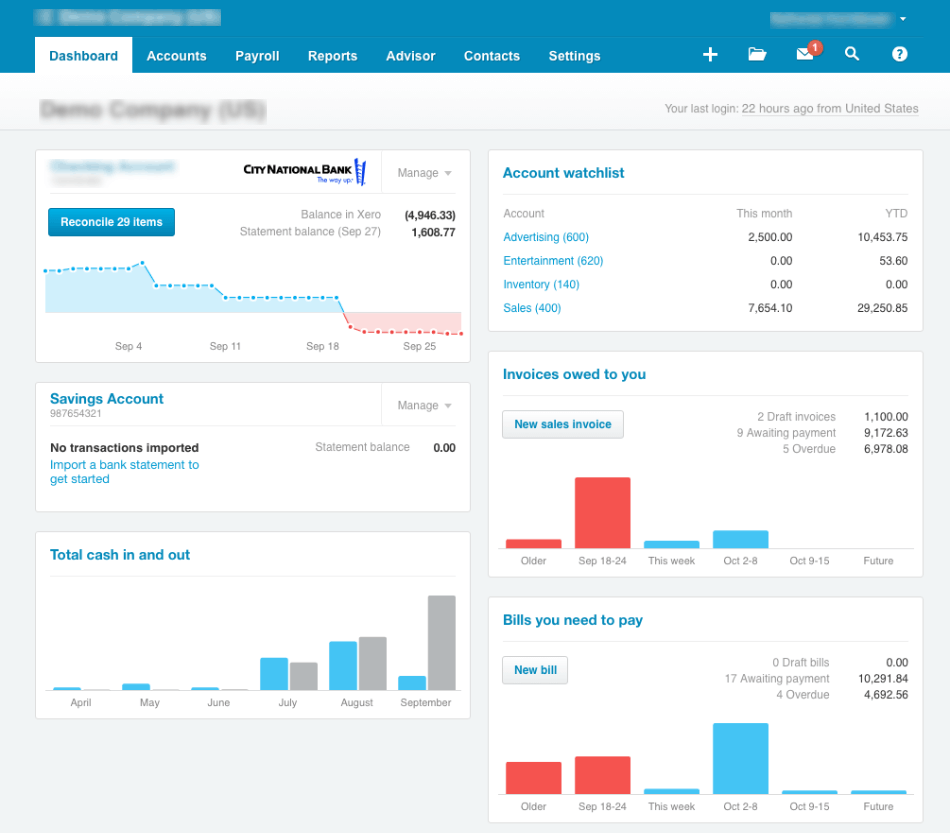

And both start with a dashboard, which shows the overall figures and lets you navigate to more detailed views of the accounts or different input types. In both cases, you can customize the dashboard extensively, too.

QuickBooks has some neat functionality to make your life easier. For instance, you can photograph receipts on your smartphone and enter them into QuickBooks remotely – really useful if you’re on the go. On the downside, the default dashboard is rather busy, and some features are hard to find: Budgeting, for instance, hides under the ‘Tools’ heading. Once you find them, they are easy to use.

Xero’s dashboard is more open and less cluttered than the QuickBooks version, and for basic operations, the workflow is often more straightforward and more streamlined. QuickBooks has a bit more of a learning curve – if you have simple needs, Xero is your way to go, but when you have a more complex business, it can be worth getting stuck into QuickBooks.

Xero’s contact management area manages customers, vendors, and contractors all in one location. But adding new accounts is not as easy as in QuickBooks (where accounts can be added from online banking – find the transaction and then simply add the account). With Xero, you have to add new accounts in the Accounts chart first, which takes a bit more time.

Both packages automatically connect to your bank account and perform automated bank reconciliation. However, QuickBooks is marginally easier to use as it flags up all unreconciled items for your attention.

