(Last updated on January 9th, 2023)

Hubdoc or Receipt Bank? Which expense management application is better in 2023?

Read this in-depth Hubdoc vs. Receipt Bank comparison to make a wise decision.

Expense management is a nightmare for many small businesses. It means taking paper invoices and receipts and having to enter them painfully into the accounting system, and then storing all the paperwork safely in case your auditor or the IRS wants to check up. It’s a time-consuming, error-prone and frustrating process.

Digitizing and automating the process frees up your time to focus on more useful things. That’s where pre-accounting tools like Hubdoc and Receipt Bank come in. Both these programs collect the data from your invoices by scanning them and using OCR (Optical Character Recognition) to understand the content. That content can then be passed through to your accounts system without anyone ever having to key it all in.

And you don’t need to keep the paper documents, either! All your scanned paperwork is saved in the cloud, where it’s much easier to find the original scans if you need them for any reason.

We’ve taken a look at two applications that can handle receipt scans – Receipt Bank and Hubdoc. We kicked the tires a bit, we’ve looked at the technical specs, and most importantly we’ve checked up on whether users have found the systems easy to learn and whether they’ve got the expected benefits out of using them.

Read on to find out how the two applications stack up.

Comparison At a Glance

1. Features

Winner: Receipt Bank. Both applications have very similar features, but Receipt Bank has a little more finesse. It also offers user permissions, which Hubdoc doesn’t.

2. Pricing

Winner: Hubdoc. Receipt Bank has a three-tiered pricing structure with limitations on the number of items that can be processed. Hubdoc offers a $20/mo price with no restrictions.

3. Ease of use

Winner: Receipt Bank. Both applications are easy to use, but Hubdoc has a few annoying features that make life more difficult than it could be.

4. Mobile Apps

Winner: Receipt Bank. Both apps are user-friendly and simple, but Receipt Bank just edges into first place with its simplicity of format and good user reviews.

5. Integrations

Winner: Receipt Bank. Receipt Bank integrates with more accounting applications directly. However, Hubdoc is the clear winner for companies which already use Xero as their accounts package, because it’s seamlessly integrated.

6. Customer Support

Winner: Tie. Both applications offer good customer support. Hubdoc support is now provided through Xero Central.

7. Setup

Winner: Tie. Both applications are super easy to set up, but applying a little more thought and effort to setting up supplier rules can help automate a higher proportion of items and save time in the long run.

8. Reports

Winner: Tie. Not really relevant to this software: you’ll be using the reporting function in your accounting software.

Hubdoc vs Receipt Bank: The Verdict

Both these applications work well and either would make a good pre-accounting package for a small or medium-sized business.

However, Receipt Bank manages to just edge ahead in a number of categories and makes it our first choice. For instance, it integrates with Tripcatcher to offer mileage capture; it has user permissions which you can configure to suit your organization’s needs; and it’s a bit simpler, quicker, and more streamlined.

Note that Hubdoc is seamlessly integrated with Xero and comes free with some Xero accounting software packages. If you already use Xero, that may make your decision easier!

1. Features

Both these applications are cloud-hosted, with strong mobile apps which allow you to photograph or scan in documents – both receipts (already paid) and bills (which are automatically posted to accounts payable). They can also fetch statements automatically from suppliers such as telecoms, banks, and utilities – particularly useful if you want to avoid year-end chasing for statements when you want to close your accounts.

Both allow multiple users to submit receipts, and automatically create transactions that you can export to your accounts system. Your system will then match the transaction to its bank feed. Receipts and bills can also be emailed into the system using a specific email address. High definition OCR (Optical Character Recognition) allows the system to process the data – you don’t have to.

A big advantage of using Hubdoc or Receipt Bank is that your receipts will all be date and time stamped, giving you an excellent audit trail. The receipt always remains ‘stapled’ to the transaction even once it’s been passed through to your accounts system, so that auditing or responding to tax office queries is simple – there’s no need for a protracted search among the filing cabinets to find the original.

