(Last updated on January 9th, 2023)

FreshBooks or Wave, which software should you choose in 2023?

Read this ultimate FreshBooks vs. Wave comparison to make a smart decision.

Freshbooks and Wave are two cloud accounting apps that have a real following among freelancers and entrepreneurs. They were both created specifically for this market sector, and do a really great job for sole proprietors in service businesses, like attorneys, designers, and consultants. Micro-businesses will love them.

But which is the best? We took a long, hard look at the software to find out. We also read user reviews, looked at the technical specs, and considered support and availability issues. And we did, in the end, come up with a winner… but it wasn’t easy as both apps are frontrunners when it comes to accounting solutions.

Read on to find out how Wave and Freshbooks compare.

Comparison At a Glance

1. Features

Winner: FreshBooks. Both packages entail top-notch features, but Freshbooks’ better tax functionality, access controls and time tracking give it an edge.

2. Pricing

Winner: Wave. What’s wrong with ‘free’?

3. Ease of use

Winner: Tie. Both apps have a contemporary look and feel, and finding your way around is easy and intuitive.

4. Mobile Apps

Winner: FreshBooks. Wave has limited mobile functionality, while Freshbooks has an excellent app with some robust features like customer chat and timesheets.

5. Integrations

Winner: FreshBooks. While Wave has some good integrations, it’s heavily reliant on using web apps via Zapier. Freshbooks has more direct integrations.

6. Customer Support

Winner: FreshBooks. While Wave has a great user community and responsive email support, it doesn’t have a live chat or phone support for free users. Freshbooks has fantastic phone support as well as lots of online resources.

7. Setup

Winner: Tie. Both applications are super easy to set up in just a few minutes.

8. Reports

Winner: Tie. Both applications are rather limited in the number of reports they give compared to a full-spec package like QuickBooks. But if you’re a solo business owner or freelancer, you may not need sophisticated reports, and they do deliver the basics.

Short Verdict

Both these apps take a similar approach to accounting, and offer a good, easy-to-use software with useful features for freelances and services businesses. Each has its strong points – Wave’s pricing (free) and Freshbooks’ mobile app and phone support.

Many categories are a tie. But we feel that Freshbooks just has the edge. Its mobile app, in particular, is a powerful feature, and its time tracking functionality is great for anyone who charges on the basis of billable hours. Sure, it comes against a price tag, but it provides a whole lot of extra value for the price.

1. Features

Both Freshbooks and Wave have the basic features of an accounting package well tied down. Both of them provide:

- bank integration and reconciliation,

- billing, invoicing, and sales tax,

- customizable invoices (a bit more so in Freshbooks),

- recurring invoices,

- email integration for invoicing,

- expenses entry and tracking,

- reminders,

- financial reports, and

- credit card acceptance and ACH transfers.

Both of them also have one specific feature that will make freelancers’ lives so much easier; you can make an estimate or a pitch, and then convert your quote to an invoice with just a couple of clicks.

They also have good support for recurring invoices, which is useful if you work on a retainer basis or offer subscription packages; and they let you email an invoice, then notify you when the invoice has been viewed. That enables you to tell whether your client was away on holiday for two weeks… or just didn’t want to pay the bill.

Why we like Wave

Wave lets you set up online payment, and enable customers to pay through a link that is included in the invoice. Invoices are customizable, with your accent color and logo. However, Wave is designed for businesses that get (and make) 100% online payments – it doesn’t support checks, so you’ll need to write checks and enter such transactions manually into the system.

Wave knows that professionals often have difficulties getting paid on time. It flags up unpaid invoices, automatically bills retainers, and saves you time when billing and chasing payment.

Other things we like about Wave are the fact that you can give access to stakeholders or collaborators, as well as your accountant, and that it lets you run more than one business. (You can do that in Freshbooks, but you’ll have to pay a separate subscription for your second line of business.) You can also customize the chart of accounts – that is, you can decide yourself what headings you want to show, and what costs go where.

Wave also lets you run personal accounts as well as your business accounts on the program. Great for solo consultants and freelancers!

