(Last updated on January 9th, 2023)

Hurdlr or QuickBooks? Which application is better in 2023?

Read this ultimate Hurdlr versus QuickBooks comparison to make a wise decision.

If you’re managing a freelance or side hustle business you may be looking for a good way to track your expenses and do some basic accounting.

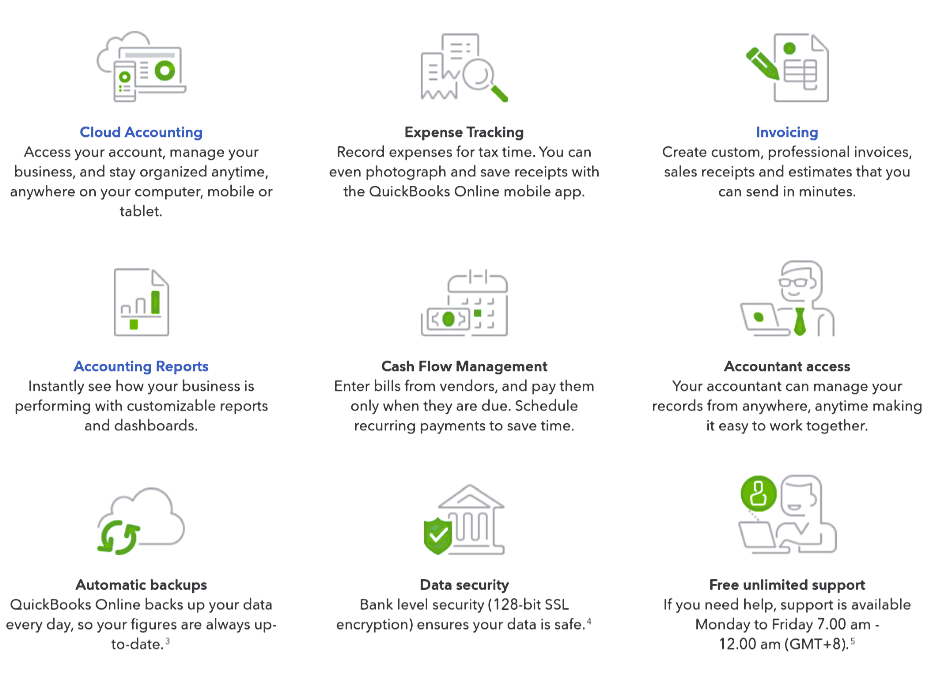

You can choose between a full-featured accounting application, and a basic expense tracking app. For instance, you could take QuickBooks Online, to do all your invoicing, accounts and cost management. It’s one of the best accounting apps around and it can grow with your business – but do you need all that functionality right now?

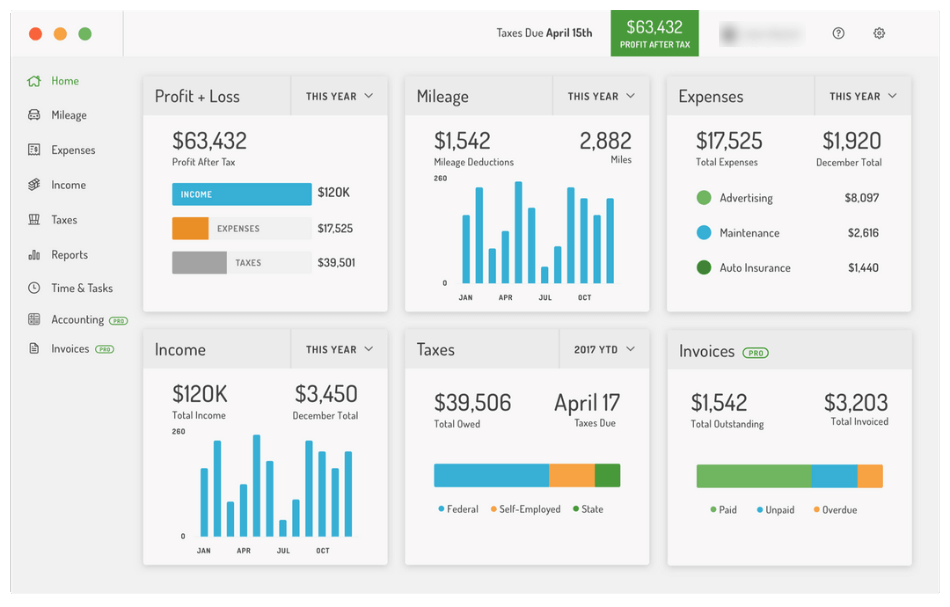

Or you could just manage your expenses with a no-frills package like Hurdlr. This started off just as an expense tracking app, but it’s subsequently added quite a lot of extra functionality. It can sync with your bank account, automatically log payments, and produce a full profit and loss account, as well as help with your taxes – and while invoicing doesn’t come free, you’ll get it if you pay just a little more.