Security features also help you keep your accounts safe. For instance, both systems are read-only where bank and credit card accounts are concerned, so hackers have no way into your account. Easy backup also helps keep data safe.

Let’s take a look at some of the differences between Hubdoc’s and Receipt Bank’s functionality.

Hubdoc has more of a small business focus, and isn’t scalable beyond 1,000 vendor accounts. It also has no user access controls, and that, for us, makes it a difficult choice for businesses which have grown beyond a small number of users. Anyone allowed in has full access to the account, can modify, add, delete vendor accounts and receipts.

Hubdoc compounds this security issue by not having an audit log, so you can’t go back to see who changed a total or added a given vendor account. While you still have date and time stamps on each item scanned or photographed, you can’t be sure that all the items that should be there, are actually there, either. We think this is quite a major concern.

Hubdoc’s OCR is good, but the application doesn’t prefill quite as many fields as with Receipt Bank. However, you can configure a certain vendor’s expenses to always go to the same account, eg gas station operators to Auto : Fuel expense. That saves a lot of work.

You can set supplier rules, so that Hubdoc knows how to code bills from recurring suppliers. That enables you to automate a high percentage of the transactions going through to your accounting package.

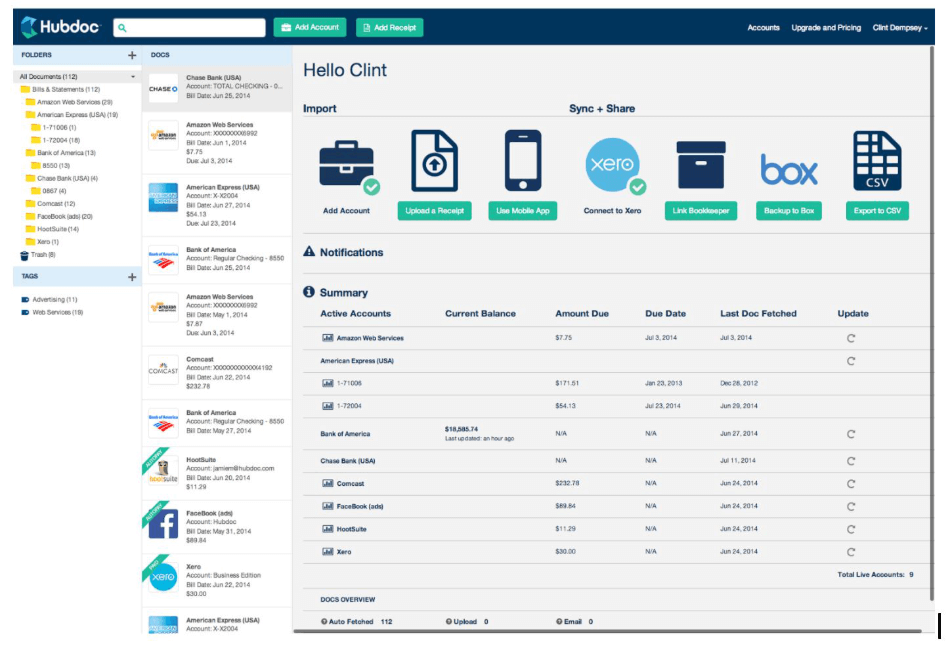

You can also use Hubdoc as an aggregator. It will sync your different accounts, for instance for utilities, banks and credit cards. You no longer need to log into each different account to keep on track; Hubdoc will integrate them and let you know if there are bills that need to be paid.

You can fetch multiple months’ and even years’ statements, which is great for end-of-year audit and really useful if you have lost some of your old paper statements.

