(Last updated on January 9th, 2023)

Wave or Xero, which software should you choose in 2023?

Read this ultimate Wave vs. Xero comparison to make a wise decision.

If you’re looking for accounting software for a small or mid-sized business, there are a huge number of different applications you might consider. Xero and Wave both have plenty of fans; they’re both cloud-based apps, focused on the needs of small business and freelancers, delivering a double-entry based but easy to understand accounts package. (All the double-entry stuff happens in the background.)

They’re both great systems that are easy to get started on and deliver a good user experience. But which is best for you?

We looked at the specifications, we looked at the Wave and Xero websites and forums and listened to what users and accountants had to say. We played with the software, and we checked out some of the basic functionality.

Let’s take a look at the results of all that research.

Comparison At a Glance

1. Features

Winner: Xero. Both these packages are great at invoicing and provide all the basic accounts functionality you need. But Wave has a few missing links – it doesn’t track inventory or billable hours, or let you pay bills directly, and its reporting is basic.

2. Pricing

Winner: Wave. Wave is free. Xero costs something. Both are affordable for small businesses and freelancers, but seriously – you can’t quibble with ‘free’.

3. Ease of use

Winner: tie. You don’t have a finance or accounting qualification? You don’t need one. Both these apps are streamlined and easy to use for all the basic jobs you need to do. They’re easy on the eye, too.

4. Mobile Apps

Winner: Xero. This isn’t an area where accounting programs typically do well. Wave has two mobile apps, one for expenses and one for invoicing; Xero does it all in one app, but it’s glitchy.

5. Integrations

Winner: Xero. Wave gives you all the right e-commerce and payment apps for small business as well as Google Sheets support. But Xero has more direct integrations letting you add CRM, inventory or project management apps.

6. Customer Support

Winner: Xero. Wave’s support is limited unless you’re a premium user. Xero has an excellent reputation for its support and has a thriving support forum too.

7. Setup

Winner: Wave. Both apps are easy to set up and get started on.

8. Reports

Winner: Xero. Wave has the basic financial reports your accountant will want to see, but not a lot more. Xero has more, with more drill-down capability; so if you are going to use your accounts app to help you evolve your business’s strategy, it’s the better of the two apps.

Short Verdict

“You get what you pay for” isn’t always true, but it is in this case. Wave, the freemium program, has good functionality, but if you stump up the extra for Xero, you will get a lot more in terms of functionality, integrations, reporting, and support.

That said, Wave is a great program that covers the bases. If you have a small e-commerce business, or you’re a freelance professional, it may be all you need, and you can save your pennies for investing in other areas of your business.

1. Features

Both of these programs offer all the basic accounts functionality. For instance, you’ll get:

- customizable invoicing

- ability to turn a quote into an invoice

- automatic sales tax calculations

- bank reconciliations

- multi-currency support

- profit and loss account and balance sheet reports

- double-entry accounting (‘under the hood’ so you don’t see it)

Neither program offers payroll, so you’ll need a third-party app for this. Xero integrates with Gusto, which costs $39 a month plus $6 per employee; Wave has in-house payroll offered in a few states as full-service managed payroll at $35 plus $4 per employee, or as self-service at $20 a month + $4 per employee.

Wave makes it really easy to invoice your customers. It automatically sends invoices out as an email, including a link for payment. It even tells you when the invoice has been viewed, so you know whether it arrived in the correct mailbox. You can customize your invoices to reflect your business branding, and you can use Checkouts in Wave to give you full e-commerce functionality.

Wave is also really good at handling subscription payments and recurring invoices – great if you run a yoga class, work on a retainer, or offer a monthly chocolate specialty box or other regular delivery product. However, it doesn’t have inventory management functions, so it’s less useful for retailers and manufacturing businesses.

Oddly, bill payment functionality is missing, though the company is working on it. You’ll have to pay bills through your bank, and Wave will import the transaction from there.