Let’s take a look at these two applications and see which of them might suit you best.

Hurdlr Vs QuickBooks: Comparison At a Glance

1. Features

Winner: QuickBooks. Hurdlr has enough capability to make it a godsend for freelances, but QuickBooks delivers much more in-depth functionality.

2. Pricing

Winner: Hurdlr. Even if you don’t use the free version, Hurdlr’s pricing is much lower than QuickBooks’.

3. Ease of use

Winner: Hurdlr. QuickBooks’ greater functionality and accounting roots mean it’s got a steep learning curve. Hurdlr is super-easy to use.

4. Mobile Apps

Winner: Hurdlr. QuickBooks has a neat app that lets you scan receipts and invoice customers. But Hurdlr lets you pretty much run your business from your smartphone.

5. Integrations

Winner: Tie. QuickBooks has more integrations with other apps for project management, inventory management, payroll and other business functions. But Hurdlr integrates with e-commerce apps and freelance platforms.

6. Customer Support

Winner: Tie. QuickBooks has phone support, huge resources, and lots of accountants who use it. But Hurdlr is 24/7, admittedly only with live chat.

7. Setup

Winner: Hurdlr. Both are easy to set up. But Hurdlr is much easier to get started with – particularly on mobile.

8. Reports

Winner: QuickBooks. QuickBooks almost always wins this section, and it does so convincingly here.

Short Verdict

QuickBooks will provide everything you need to run your business finances. If you need to invoice your customers, produce financial accounts, and run your entire business – including, eventually, staff – it’s got everything you need. But it doesn’t come cheap and it does have quite a learning curve.

On the other hand if you use a platform company or trade only on Etsy or eBay, or through PayPal, you might not need a lot of the reporting and other features that QuickBooks delivers. If you want a no-frills accounts package, Hurdlr will do everything you need to keep your accounts in order. And it’ll do all of it on your smartphone.

So, horses for courses, as they say – choose the package that best suits your needs. But if you do think your business is going to grow, or you need invoicing and reporting, QuickBooks wins this comparison.

1. Features

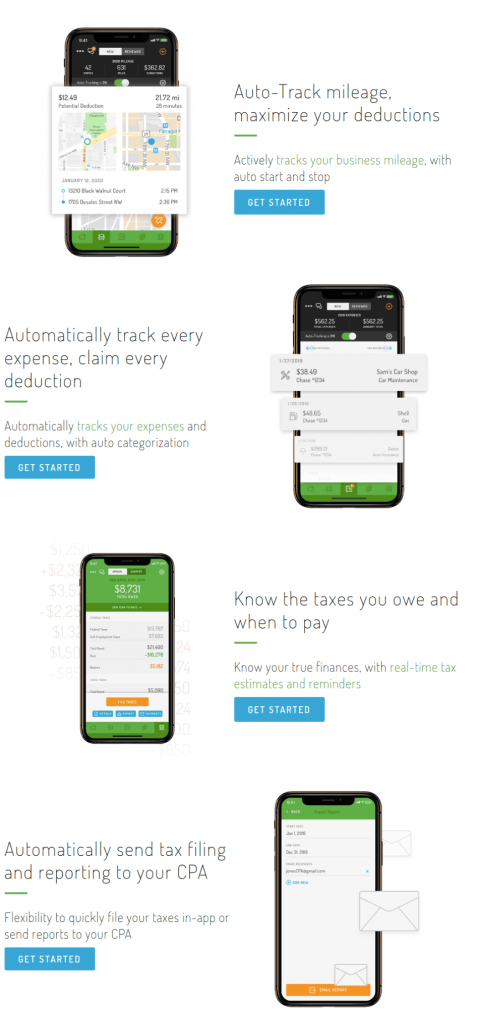

Hurdlr will connect to your bank account and business credit card automatically, so any transactions are automatically imported to your accounts. But as an app that’s been built for the internet freelance, it also connects to Lyft, Uber, Square, PayPal, and even to Upwork for freelancers who use that platform.

