(Last updated on January 9th, 2023)

FreshBooks or Xero, which software is a better option in 2023?

Read this ultimate FreshBooks vs. Xero comparison to make a wise decision.

If you’re looking for accounting software for a small business, you’ll probably have heard about FreshBooks and Xero. Both are refreshingly modern-looking applications, and both are delivered as cloud services, giving you the flexibility to use them from any computer that’s got internet access and a browser open.

But which one is right for you? We put the software through its paces. We looked at the technical specs, we read user reviews, and we tried to find out where the two applications differed in their functionality and ease of use.

Read on to find out whether you should be using Xero or FreshBooks!

Comparison At a Glance

1. Features

Winner: Xero. Both these apps are functional accounting systems that support services businesses particularly well. However, FreshBooks loses out by not offering inventory or asset accounting functions; it is sometimes a little too trimmed-down.

2. Pricing

Winner: tie. Both FreshBooks and Xero have tiered pricing structures allowing you to choose the level of functionality you need at broadly similar prices.

3. Ease of use

Winner: FreshBooks. Both systems are really easy to use, but Xero, because it is designed to enable more complex transactions and processes, presents a slightly steeper learning curve.

4. Mobile Apps

Winner: FreshBooks. Both FreshBooks and Xero deliver apps on both iOS and Android. But FreshBooks feels “mobile native” and delivers more functionality on-the-go.

5. Integrations

Winner: Xero. You get hundreds of potential integrations with both applications. But Xero has more. If you want to link your CRM, direct mail, inventory management, workflow, and project management apps directly to your accounts system, that helps.

6. Customer Support

Winner: tie. FreshBooks would win for its phone support and really well designed in-app help features. But Xero’s big user community and 24/7 email support give it equal billing in our view.

7. Setup

Winner: FreshBooks. Xero is pretty easy to get started, with a useful setup wizard and the ability to import from Excel. But first-time users will find FreshBooks even simpler and more user-friendly.

8. Reports

Winner: Xero. No contest here. FreshBooks gives you a limited number of basic reports. Xero gives you actionable business information, with the ability to drill down and see the detail.

Short Verdict

For once, we’ve got a tie! Xero is clearly the better software if you have more complex requirements, and if you see your business becoming a mid-sized enterprise in the medium term, it gives you the best upgrade path.

But if you’re a startup or freelancer without the need for inventory or asset management, FreshBooks could be for you – it’s easy to use, and support for time tracking and collaboration is top-notch.

1. Features

Both these applications deliver basic accounting features that you’ll need to manage any business:

- invoicing and payment acceptance

- time tracking and project management

- expenses tracking

- bank reconciliation

- double entry based accounting system

- profit and loss account

- multi-currency support

In line with most other accounting apps, neither offers payroll functionality, though both will integrate with payroll systems like Gusto.

Though at the top level the two apps look similar, when you look more closely, their functionalities differ in detail, and their strengths and weaknesses are quite strongly differentiated.

Let’s take a look at FreshBooks first. It has key strengths in the capabilities it delivers for freelances and services businesses. Time tracking and billable hours support are provided at all price levels, with good project management functionality. For instance, the system has a built-in timer so you can record hours worked on a project and pass them straight through to invoicing. You can track due dates and milestones too.

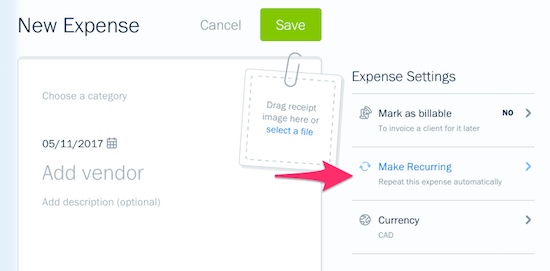

Invoicing is customizable, and you can create recurring invoices easily, which is great if you work on a retainer basis. You just have to click the ‘make recurring’ tab when you create the first invoice. Late payment fees can be added to invoices automatically, and you can save customers’ credit card data within the system for them to make payment.