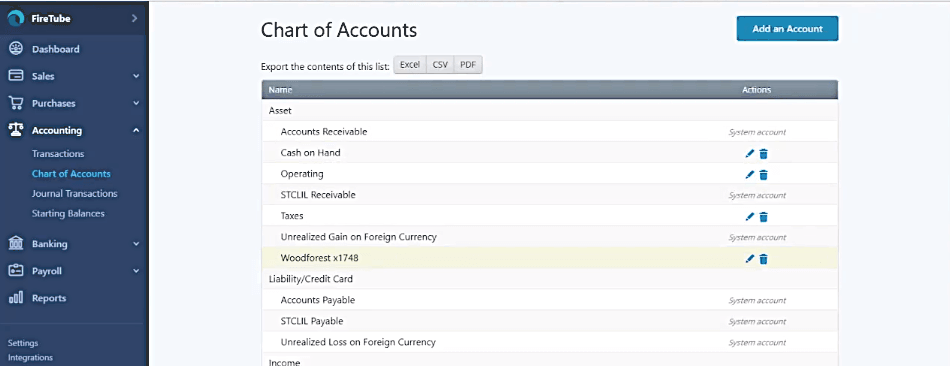

Wave lets you customize the chart of accounts. That means you can decide what category you want particular transactions to belong to and you’ll be able to track them.

If you ‘re a solopreneur, you can use Wave to handle both your personal and business accounts (though it doesn’t handle investments – for that you’ll need a personal finance manager like Personal Capital or Mint). You can use it to handle two separate business accounts, too. But, annoyingly, it won’t give you any help with your tax filings.

It also doesn’t track billable hours or mileage (which with a 54 cents a mile tax deduction could save you quite a bit in tax payments). And it doesn’t have a project management capability so that if you need to track milestones, you’re going to have to integrate a PM software instead.

And Wave doesn’t have an audit trail. That’s okay if you’re using Wave for your own business and it’s just you using it. But if you have a growing business with a number of users, and there’s an issue later on – the client says they’ve been billed for the wrong number of hours or at the wrong rate – how do you trackback to who input that data, when, and why?

Another small issue is that Wave only lets you add notes to invoices that are visible to your customers. You don’t always want that, particularly if you have a customer who had to be chased for payment last time out. (Of course, if you have your CRM integrated with Wave you would be able to use the CRM for the note instead, but it’s not supported within the basic Wave functions.)

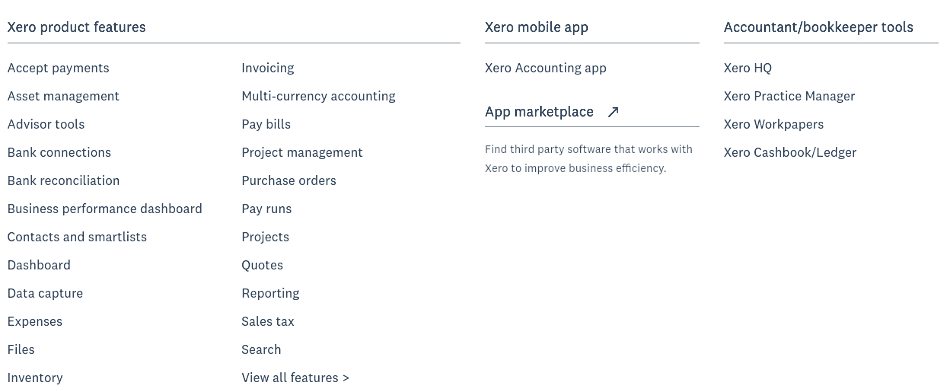

Xero, like Wave, offers customized invoices, easy invoicing, and automatic bank reconciliation. But it adds more complex functions; for instance, you can offer credit notes, which aren’t supported in Wave (there’s a workaround, issuing a negative invoice). You can add late fees automatically, too.

Xero supports professionals and freelances well. You can track your time, and if you work on a billable hours basis, you can simply convert your hours to an invoice. You can also pass expenses on to clients very easily. Xero has really good project management capabilities, too, though these are only available in the top pricing package.