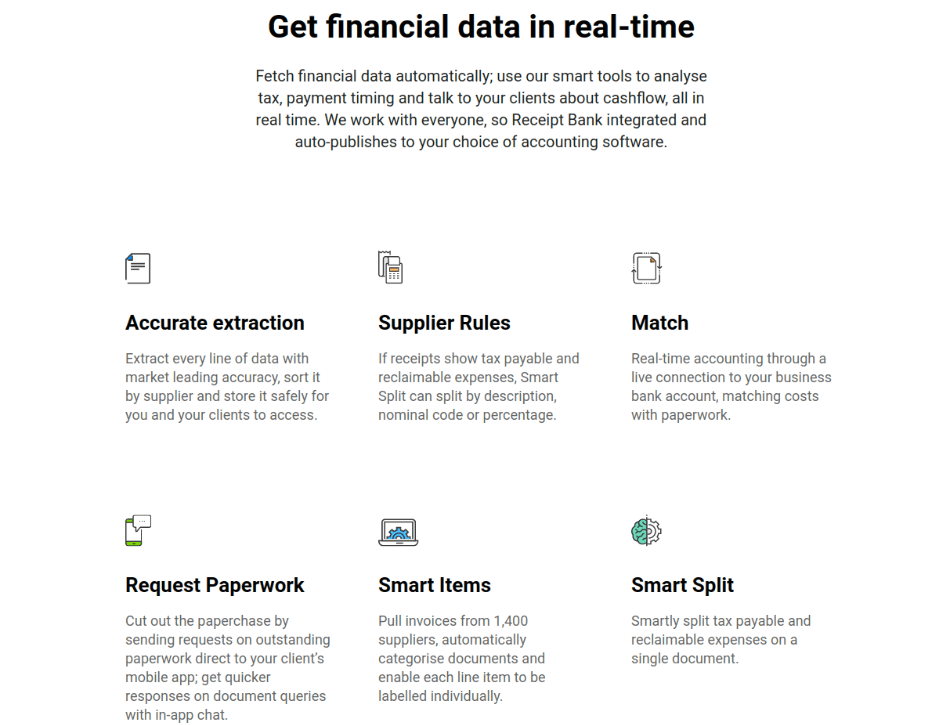

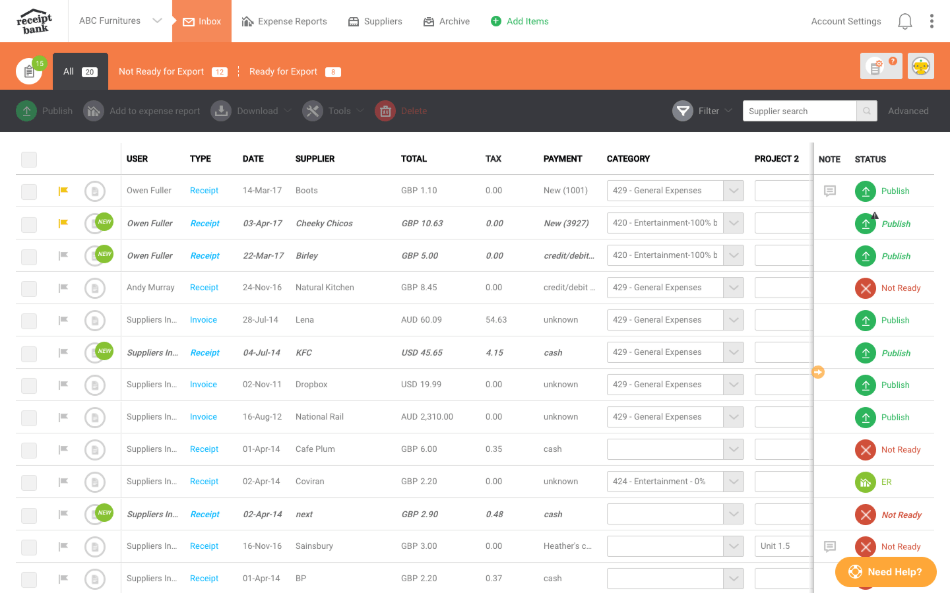

Receipt Bank enables scanning and photo input, and you can also drag and drop files from your computer into web browser app. It automatically syncs to your banking software and the higher-priced plans include automatic data extraction from bank statements.