However, Wave has a few downsides. It doesn’t have a bill payment facility, though it does remind you when bills are payable. More annoying for most freelancers will be the fact that it doesn’t have mileage functions and won’t do your quarterly tax estimates.

What we like about Freshbooks

Freshbooks has some great features. Its time tracking is top-notch. If you work on the basis of billable hours, you’ll love it; there’s a timer in the application, which automatically enters your hours into your invoices. Project management is also a robust feature; you can set due dates, track project and milestone status, and even handle collaboration through the app.

Freshbooks, like Wave, lets you invite collaborators. But Freshbooks gives you more in the way of access controls to let people see only those parts of your accounts you want them to see.

Freshbooks automatically handles your tax deductibles and is strong on tax calculations.

But both accounting applications have some gaps. Neither has inventory management functions, and neither runs payroll. Freshbooks doesn’t have any fixed asset functions, either. This reflects the applications’ target market of small service and consulting businesses. If you’re a small scale manufacturer, a businessperson with more than a handful of staff, or a retailer, there are better applications for you out there.

Since their inception, both apps regularly go through new developments. For instance, Wave had a few shortcomings back in 2018, with some useful functions missing which have now been added. Right now, though, Freshbooks just edges ahead, particularly with its better tax support – because we know tax is always a headache, and the more automation you can throw at your tax filings, the better it is.

Winner: FreshBooks

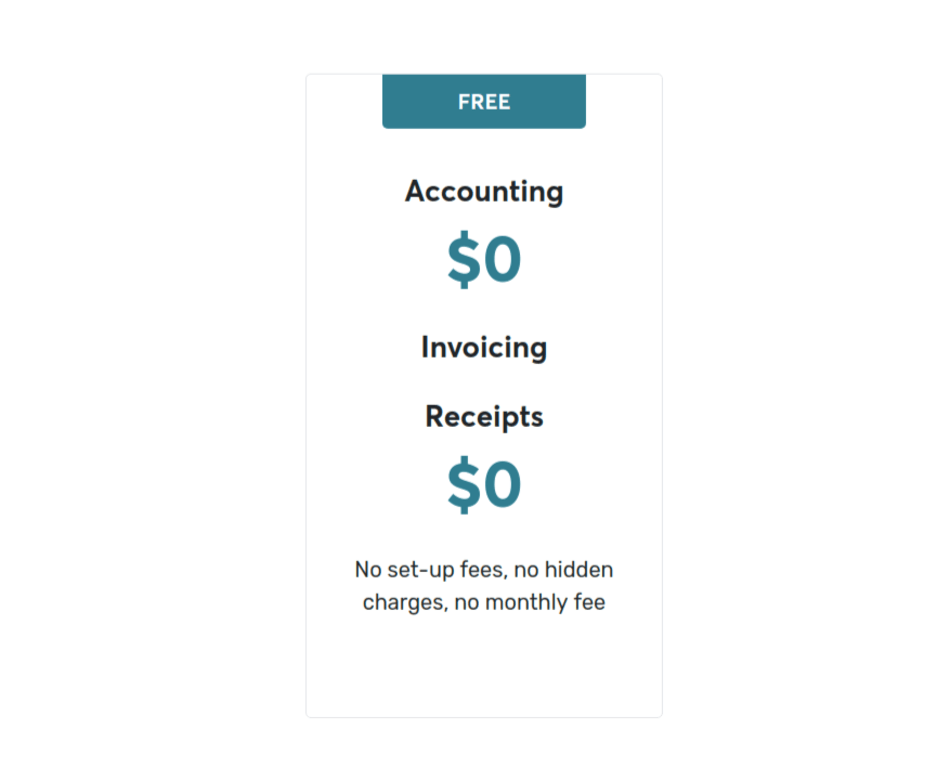

2. Pricing

We were going to hold on to the identity of the winner right to the end, and no spoilers – but as soon as we tell you that Wave is free, you’ll have guessed the result.

Wave is free. It costs zip, zero, nothing. For that, you get unlimited users and unlimited billable customers. What’s not to like?