You can also use FreshBooks to make pitches or proposals, and convert those automatically into invoices when the work has been delivered.

On the other hand, if your business is involved in retailing or manufacturing, you’ll find FreshBooks frustratingly lacks any inventory or asset management functionality. Its bill payment and expenses management capability is also considerably less sophisticated than its invoicing.

Where we feel FreshBooks really scores above many accounts packages is in its collaborative properties. You can invite clients and contractors to projects; contractors can use FreshBooks to log their hours, and you can pull those through to an invoice automatically. At the same time, the system has good access controls, so your graphic designer isn’t going to be able to see your bank account (or pay themselves out of it).

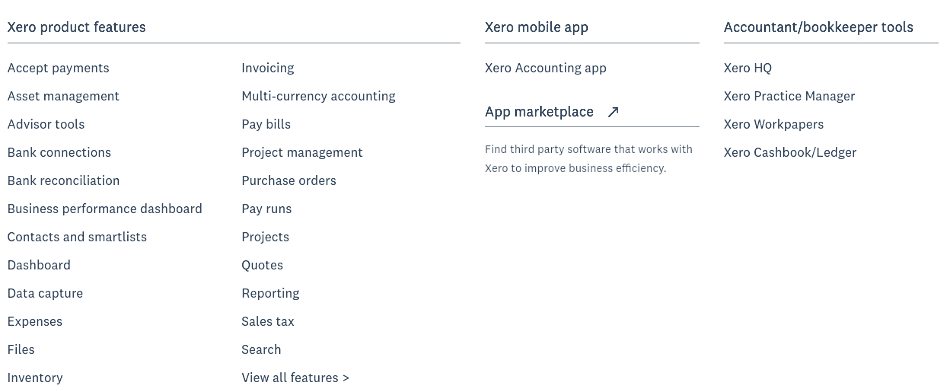

Now let’s see how Xero stacks up. Xero has a similar bunch of time tracking and project management features, though unlike FreshBooks, it restricts some of them to the higher-priced ‘Established’ package. Generally, it goes a little further than FreshBooks in adding complexity and flexibility.

For instance, invoices are more customizable, and the expense tracking features in the higher-priced packages are robust. You can assign expenses to a particular client, as well as to a category. Bill payment is easy, and you can set up recurring bills very quickly. In addition, costs can automatically be passed through to invoices if you need to bill expenses to your clients.

Xero also has asset tracking and inventory management features, which FreshBooks doesn’t. If you invest in fixed assets, Xero will handle your depreciation automatically, too.

Xero has a good budgeting feature that can help support your business strategy, something that’s missing from FreshBooks. Plus, if you want to play with scenarios, or assess whether you could shift your business up a gear by investing in new capacity, you can import and export your Xero budgets from/to CSV files or Excel spreadsheets.

Where we find Xero really convincing value is in its support for specific industry verticals. It has versions set up for retailing, particularly e-commerce, as well as for legal businesses and IT/computing. If you’re in any of these verticals, it makes good sense to look at Xero – it will have customization for your vertical already set up.

This functionality sometimes comes at a cost. Multi-currency isn’t well automated, and workflows are sometimes clunky simply because you have a lot of choices, some of which you don’t need.

And while Xero supports Paypal and Stripe, which is great for e-tailers, it doesn’t take incoming credit card payments. (You can use your business credit card to pay bills, though.) You’ll need to think about what payment functionality you want.

2. Pricing

Both applications have similar tiered pricing packages. FreshBooks is tiered by the number of billable clients, but time tracking is standard. That’s unusual in accounting software where this functionality is often reserved for higher-priced packages.

That makes FreshBooks a great choice pricing-wise for professionals like designers, copywriters, and PR execs who work with a handful of regular clients or on retainer. However, the limits on billable clients would make life difficult for most b2c businesses.