Xero offers quite a few functions that Wave misses out;

- inventory management up to 4,000 tracked items

- fixed assets, including depreciation

- 1099s for contractors

- really robust access controls when you add multiple users

- bill payment.

Paying bills is much simpler with Xero. If you have a purchase order, you can just convert it to a bill, and bill payments can be made recurring simply by checking the box.

Xero has a robust budgeting function and can export your budgets to Excel, or as a CSV file, if you want to try out different scenarios or, for instance, assess your ability to cope with lower or higher volumes of business.

Xero also has versions aimed at particular verticals – e-commerce, IT, retail, and legal practice.

Winner: Xero.

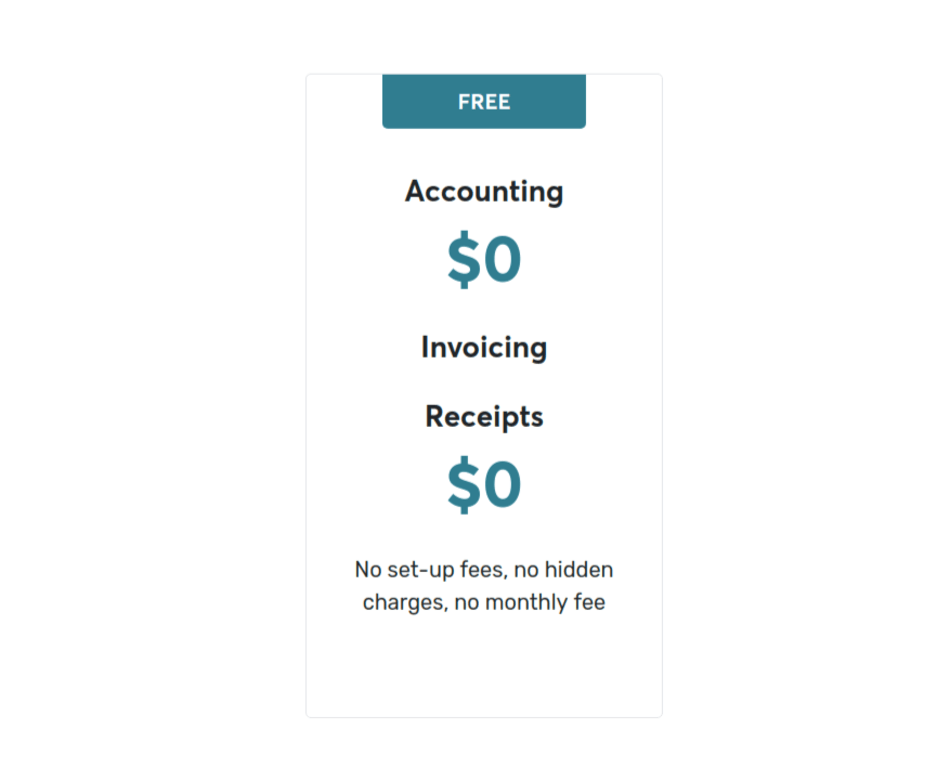

2. Pricing

Wave is free. Totally free. All the functionality is there, including invoicing and receipt scanning – except for payroll which will cost extra ($20 plus $4/employee self-service, $35 a month in some states for full-service payroll). Most accounting applications require extra payroll functionality to be added at a charge, so this isn’t out of line with the industry, and Wave’s payroll pricing is within the normal range.

Where Wave makes its money is on credit card processing and ACH payments. It charges 2.9% plus $30c for most credit cards, 3.4% plus $30c for Amex, and 1% on all bank payments ($1 minimum). The credit card charges are relatively standard, but other apps don’t charge for ACH payments – that can add up if you do a high volume of business.

On the other hand, if you have variable business levels or your business is a side hustle, it’s going to end up cheaper and give you more predictable profit levels than paying a monthly subscription to a payments service.