Winner: A tie

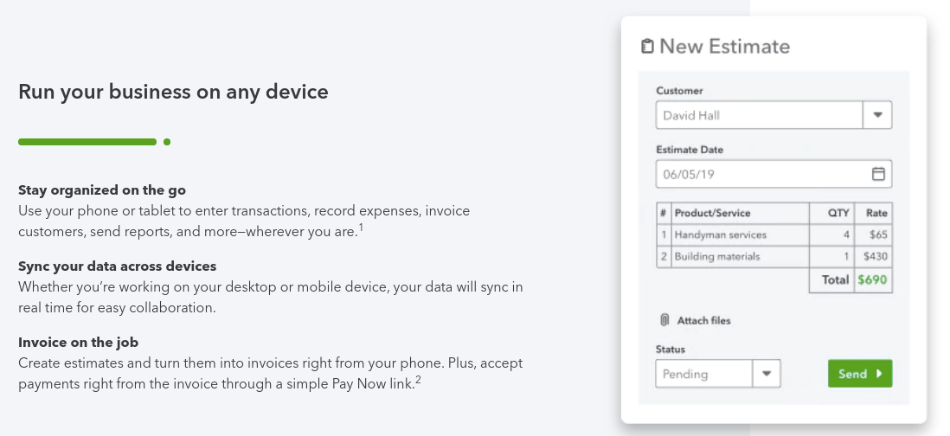

4. Mobile apps

Both applications have mobile apps. However, the apps are limited compared to the full version. QuickBooks iOS and Android apps let you invoice on the go, which can help keep inventory moving if you sell to retail. Contacts and expenses can also be captured via the mobile app. Xero offers similar functionality, but a few customers complain that the apps aren’t reliable – they can crash unexpectedly.

Winner: QuickBooks

5. Integrations

First of all, let’s consider the primary issue concerning the type of browsers you can use with each program. Apart from a few details, the two applications are pretty similar – you can use them on most of the major browsers. Generally, the latest two versions of each browser are supported.

| Xero | QuickBooks |

| Google Chrome | Google Chrome |

| Internet Explorer 11 | Mozilla Firefox |

| Mozilla Firefox | Safari |

| Safari | Microsoft Edge |

| Microsoft Edge |

Both applications have good support for import/export to Excel spreadsheets and CSV files. For instance, Xero can import your contacts list as a CSV file.

Integrations with other software differ. QuickBooks has a number of in-house add-ons such as TSheets, but it also has 550 integrations with other programs. Xero integrates with over 700 third-party apps.

Both support the majority of the major apps. For instance, you won’t have a problem integrating with Salesforce whichever accounting package you choose, though you may need a third party integration app. E-commerce app Shopify is supported by both Xero and QuickBooks.

On the other hand, if you want to integrate your accounts with email marketing, Xero appears to prefer MailChimp while QuickBooks goes for Active Campaign.

How does it work in practice? Most customers seem happy with their integrations, whichever accounts package they’re using.

It’s also worth noting that there’s a big community of accountants able to support both packages.