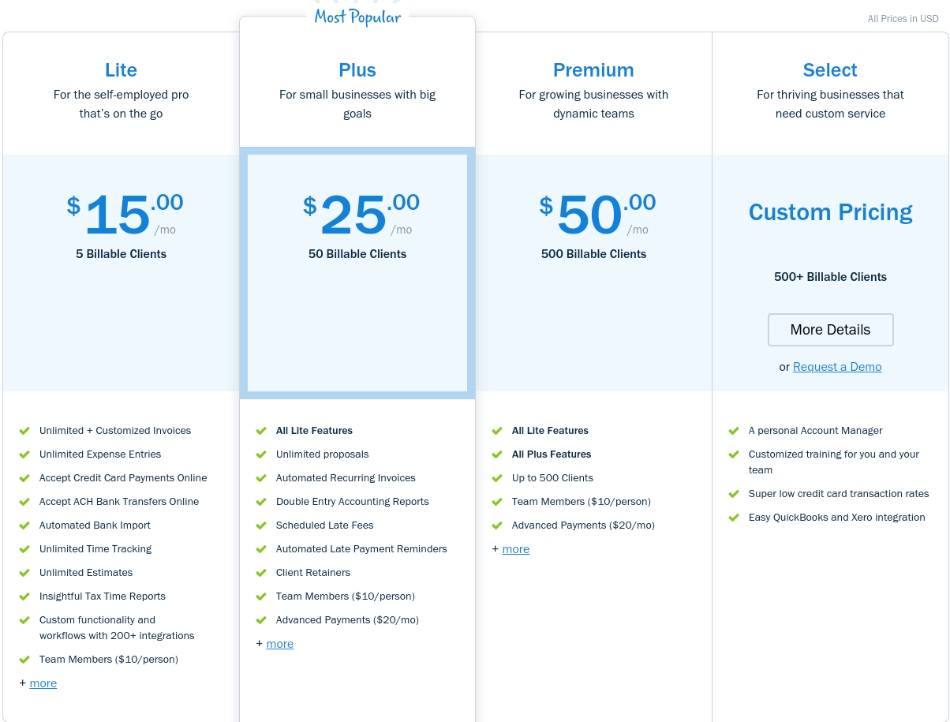

FreshBooks packages

| Plan | Cost per month | Limits |

| Lite | $15 | 5 billable clients no recurring payment functionality or late fees |

| Plus | $25 | 50 billable clients |

| Premium | $50 | 500 billable clients |

| Select | Custom pricing |

Each additional team member: $10 per person

FreshBooks offers a 10% discount if you pay annually rather than monthly. Right now, it’s also offering 60% off for 6 months, and has a 30-day free trial.