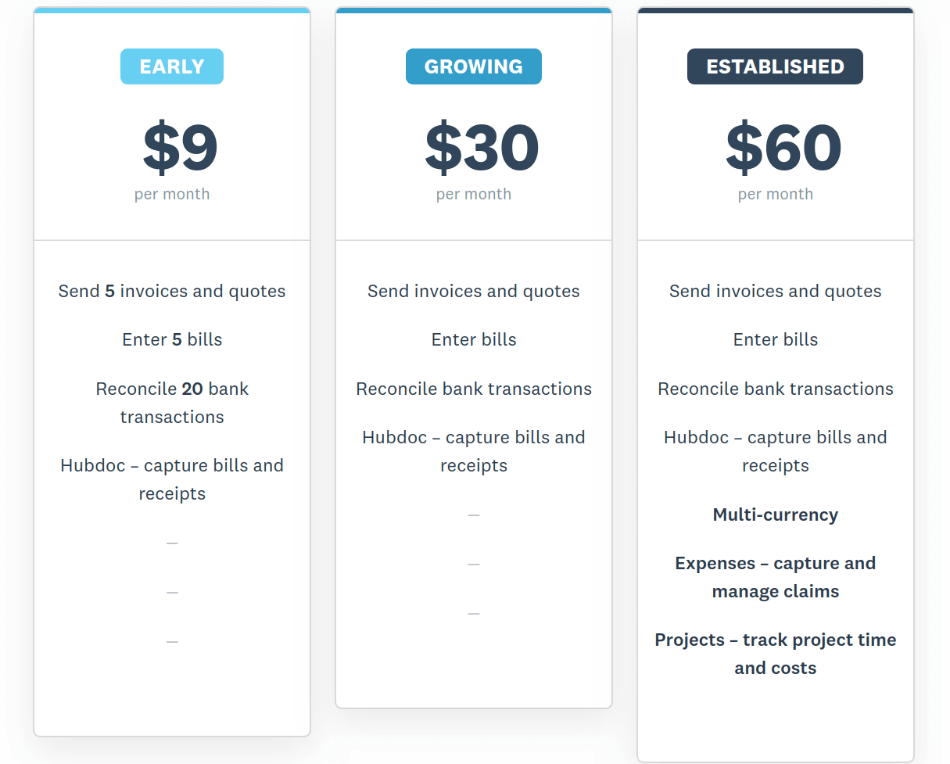

Xero has a tiered pricing structure with three levels of package. Full multi-currency support, project tracking and expenses tracking functionalities are only available in the highest-priced package. The tight restrictions on the number of transactions in the lower-priced package make it suitable only for freelancers with a very limited number of clients; for instance, if you do most of your work through an umbrella company. We wouldn’t recommend it – go straight to the ‘Growing’ package if you want to get the best out of Xero.

Xero’s three plans all support unlimited users. If you have freelance salespeople carrying your product, resellers, or project teams who need to have access to the figures, that’s really useful.

| Plan | Price per month | Limits |

| Early | $9 | 5 invoices/quotes 5 bills 2 banking transactions |

| Growing | $30 | No multi-currency no expenses tracking no project tracking |

| Established | $60 | All-in |

Significant discounts on the first three months’ subscriptions are available for new users, and there is a 30-day free trial with pre-populated data.