Well, payments will cost you something. That’s how Wave makes its money. But there’s no upfront cost for the service; you’ll only be charged for credit card payments, at 2.9% plus 30 cents per transaction, and 1% for ACH transactions. (Amex, as usual, is a bit more expensive at 3.4%.) That’s pretty reasonable, in line with other payment services – Wave isn’t greedy.

Payroll will also cost you money though if you go with Wave Payroll, at $20 a month self-service ($35 full-service in some states: you don’t get a choice), you’re getting one of the cheaper packages around (Freshbooks integrates with Gusto which is $39 a month).

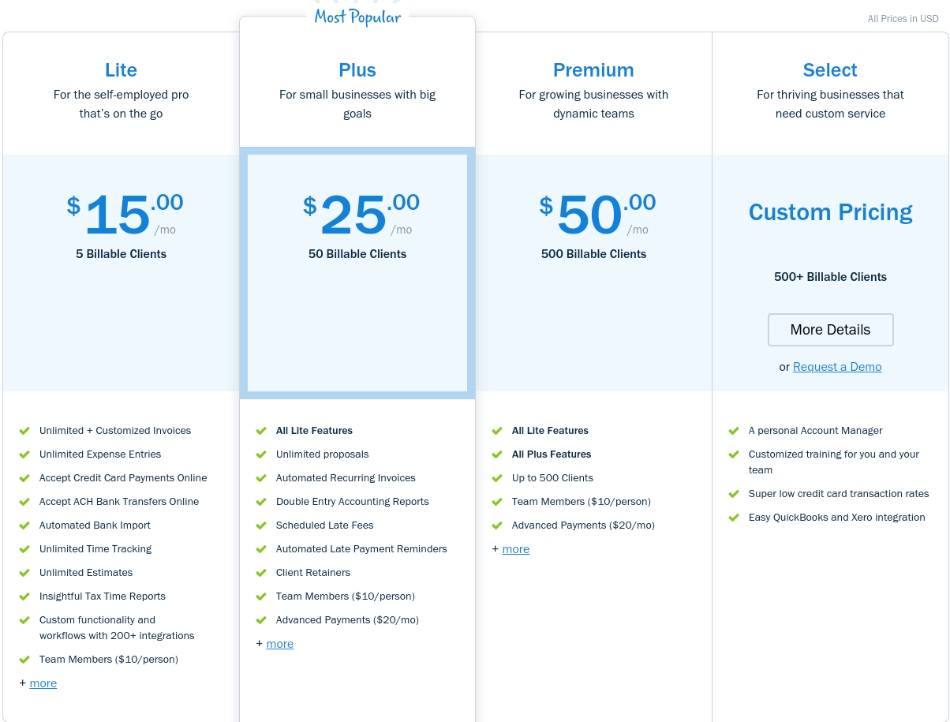

Freshbooks has a tiered pricing structure with three pricing packages and an extra charge per additional user. It’s tiered by the number of billable clients, with a limit of just 5 clients for the lowest ‘Lite’ package. Extra users cost $10 a month each, so as you add staff or collaborators, that can soon add up.

The lower-priced packages don’t include the full functionality of Freshbooks; for instance, a lot of the automation (payment reminders, recurring invoices, late fees scheduling) comes only with the higher price packages.

Freshbooks packages

| Plan | Cost per month | Limits |

| Lite | $15 | 5 billable clients |

| Plus | $25 | 50 billable clients |

| Premium | $50 | 500 billable clients |

| Select | Custom pricing |

Each additional team member: $10 per person

Freshbooks gives a 10% discount if you pay annually, rather than monthly. It also gives a 30-day trial. It has just announced 60% off Lite, Plus and Premium plan for six months as a response to the Coronavirus emergency.