Receipt Bank goes that little bit further than Hubdoc in functionality. For instance you can add splits (for instance where a hotel bill includes food and phone charges) and labels before exporting (‘publishing’) to the accounts software. Receipt Bank also has a line-item extraction feature, which is useful if receipts contain items for different projects or in different tax categories.

Supplier rules work pretty much as they do in Hubdoc. Setting up rules enables you to automate a lot of the process – for instance, Chevron will always go through to automotive fuel expenses. That takes the manual grind out of processing such receipts.

Because the application is designed to work for large enterprises as well as small businesses, Receipt Bank also has granular user permissions. You can specify exactly what each user of the system can see, edit or export. Receipt Bank is also quite clever at telling which user has done what – for instance it will read the last four digits of the credit card number that was used to pay, and automatically attribute that card to the right individual.

Winner: Receipt Bank

2. Pricing

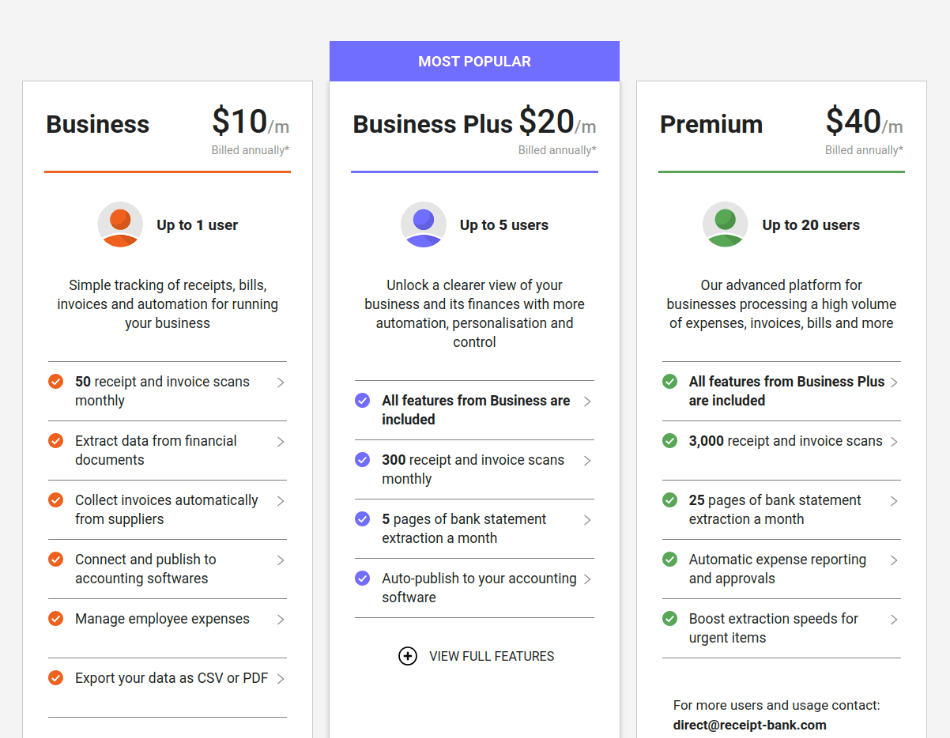

Both these applications are priced on a monthly basis, and both have a short free trial so you can easily find out whether they save you time and add value to your business.

Hubdoc is priced at $20 a month for each business. However, you can get a free ride – if you use Xero as your accounting package, on a business edition pricing plan, you’ll get Hubdoc as part of your subscription.