Winner: Wave

3. Ease of Use

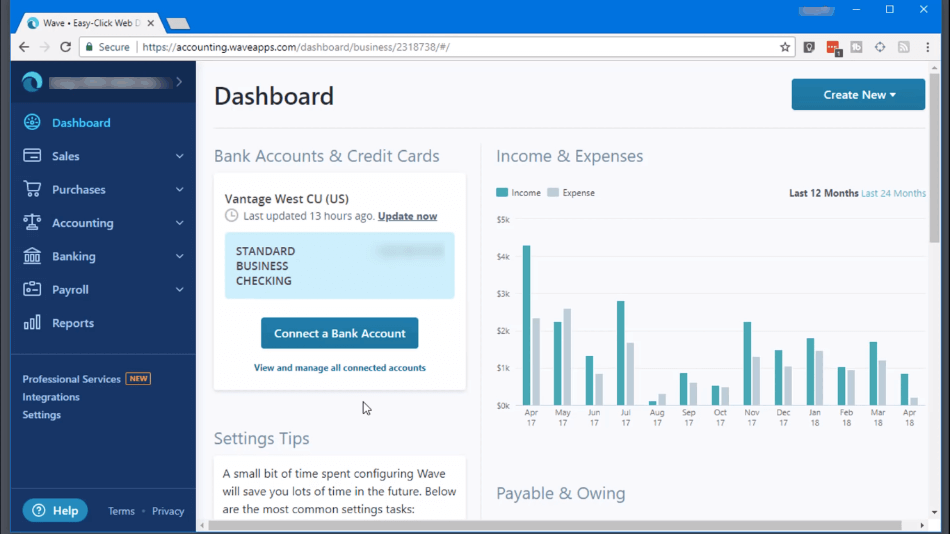

Both these apps rank very well for ease of use. The look and feel for both of them are fresh and modern – they don’t give the impression of coming out of an accounting textbook or an early 1990s ERP package.

Both have a quick-add menu that lets you carry out basic transactions, like invoicing, from anywhere in the system – you don’t have to go into a particular module or back to the front page.

We like Wave a lot for basic usability. For basic functions like invoicing and expenses, it’s really simplified and highly intuitive and requires the minimum keystrokes to carry out your tasks. It also makes payment easy for your customers through building payment links into your invoices – that’s a big plus! However, screens for different functions are sometimes inconsistent in design.

The simplicity of the system, though, reflects its relatively ‘lite’ capabilities. If you want to do something like stage payments with a penalty for late payment, you’re going to hit a barrier.

Users’ main beef, though, isn’t the software design; it’s bandwidth. Wave can take too much time to load and refresh pages. This is something that the company has been improving, and for those who run just a handful of transactions a week, it’s not a deal-breaker. If you are growing your business and have a lot of bills to pay and invoices to send, though, it can cut into your valuable time.