Winner: Xero

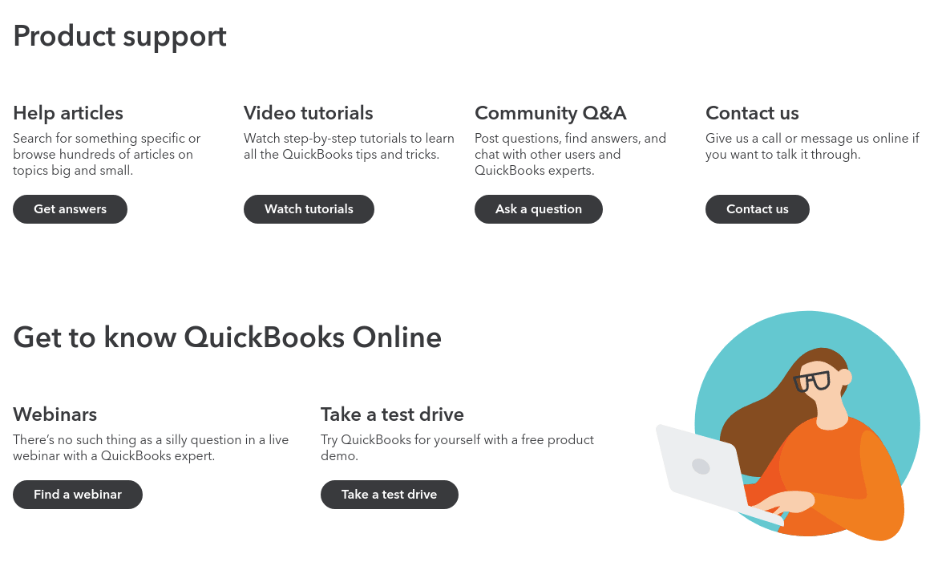

6. Customer Support

Both QuickBooks and Xero have strong user communities and provide plenty of online support. QuickBooks provides video tutorials and regular webinars, and support is accessible from within the application. It’s easy to connect to support tech. One downside, though, is that phone support has limited hours.

Xero doesn’t offer live phone support but has strong email support. It’s responsible and available 24/7. It also has user and business guides online, plenty of help articles, and Xero U for more intensive training.

Winner: A tie

7. Setup

QuickBooks has a smooth, structured setup process that allows you to choose whether to install modules such as payroll, time tracking, or inventory management. This enables start-ups to set up the minimum they need, then add functionality as it becomes useful – for instance, adding employee functions once you start hiring.

QuickBooks also lets you import data from Excel or CSV files to help you get started without having to re-enter data.

Xero has a similar easy setup structure, but a couple of big differences make it rather less flexible. First of all, you need to enter your bank information at setup; the system won’t start without it. Secondly, you have to load the entire system at once – you can’t pick and choose different modules.

Both setup processes are easy to manage. You may prefer the ‘start with the basics’ QuickBooks version, or you might prefer to get the whole system installed right off the bat with Xero.

Winner: A tie

8. Reports

While part of an accounting system’s job is to keep accurate records of financial transactions, it’s also incredibly important as a tool for forecasting and planning the future of your business. That’s why having a top-notch reporting functionality is crucial. If you can’t get the right reports, it’s like driving a car with no fuel gauge, speedometer or rev counter.

QuickBooks has a considerable number of standard reports already installed. There’s a business overview, a report on who owes you / what you owe, with information on aged receivables; sales report, expenses report, sales taxes report. All can be customized, and they can be exported and shared easily. Over 60 different reports are provided.

It’s easy to track accounts receivable or payable by customer or by a vendor – something that’s not quite as easy to do in Xero.

Xero has a similar range of reports, and it has better support for payroll and employee reporting functions. The sales report shows product performance, and aged receivables reports let you see those not paying their bills.

However, Xero doesn’t have an ‘uncleared transactions’ report like QuickBooks, so you’ll need to use the search function to find out which transactions haven’t yet cleared through your bank account. (For businesses where cash flow is tight, it can be crucial to know how much cleared funds you have in the bank – and that’s often rather different from your accounts figures.)

Both QuickBooks and Xero will automatically produce 1099 reports for contractors.

On the whole, QuickBooks not only has a larger number of standard reports, but it’s slightly easier to customize and more intuitive.

Winner: QuickBooks

Final Thoughts

Both QuickBooks Online and Xero do a great job of providing an easy-to-understand and user-friendly accounts package for small businesses. They’re both cloud-hosted, both provide good reporting as well as excellent transaction recording. Both have top-notch bank reconciliation functions, too – an area of accounting that small business owners sometimes underestimate.

Both also offer tiered pricing structures that allow you to start small and upgrade as your business grows.

In many areas, the two are equally good; overall, we think QuickBooks has the edge in functionality and reporting. It does have a slightly steeper learning curve, and a few quirks (like not all features showing up on the dashboard), but for most businesses, it’s the best deal.

However, Xero scores well in a couple of areas. Its project management module makes it the right choice for consultants and businesses that work on a project basis. And its pricing, which gives unlimited users, makes it an excellent choice for a business that might need a lot of consultants or partners to be able to access the system.

Xero also has good support for particular verticals, so if you’re a consultant, lawyer, or in the IT business, you might take a look at Xero’s particular functionality set and see if it suits you. And of course, you can use the 30-day free trial to find out!