Receipt Bank has a more complex structure, costing from $10 a month for single-user access,up to $40 for as many as 20 users. However, price packages limit the number of items processed as well as the number of users. Businesses which exceed these limits can request a quote for their particular needs.

| Package | Price $/month | Users | Items |

| Business | 10 | 1 | 50 |

| Business Plus | 20 | 5 | 300 |

| Premium | 40 | 20 | 3000 |

The limitations of Receipt Bank’s packages in terms of the number of items you can process could make the difference if you have relatively few users but a large number of transactions to process. Hubdoc doesn’t have these limitations.

Winner: Hubdoc

3. Ease of Use

Receipt Bank opens on to a dashboard that summarizes the documents that have entered the system, and makes it easy to see if any receipts need attention before being published to the accounting software. That means you can easily skim over receipts that don’t need your intervention, and streamline your workflow to concentrate on the exceptions. It’s great for CEOs, CFOs, and accounts staff.

Individual users find the mobile app for entering receipts very easy to use. And there’s almost no time lag when you publish to QuickBooks Online, which means if you have a once a week session to get your accounts in order, you’re not wasting time waiting for them to come through.

Receipt Bank also ‘learns’ from previous transactions, and remembers where you posted a particular transaction last time, so it will automatically suggest where a given receipt or bill should post. That saves you having to enter data and can automate around 80 percent of transactions once you’ve been using the software for a while.

Both Receipt Bank and Hubdoc have high quality OCR with a high success rate, so that you won’t have to do a lot of corrections.

Hubdoc opens up showing a simple folder structure, which is very easy to use even for technophobes. It’s much more open and less full of data than the Receipt Bank interface, and show clearly the actions you can take, from uploading a receipt to syncing with the accounting system.

However Hubdoc has a few annoyances. It has a number of default fields that you can’t change, such as ‘unpaid’, and ‘invoice’. That’s annoying if like some small businesses you have a large number of cash or credit card receipts to process and only two or three bills to pay. If your workload contains mainly paid receipts, you’re going to have to change the defaults every single time, and that’s more keystrokes and more effort.

Hubdoc is also slightly less successful than Receipt Bank at automatically posting to the right accounts. Users have also stated that it can be slow in operation.

Winner: Receipt Bank

4. Mobile apps

Hubdoc’s mobile app is very easy to use,though iPhone users may not like the fact that it’s a non-rotating app. If the receipt you’re photographing is in the opposite orientation this can be an annoyance; not only is it not easy to take the photo, but you’ll need to rotate the photo once it appears in the system. That’s three extra clicks you really don’t need to complicate your life, and it will take a bit of time to display, too.

Hubdoc also can’t handle two-page receipts well. That’s annoying if you have hotel bills which run over on to a second page.

Receipt Bank takes just seconds for each photo, and like Hubdoc is very easy to use. It handles most expenses, but not mileage – however, it integrates with Tripcatcher for the purpose, so you can still capture mileage, which is particularly useful for tax purposes.

Receipt Bank gets particularly good reviews from users on the app store. It’s robust and while it may not have huge ambitions as an app, compared to more complex accounts apps, it does its job reliably and well.

Winner: Receipt Bank

5. Integrations

Hubdoc integrates with accounting packages QuickBooks Online and Xero, and with Bill.com. If you use another accounting package, that doesn’t rule out using Hubdoc, but you’ll have to export your data to a CSV file and then import it to your accounts system.

Hubdoc also integrates with cloud storage providers such as Box and Dropbox, so you can keep all your documents safely backed up.