Hurdlr is really excellent as a mileage tracker. It’ll use your smartphone to track mileage and work out how much you can deduct for taxes.

It has a useful tax estimator. That’s one of the biggest bugbears facing most freelances. Hurdlr claims the average user can save $5,600 on their tax bill. And it shows you this in real time, so you know how much you’ll need to keep aside for taxes and self-employed Medicare contributions. There’s a Deductions Finder which uses algorithms to suggest which expenses you can deduct from your tax liability. You can even file your taxes in-app.

It’s also got quite a bit of flexibility – for instance, you can create your own expense categories, if its regular categories don’t give you everything you need.

The big thing missing, up till recently, was invoicing. You still won’t get it in the free version of Hurdlr, but the paid-for Pro version supports invoicing, as well as credit card payments linked to the invoice. You can customize your invoices, and apply automation to them, saving time and effort on regular billing.

Hurdlr also handles owner’s draw if that’s the way you pay yourself.

It’s a neat little app and has all the basics. But QuickBooks adds a whole lot more which you might not need right now but probably will if you grow your business over the medium term.

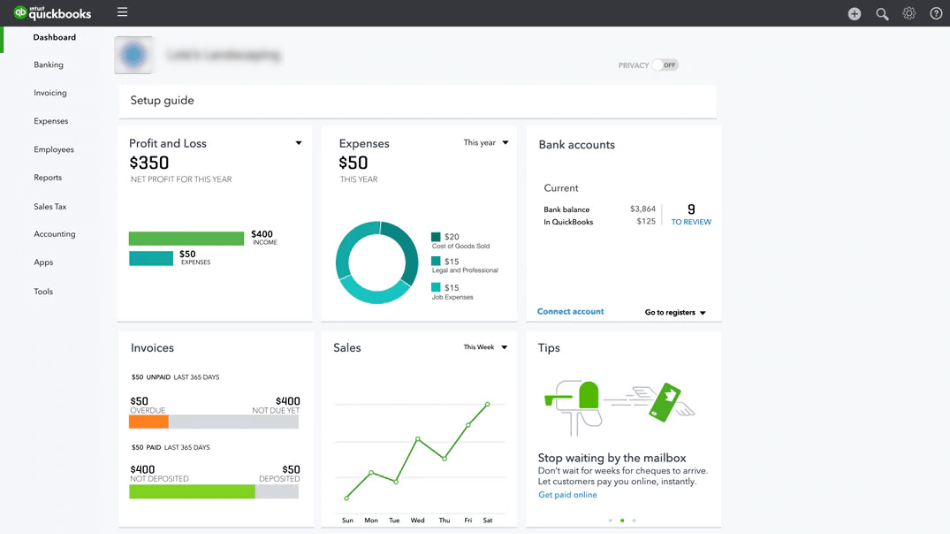

- QuickBooks’s sales tax functionality is useful – it will add tax according to the rules you set, which might be different for different products, services or clients.

- If you have inventory, QuickBooks offers you much better support. You’ll be able to track what’s in stock, what isn’t, and set minimum levels and re-order levels.

- QuickBooks supports multiple currencies across the package, great for exporters or people providing services to global clients.

- There’s much more support on payables and receivables. If you’re a B2B business and need to manage customer credit, QuickBooks will help you chase up past-due and unpaid bills and show you just which customers have a tendency not to pay up on time.

- Move up the price packages and QuickBooks gives you a lot of project management and time tracking capability. For professional services businesses, and freelancers who do a lot of collaboration on projects, this can be a real game changer – tracking profitability by project is a powerful way to concentrate on the jobs that make you the most money.