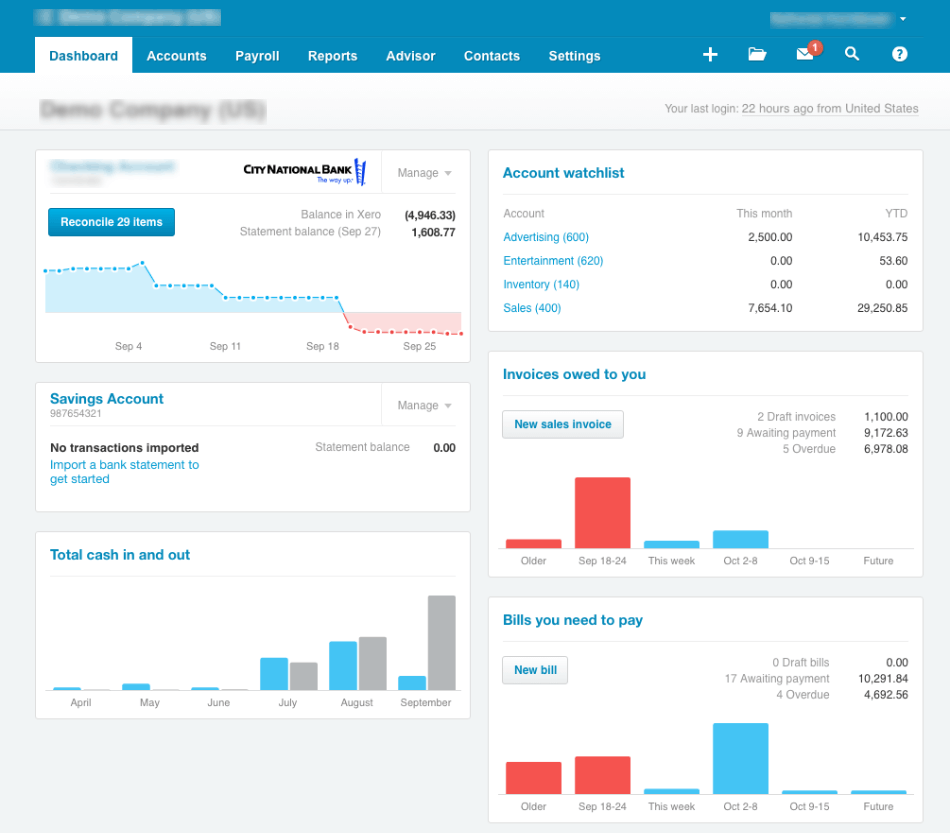

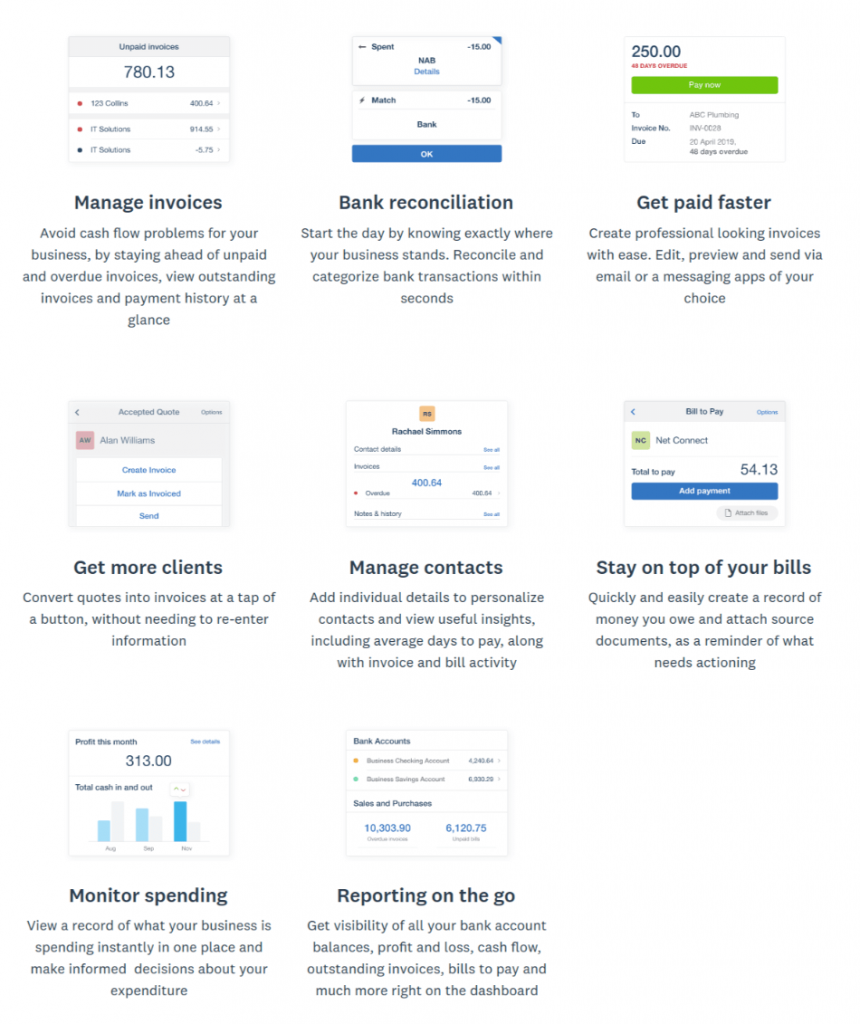

Xero is very streamlined. Many processes take just one or two clicks. Both invoicing and bill payment are really simple to carry out, and the contact management area lets you manage clients, vendors and contractors easily.

There’s been some good thinking about what you need to see, and where – for instance, currency translations show up on all the relevant documentation so you can always check an invoice, say, against the client’s currency as well as your base currency.

Xero has really good drill-down capabilities, too. That allows you to examine any trend or statistic that looks interesting and informative or track the audit trail for a transaction. You can check through from payments to the bank reconciliation, or from an invoice to payment.