Winner: (you guessed it) – Wave

3. Ease of Use

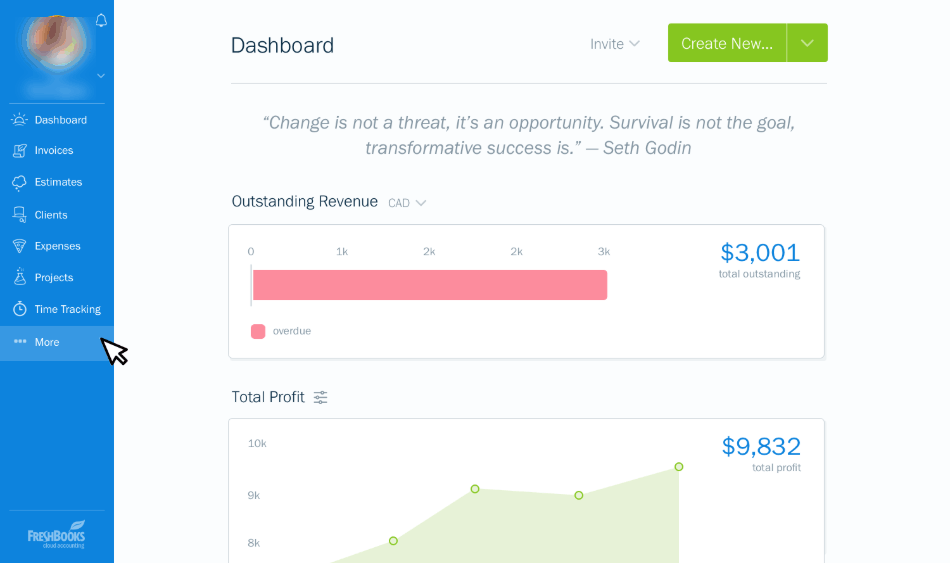

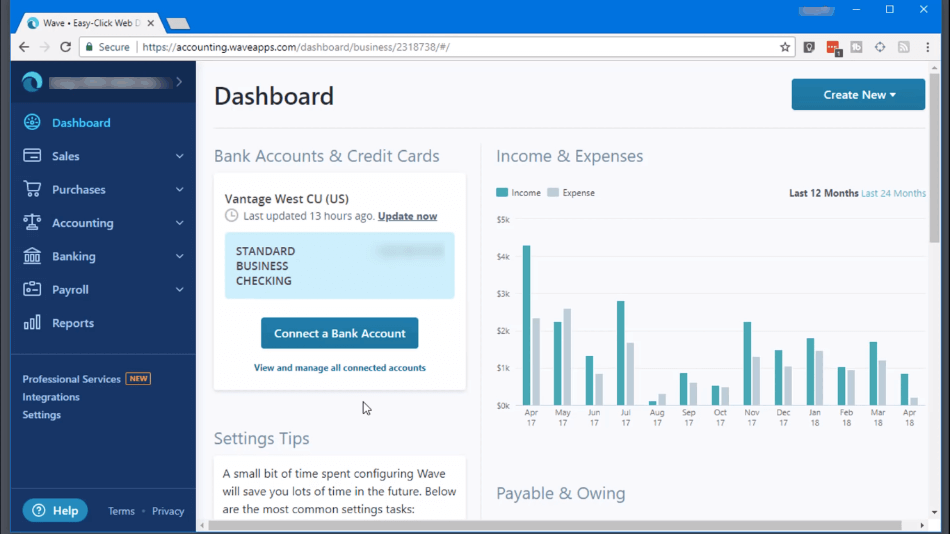

Both these applications open with a dashboard that shows an overview of your business using graphics, and have menus on the left-hand side granting access to the different accounts functions. There are slight differences in emphasis – Wave shows you revenue, then amounts owing and owed, together with an analysis of overdue, while Freshbooks kicks off with charts of receivables and profit.

Both are very clear and uncluttered, graphically simple, with no walls of numbers or small print. Transaction entry is simple and intuitive; for instance, when you want to create an invoice. Both Freshbooks and Wave have a refreshingly modern look and feel.

Wave can be slow to load. That’s okay if you just issue three or four invoices a month, as some consultants do, but if you’re billing daily, it can eat up a bit of time. Apart from that, though, both these apps score highly on usability.