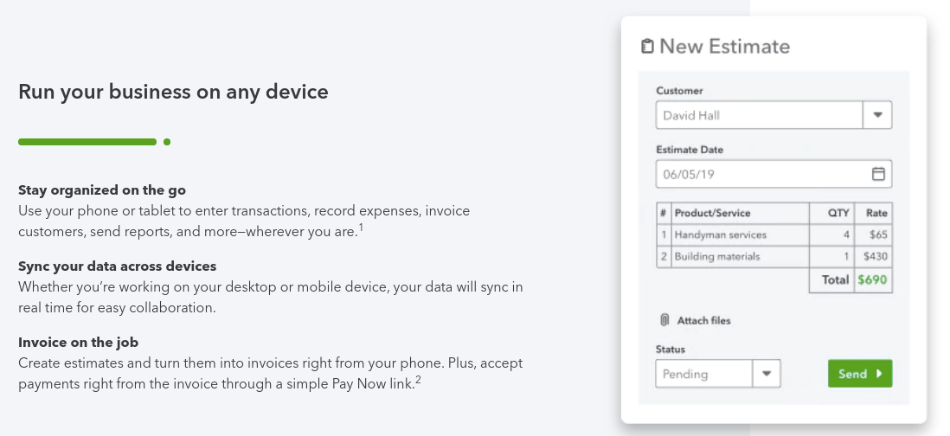

- QuickBooks also lets you create estimates and convert them automatically to invoices once the work has been done.

- QuickBooks will handle 1099 payments for contractors. And while it doesn’t do payroll, it integrates seamlessly with the QuickBooks Payroll package for an additional monthly fee.

Winner: QuickBooks

2. Pricing

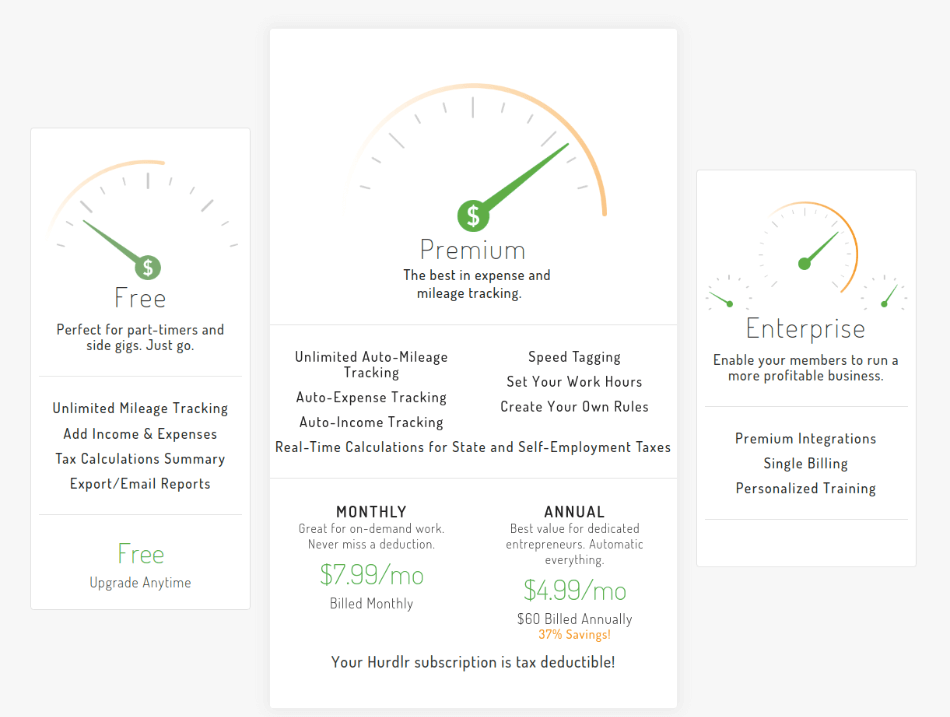

The basic version of Hurdlr is free. Though you won’t get invoicing with that, it will help you keep your accounts and control your expenses. There are two paid-for packages; Premium adds tagging and automation, potentially saving you a little time, but we think the Pro version adds much more powerful features with invoicing and full double entry accounts.