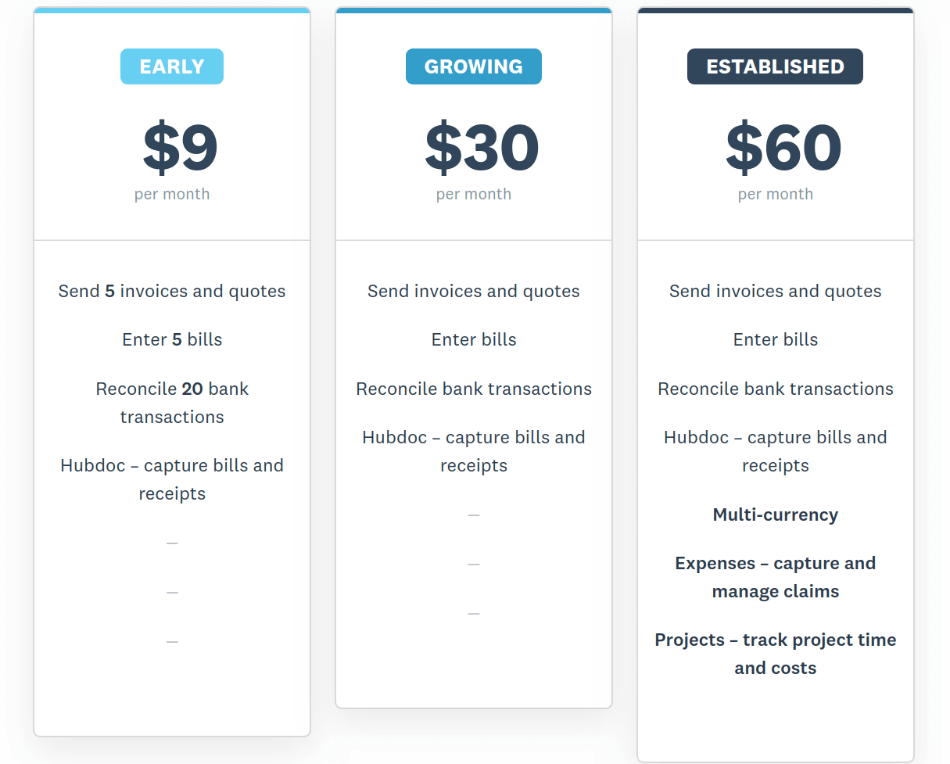

Xero gives you unlimited users right from the get-go but has very limited functionality on its lower-priced packages. We don’t think the Early plan cuts the mustard, and if you want the project tracking functionality that Xero’s so good at, you’ll need to take the top pricing level Established plan.

| Plan | Price per month | Limits |

| Early | $9 | Unlimited users, but only: 5 invoices/quotes 5 bills 2 banking transactions |

| Growing | $30 | Unlimited users and transactions but: No multi-currency no expenses tracking no project tracking |

| Established | $60 | All-in |

Xero offers a 30-day free trial, the same as FreshBooks. At the top level, it’s $10 a month more than the equivalent FreshBooks plan, but without the limitation on billable clients.

Winner: Tie

3. Ease of Use

Both these applications score very highly on ease of use. They both have a bright modern feel compared to some of the more traditional accounting apps. The double-entry bookkeeping that your accountant want to see is there, but it’s hidden away so you can do your job without having to know about ledgers, debits or credits.

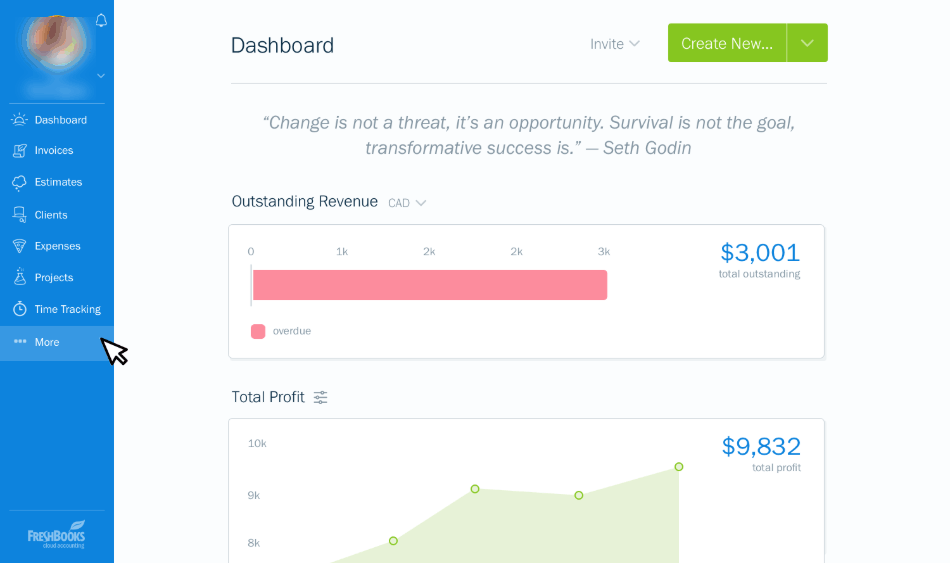

FreshBooks is very intuitive with a clear interface and easy navigation. If you want to perform basic functions like invoicing, the workflow is really streamlined. There are even ‘post-it notes’ paper clipped to some pages showing you where to go next or explaining features of the system.