Winner: A tie

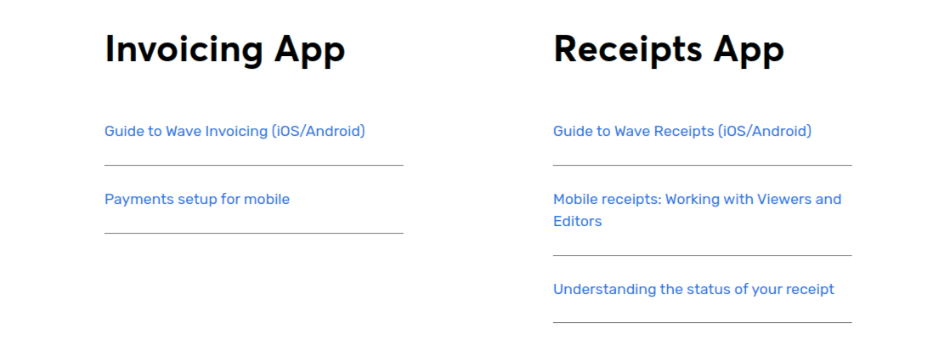

4. Mobile apps

Wave’s mobile apps are limited to entry of expenses and invoices, and each of these functions has its separate app, which isn’t particularly user-friendly. You don’t have access to the full accounts from the mobile apps.

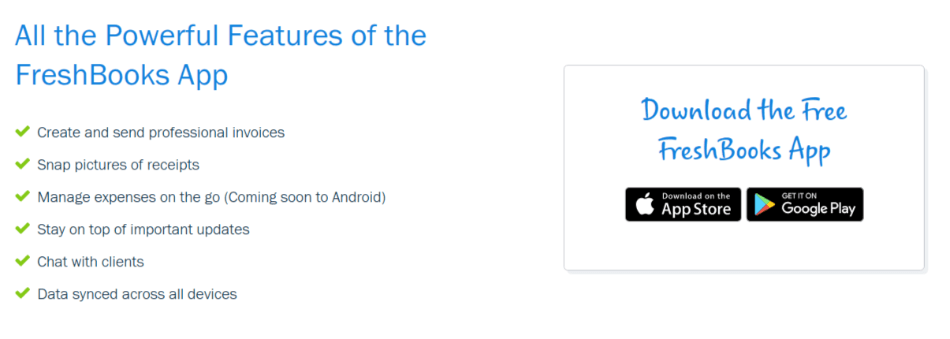

Freshbooks, on the other hand, has put a lot of functionality on the phone. For instance, its mobile app includes a time tracking function which is really useful, particularly if you often work on client sites or the road. You can chat to clients within the app, and it flags up, in real-time, invoices which have become overdue, as well as letting you know when they’ve been paid.

We just love Freshbooks’ mobile app. It’s not just a boiled-down version of what’s running on your desktop – it gives you some great, relevant functionality.

Winner: Freshbooks

5. Integrations

Wave integrates with its own Wave Payroll solution and to a lot of payment options and e-commerce apps such as Shopify, PayPal, ShoeBoxed, Etsy and Stripe. But without inventory functions, it’s less useful for Etsy than it could be – though it will work for artists and craftspeople selling one-off pieces. It also connects to Google Sheets, but other integrations have to be handled through Zapier. This integration gives access to over 1,000 apps.

FreshBooks has over 200 direct integrations – and more web apps through Zapier. Direct integrations include Google Apps, Acuity Scheduling, Mailchimp, Hours, Gusto Payroll, several CRM solutions, and Stripe online payments.

Winner: FreshBooks

6. Customer Support

Wave only has online customer support. There’s no phone line – you get live chat support for 60 days, but after that (unless you use one of the paid services, Wave Payments or Wave Payroll) you have to email. However, 4 million businesses use Wave, and a lot of them contribute to the active user forums, a great source of know-how at community.waveapps.com. The forums are also visited by Wave staff who are often able to assist directly as well as giving good advice. On many forums, we saw recent questions getting 5-6 responses on the same day.

That explains why Wave gets over 95% customer satisfaction ratings.

FreshBooks is more responsive, with email and phone support live in extended business hours (not 24/7). You can message support from within the app or ring the toll-free phone line.