We’re not sure the Premium version is really worth shelling out for. But the Pro version delivers a lot of bang for ten bucks a month, including managing your annual tax filing, and separate access for your accountant.

| Package | Functionality | Price (annual) |

| Free | Basic bank sync, expense tracking, tax, reports | free |

| Premium | Adds tagging, categorization | $5/month (or $8/month without annual billing) |

| Pro | Adds invoicing and full double entry accounts | $10/month |

QuickBooks doesn’t have a free version and its packages start at a higher price point of $25 month. You can try it for a month for free, or get a 50% discount for the first three months – so if you wanted to compare QuickBooks to the free Hurdlr product, you could run both for a month to get a good idea of how they compare.

| Plan | Price per month | Users |

| Simple start | $25 | Single user |

| Essentials | $40 | Up to three users |

| Plus | $70 | Up to five users |

| Advanced | $150 | Up to 25 users |

QuickBooks gives you more users with each step up, but also gives more functionality in each successive package. If you want time tracking you’ll need Essentials, and project management functions don’t come in till the Plus level, which costs $70 a month.

Winner: Hurdlr

3. Ease of Use

With functionality we already had something of feeling that QuickBooks and Hurdlr were chalk and cheese – that’s even more so in this category. Hurdlr is incredibly easy to use, particularly if you’re just using the basic expense recording function. Simply scan a receipt with your smartphone and Hurdlr does the rest!

The app has strikingly clear looks, and is easy to find your way around. Even using the Pro version is very far from rocket science.

QuickBooks on the other hand is notorious for having a steepish learning curve even in the less fully-featured price packages. That’s partly because it offers you so much flexibility and so many choices – the cost is having to learn your way around a bit more.

We shouldn’t over-stress the trickiness of QuickBooks, though. It’s still a package that’s pretty friendly for non-accountant users, and finding your way around from the initial dashboard isn’t difficult. But you may find some regular transactions take a bit longer to process than with Hurdlr, because you need to make more choices.

We also find that QuickBooks sometimes takes a bit longer than other packages to perform basic functions. Again, that’s often because you’ve got more choices to make than in simpler systems. However, once you get into the higher priced packages there’s an impressive amount of customization and automation you can do that offsets the complexity.

Winner: Hurdlr

4. Mobile apps

Hurdlr is available as both a web app and a mobile app, and the two feel very similar. If you’re a mobile freelance, you’ll really love Hurdlr – it’s been designed to support you in every way. The mileage tracker is just one of the features on the phone app, which replicates pretty much everything you can do with the web application and automatically syncs with your data on the cloud.

Hurdlr gets really good reviews on both App Store and Google Play Store. It even gets extra points for being optimized for low battery usage, so you won’t need to recharge if you’re on the road. However you do need to set it up properly and give it the right permissions – some users have had a few issues with this. It’s worth pointing out that Hurdlr staff do answer user reviews and are often able to give help.

QuickBooks also offers a mobile app for both Apple and Android, but it’s not as fully featured. You’ll be able to scan in receipts, and it also allows you to send invoices, but it doesn’t deliver the full accounting experience which is reserved for the web app.

On the other hand we like the way the app links customer details and even delivers you a map and directions to find your customers’ premises. That’s really useful and very neatly delivered.

Winner: Hurdlr

5. Integrations

Usually this section in our reviews is about who has the most integrations. But this time round, it’s about which integrations are going to be most useful to you, because these two apps are so different in the way they work.

Hurdlr’s sweet spot is the internet-native freelance or solopreneur. Its integrations show that clearly – it connects with e-commerce apps and freelance platforms. So for instance you’ll get seamless integration with Uber, Upwork, Keller Williams (for realtors), as well as PayPal, Uber, Stripe, and Shopify.

Hurdlr also integrates with Wave, Xero and FreshBooks if you want to just use it for mileage and expenses, and use one of these applications to do your accounting. Putting Wave and Hurdlr together could be a great way to go if you want a totally free solution.

QuickBooks, on the other hand, is really there for the growing small business and has integrations letting you add payroll, inventory management, project management, and other functions. Yes, it does also integrate with quite a few online shops and payment methods, but its focus is more on integrations like SOS Inventory, Method:CRM, Gusto Payroll, and TSheets.

And QuickBooks has an impressive number of integrations – hundreds of apps!

We can’t declare a winner here. Both apps do a great job of supporting their particular client base with the right integrations.

Winner: Tie

6. Customer Support

Hurdlr looked as if it disqualified itself right at the start here, since it doesn’t offer phone support. However, its website chat support is excellent; response is fast and it’s often really effective.