FreshBooks opens on a dashboard that gives you a summary of your business. It also flags up recent transactions and users. That’s really useful if you work with distributed project teams as it keeps you up to date.

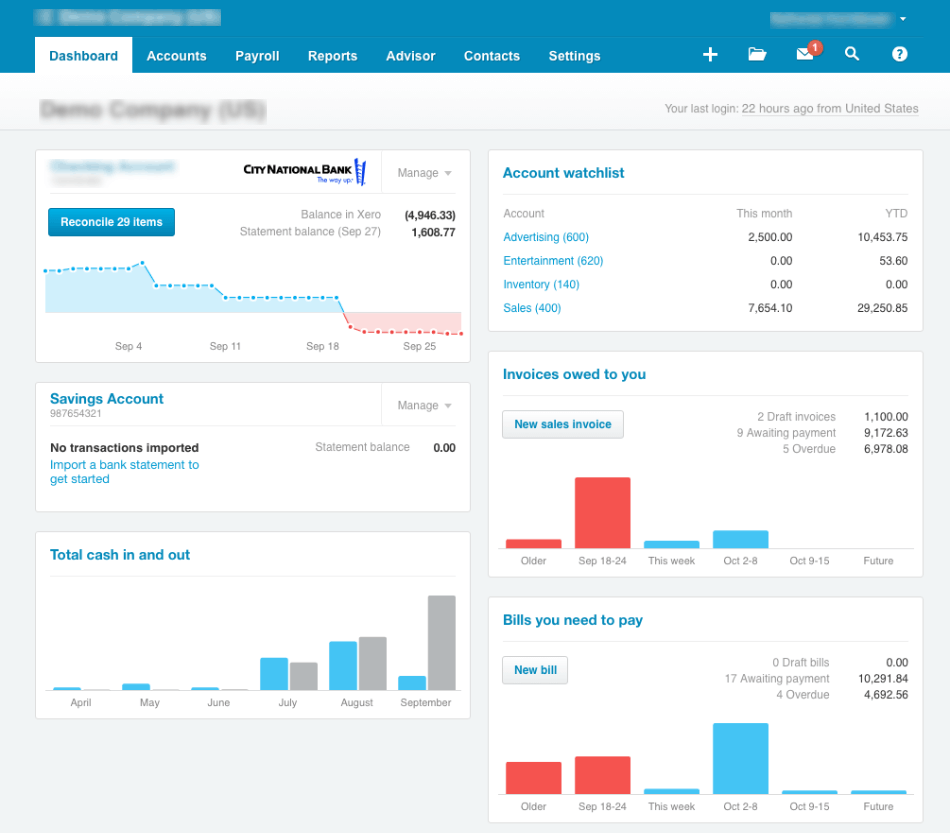

Xero also has a fresh and uncluttered GUI, and it delivers easy workflow for basic accounting. But once you want to use advanced functions, it becomes trickier. Even so, Xero has been clever about how it makes the system deliver flexibility without losing simplicity; for instance, the ‘approve’ button has a drop-down facility so you can carry out extra actions.

The learning curve for both systems is very gentle; you’ll be up and running fast. But FreshBooks is just that bit easier to use and nudges its way into first place here.