You might not need to go that far. The in-product help feature is very well written and targeted, and there’s a huge amount of support available online. But if you do have problems, Freshbooks actually encourages you to call – and their customer service people are top-notch.

Winner: FreshBooks

7. Setup

FreshBooks is very easy to set up. It asks you for basic details about your business, prompts you to customize your invoices with your business logo and background colors, and send a test invoice. If you want to use Freshbooks for bank reconciliation, set up your financial institutions, and if you want to accept credit card payments, sign up for Freshbooks Payments or Stripe from within the app.

Help tutorials are built into the program – it will feature tutorial videos when you get started, and the first time you use any function, text balloons and arrows will show you where to go and what to click, or where to enter text and figures. And it has great, lively, informal illustrations to make you feel at home.

In Wave, too, getting started is easy. There are just three steps to get started – click the sign-up button, sign up with your Google or Yahoo account (or use an email address and password if you prefer), enter your business name and type and the main currency you use. The business type you enter will determine the categories that appear in your chart of accounts, so it’s important to get this right.

And that’s it! You can use the package right away – though you probably want to customize invoices, add your website address and phone numbers, and so on. It takes just two or three minutes to get set up.

Winner: A tie

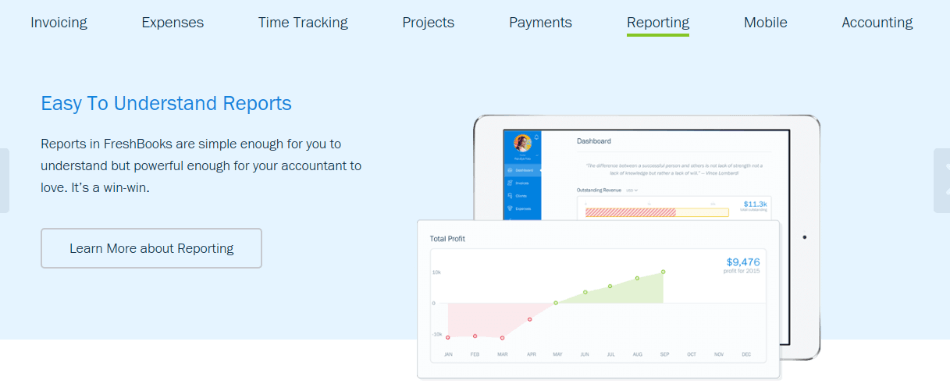

8. Reports

Wave only provides 12 basic reports; a profit and loss account, a balance sheet, and a sale tax report, plus breakdowns of the business (for example, revenue by customer or product). They can be exported as PDF or CSV files, but can’t be customized.

While these reports cover the basics, the absence of cash flow reporting and the lack of customization make the selection rather disappointing.

FreshBooks provides 14 reports and no balance sheets. Again, while this might be enough for a freelancer or a small business with a limited number of clients and services, at some point the lack of ways to slice and dice your business reports could mean you don’t have enough visibility of where your profits are really coming from.

Winner: A tie

Final Thoughts

Both these applications perform an excellent job of accounting for their target market. They are both user-friendly, both have a modern look and feel, and both provide some useful features aimed squarely at consultants and other professionals. For instance, being able to convert a pitch into an invoice in a single click is a top-notch feature.

They have a few limitations. If you have physical inventory, they aren’t going to give you much support. Payroll, also, is not supported as standard; you’ll need to integrate a payroll software like Gusto. And reporting is limited compared to programs meant for larger businesses. But if you’re a freelancer or a small services business, either will work for you.

Freshbooks wins mainly for three reasons. First, its responsive and knowledgeable support staff and the fact that you can get them at the end of a phone line. Secondly, its well-thought-through and highly functional mobile app. And thirdly, its feature set, which contains time tracking and billing features specifically addressed to the target market and which we rate highly.

For just plain old boring accounting? You can get Wave for free, and free is never a bad price. If you already have a CRM or project management software that delivers features like time tracking and project scheduling, you might consider it. But Wave probably won’t scale up if you want to grow your business.

Winner: FreshBooks