In depth customer reviews show that many users have found customer support could help them get real value out of the mobile app, whether the issue was integrating with Square, or getting tax filings done efficiently.

Plus, chat is available 24/7, even on Sundays. That’s really impressive – these guys totally understand what it’s like to be the kind of freelance who never stops working, even at eleven on Saturday night (which, by the way, is when these words got written, so yes, we love Hurdlr!)

QuickBooks gives you a choice of phone, chat or email, but only in extended business hours. Which may not help you if you’re working over the weekend to meet a Monday lunchtime deadline or have to get your accounts done late at night because that’s the only time you have free.

On the other hand QuickBooks does have phone support which we know some people prefer to online. And it has a really huge amount of online support, including video tutorials, articles, FAQs, and webinars. QuickBooks also has a huge ecosystem of third-party professionals, including trainers as well as accountants and bookkeepers.

Winner: Tie

7. Setup

Hurdlr is super easy to set up. You just choose your business type – freelancer, consultant, AirBNB host, for instance – and if necessary narrow it down by the type of work you do. (You can add more than one business, too, which is a great help if you are self-employed and you have a side hustle too!)

Then just enter your email, create a password, and you’re ready to roll. In fact if your main concern is mileage tracking and receipts scanning, this is the last data you’ll need to input manually.

Because QuickBooks is provided over the cloud, there’s no installation to do, and again you’ll find the setup process is easy with just a few details (including your bank account) to fill in. you can even choose which parts of the software you need right now – if you don’t need a particular capability you don’t need to set it up, and you can add it whenever you want to do so.

However, QuickBooks does require a little more work to get started. While setup is easy, the learning curve needs to be surmounted and that can take a little while. Also, for those of you who are very smartphone-oriented, you’ll need to do all the setup on a computer before you can get the mobile app working.

Winner: Hurdlr

8. Reports

Hurdlr will generate automated reports every month and sends them you by email, so you can’t ignore them. That’s a really nice feature that busy freelancers value. And Hurdlr will deliver all the reports you need to run a small business – including your tax liability as well as profit and loss, revenue trends, and mileage to date.

But QuickBooks really owns reports. Even in the cheapest package you get a big bundle of different accounting reports. You get reports on receivables, you get reports on your profit and loss account, you can slice and dice your revenue by project or customer. And as you go up the price packages you get more and more reports, together with more customization.

Winner: QuickBooks

Final Thoughts

This is a difficult comparison to make. Hurdlr started as a quick way to record your expenses, and it’s moved up into the small business accounting space, while QuickBooks has always been a complete and incredibly fully-featured accounting package. Hurdlr’s sweet spot is the solopreneur or freelance, AirBNB host or Uber driver; QuickBooks’ is the small business with, maybe, several employees and contractors and three or four accounts users.

Hurdlr’s integration with platforms like Upwork makes it a great accounting app to use if you make all or most of your income through a platform company. If your needs are primarily for recording your income and expenses in a user-friendly way, Hurdlr delivers an inexpensive and user-friendly way to do so.

But if you’ve got inventory, receivables, or employees, you’re going to start needing a bit more – and that’s where QuickBooks excels. Yes, there’s a bit of a learning curve, but QuickBooks will give your business everything it needs in terms of functionality. It will also deliver robust reporting which you can use to drive your business forwards.

Things might change in future. Hurdlr is now offering an enterprise solution and we find that absolutely fascinating. It suggests Hurdlr is rapidly moving towards becoming a full-service accounting application rather than just an expense tracker. But right now, we don’t feel Hurdlr can guarantee that it can grow with your business – whereas QuickBooks definitely can.

FAQs

Which version you pick will depend on the functionality and the number of users you need. Many small businesses operate well with Simple Start, but if you have inventory management or project management requirements, you’ll need to step up to Plus. It’s worth starting with the cheapest package that fits your needs, as it’s super easy to upgrade from one package to another – it’s not so easy to downgrade if you find you don’t need the functionality.

Unfortunately, there isn’t a way to convert your data automatically from Self-Employed to Simple Start. You’ll have to export your data to a CSV file and then import that to QuickBooks Online.

Hurdlr Enterprise is designed to help organizations keep track of employee expenses. Employees can use it to track mileage and record their receipts, while workflow tools allow managers to set policies and grant approvals.