Winner: FreshBooks

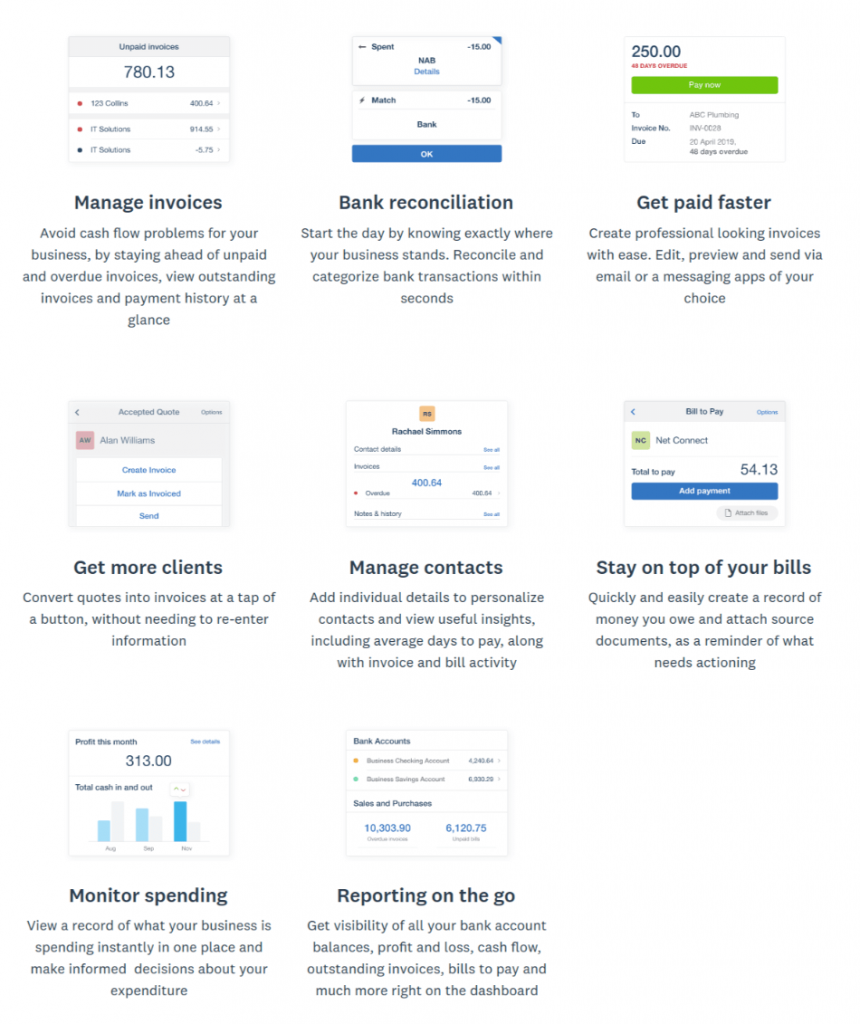

4. Mobile apps

We think FreshBooks has one of the best mobile apps in this space. Most accounting packages just let you scan in receipts or create invoices, but FreshBooks lets you do a lot more. It highlights the latest transactions, so you can keep up to date on your business finances wherever you are.

It also enables time tracking via your mobile device – great for service businesses who need to log hours spent on client premises or service calls. And you can chat with clients from within the system, as well as doing some expenses management from mobile.

Available on Apple App Store or Google Play, the FreshBooks mobile app feels like a real mobile-native front end, not a boiled-down, feature-limited access point.

Xero offers invoicing and receipt scanning through its mobile app. It’s well designed and easy to use, though some customers complain that it’s buggy and prone to unexpected crashes.

Winner: FreshBooks

5. Integrations

Both Xero and FreshBooks have numerous integrations allowing you to link them to other business software such as payroll, online payments, or CRM. FreshBooks offers over 200 integrations, including Gusto payroll. It can also integrate into inventory management systems to replace the ‘missing’ functionality in the accounting software.

FreshBooks is great if you use internet payments since it integrates with Stripe, Paypal, and Square, as well as taking credit card payments. Use Zapier, and you’ll get access to even more integrations.

However, its integration list is put in the shade by Xero, which claims over 700 third party apps will work with its accounting software. It also has its own software such as Xero Payroll; for more advanced project management, it integrates with Xero Projects and Workflow Max.

Winner: Xero

6. Customer Support

FreshBooks gets good reviews for its friendly and responsive phone support, provided via a toll-free line. You can also message support from within the app.