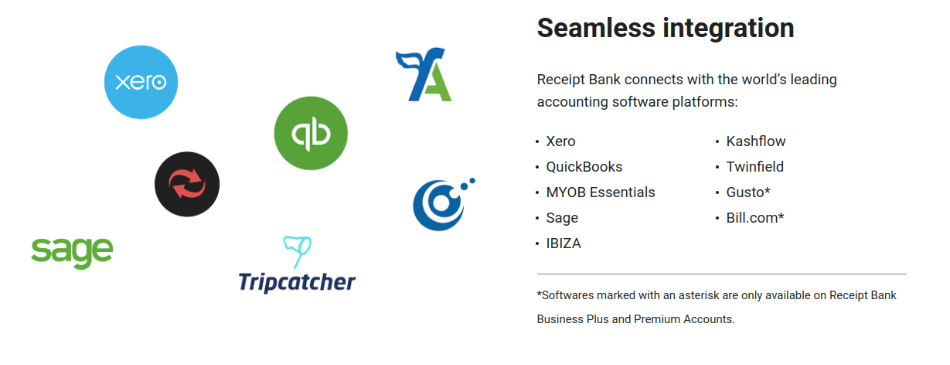

Receipt Bank integrates with a few more accounting packages; it works with QuickBooks Online and Xero, but also with SageOne and Freshbooks, MYOB Essentials and Kashflow. It also integrates with Gusto payroll.

Winner: Receipt Bank

6. Customer Support

Receipt Bank has excellent customer service which can be accessed from within the application or from within the mobile app. Support can also be accessed from the Receipt Bank website during business hours.

Receipt Bank’s service for accounting and bookkeeping firms is particularly valuable. Each professional firm gets a dedicated account manager and can book virtual meetings to address problems or simply get a boost to their skills.

Hubdoc’s support is provided through Xero Central – again a major plus point for those who’re already using Xero as their accounts software. Reviews are pretty good, which is refreshing in a world where customer service usually comes in for criticism from disgruntled users.

Winner: Tie

7. Setup

Neither of these software applications requires installation, and they’re both quite easy to configure. But you’ll want to do the initial preparatory work if you want to save time through automation. First off, both need to be synced to your chart of accounts – the hierarchy of accounting items in your accounts package.

With Receipt Bank you’ll want to set up supplier rules so that the application can auto-publish transactions for vendors such as your telephone, rent, utilities, or gas stations. Then you won’t have to intervene manually at all – bills and receipts will automatically go straight through to your accounts system.

Hubdoc too demands you spend a bit of time on setup to get the maximum mileage out of its auto-sync capabilities. It automatically imports the chart of accounts, vendor and customer details, but the rest is up to you.

Winner: Tie

8. Reports

We usually give quite a lot of coverage to reporting features. However, this isn’t the most important functionality for these applications, since the reporting you really want will occur in your accounts system.

Winner: Tie.

Final Thoughts

Hubdoc focuses on data capture, categorization and storage and it’s very good at what it does. However, Receipt Bank does have a little more finesse, for instance with user permissions, and with the ability to split invoices. It has more integrations, and is a bit more streamlined; it’s also a bit more speedy, while some users report Hubdoc can be slow.

The entry level for Receipt Bank is also half the price of Hubdoc – though it comes with restrictions on the number of users and on the number of items that can be processed per month. Neither of these applications is a big-ticket expense, so pricing is probably not going to drive your decision.

Overall, Receipt Bank is our pick for 2023. But Hubdoc comes very close and is rapidly developing its capabilities, so this could change over the next few years.

Hubdoc is now part of Xero, and we would recommend Hubdoc for most Xero users, because you’ll get it for free, and it’s seamlessly integrated with the accounting application. You also get a single support center, which may be useful if you have problems with implementing supplier rules or syncing to the chart of accounts, for instance.

FAQs

Yes, Receipt Bank works with QuickBooks so that you immediately pass through your receipts and bills to create transactions in your accounting system. Hubdoc will also work with QuickBooks.

Yes, in both applications you can download all your data, as a zip file from Hubdoc and as a PDF or spreadsheet from Receipt Bank.

Both Receipt Bank and Hubdoc allow accountants and bookkeepers to sign up and use the application on behalf of their clients. You’ll be able to enter your expenses while your accountant will be able to check that they have been properly posted to your accounting system.