In-product help is also good. As with many other features of FreshBooks, it feels as if it’s been designed by a user who has been through the learning curve, rather than an accountant or techie.

Xero has strong 24/7 email support but doesn’t offer phone support. However, its big user community, including plenty of accountants and bookkeepers who use the software, means there’s lots of expertise available. Online resources are top-notch, with Xero U offering intensive training for users.

If you’re self-reliant when it comes to software, you’ll love Xero – if you need (or want) your hand held, FreshBooks has the edge.

Winner: FreshBooks

7. Setup

Since they’re both cloud computing solutions, you’ll find setting up either system a breeze compared to installing desktop software. The setup is mainly about plugging in your business information, such as your bank account details.

FreshBooks is installed via a series of wizards, starting with ‘choose your industry’ – this will configure the chart of accounts so that all the right accounting items appear automatically for your kind of business. (If you didn’t understand the words “configure the chart of accounts,” then you are exactly the kind of user FreshBooks has been designed for.)

It’s also easy to import data from spreadsheets. If you’re making the move from using a spreadsheet to manage your business to using an accounts software package for the first time, this is a key feature.

Once you start using it, FreshBooks has great first-time in-app support. The first time you use any feature, the system will call up targeted explanations and walk you through the processes. Clear graphics – arrows, speech balloons, ‘post its’ – make it easy to see where you’re headed and what to do.

Xero also has a setup wizard to make your life easy. You’ll need to enter your bank info at the start, though Xero also loads sample company accounts so you can spend some time looking at where things go before you enter your own transactions. We found set up a bit more time-consuming than in FreshBooks.

Xero also lets you import data from Excel, and helpfully has a number of Excel templates that will format your data the right way before you upload it. It also has a neat feature – the first time you run it, the software suggests the top ten activities most business owners want to carry out, and takes you to whichever you pick.

Winner: FreshBooks

8. Reports

In most sections, we’ve found both the rivals give a good account of themselves. But if you want business reporting, the result is cut and dried; it’s Xero all the way.

FreshBooks only offers 14 reports. There’s no balance sheet, and customization is limited. This is fine if your effort is going into your day to day business activities, or into marketing, but not so good if you want to look at where you’re really making your money. Once your business becomes more complex, you may end up wanting more.

On the other hand, Xero offers a good range of reports. This is an area that Xero’s developers have been improving continuously, adding customization and filters so you can find exactly the data you need. You can build up and automate your own monthly management reports.

Xero isn’t perfect. We didn’t find it easy to drill down from the top-level report to see what’s going on at individual customer level. Xero doesn’t have an uncleared transactions report, so that’s something you need to do manually, and that will take time. (In non-accounting speak, Xero will reconcile most transactions to your bank account automatically – but it doesn’t tell you about the ones that for whatever reason haven’t been matched.)

Winner: Xero

Final Thoughts

It’s a tie!

But you will almost certainly know, by now, that one of these apps is perfect for you and the other isn’t.

FreshBooks is great for small teams, collaborative style businesses, professionals who work on the basis of billable hours, and project managers who need to book expenses by client. It’s also a great recommendation as a first accounting system if you’re making the transition from paper or spreadsheet record keeping.

The downside is that while FreshBooks is superb for young businesses, it’s not really going to scale up if your business grows and becomes more complex. And if you’re in retail or manufacturing, its lack of inventory functionality rules it out.

Xero offers more in-depth support for the growing business. In particular, it’s a step up in reporting functionality and has more flexibility in many areas. You’ll also easily be able to find an accountant or bookkeeper who’s used to using Xero; once you get to the stage of needing to file financial reports, you’ll be grateful for that!

Xero also offers more integrations and unlimited users right from the bottom pricing package upwards. Together with the unlimited users, we find its support for payroll and 1099 contractor reports better, so as you grow your employee or contractor base, Xero will really start to prove its worth.

We’d be happy recommending either software – they’re both excellent.