We do wish, though, Xero was better at bank reconciliations. It matches most of your transactions with items in your accounts – each payment with the corresponding invoice, for instance – but it doesn’t automatically alert you to unmatched transactions. That means you’ll need to check the bank reconciliation manually. Really, the software should save you the work.

Winner: tie

4. Mobile apps

Wave, rather oddly, decided to create two separate apps for mobile users: Receipts and Invoice. One lets you send invoices, and the other (you may have already guessed) lets you scan in receipts for expenses. These are both useful functions, but why split them? If you’re on a sales trip, you may have an order to process and two or three receipts to scan – you don’t really want to have to open two separate apps.

Xero lets you handle invoicing and expenses in a single all in one app. Like Wave, it’s limited to basic inputs and doesn’t give you the ability to see all your accounts. And users complain that it is glitchy and liable to crash unexpectedly. That’s really bad news since you won’t know whether it has synced your invoice or scan with your accounts or not.

To be honest, if you want a mobile-native, great accounting mobile app, you’re not going to find it with either Wave or Xero.

Winner: Xero

5. Integrations

Both Wave and Xero integrate with basic payments apps such as Stripe and PayPal, and with e-commerce applications like Shopify, Shoeboxed and Etsy. Both also integrate to Harvest for time tracking and to Geckoboard for dashboard capability. And both work with Google apps, which is useful if you’re already using Google Drive and Docs to collaborate with team members.

Wave also offers direct mail integration with MailChimp. But it has only a handful of direct integrations. On the other hand, a whole load more integrations can be handled through Zapier.

Xero has a lot more direct integrations, including Expensify, Squarespace, and Workflow Max. It claims that it can integrate over 700 third-party apps. And for those of you who are nerds or have an IT department that wants to get stuck in, Xero opens up its API; Wave doesn’t.

Winner: Xero

6. Customer Support

Wave offers webinars, video tutorials, and other online resources to help its users. It has a bunch of user forums which are informative and supported by Wave’s own developers and tech support staff, as well as by the user community.

But Wave’s live phone support is only available for the first 60 days unless you use one of the paid-for services.

Xero offers free 24/7 email support, phone support, and live chat accessible from within the app. Unlike a number of players in this space, Xero gets really high ratings on support and training from its users. If you want really intensive training, you can even head to Xero U.

Winner: Xero

7. Setup

Both these programs are delivered as cloud apps running in a browser, so there’s no installation to do. Setup for both is simple; you can import contacts as a CSV file, and the amount of information you need to enter is pretty limited.

Xero does require you to enter your bank details at startup; and you need to load the whole system, you can’t pick and choose parts of it even if (say) you don’t need the balance sheet functions.

Wave uses a simple launchpad to guide you through the setup process, which just takes a couple of minutes and doesn’t demand you enter more than very basic information.

Both programs are easy to get started with; the learning curve is not steep. Some users who found systems like QuickBooks and Sage far too complex and demanding report being able to start using Wave right away – so if you’re not a tech whiz, and finance makes your headache, it might be a good system for you!

Winner: Wave

8. Reports

Wave’s reporting functions are very limited; it offers just 12 standard reports. They cover the bases for financial accounting – P&L, cash flow, sales tax breakdowns – but don’t really give you the kind of granular business information you’ll want to move your business forward. The reports can all be exported to a spreadsheet, but they’re not very customizable. It’s a serious weak point for this otherwise pretty good app.

Xero, on the other hand, produces a total of 52 reports. Some, like the journal report, are of interest mainly to your accountant, but others like inventory lists, and detailed reports on aged receivables, are really useful for managing your business. You also get a budget variance report which gives you key information on where your expectations were undershot or exceeded, and which expenses you might need to rethink.

Xero provides good support for employee reports, payroll, and product performance reporting. It has good class tracking functionality, meaning that you can pull out sales by customer, product, or location, or aged receivables by customer or type of sale.

You can star reports to show up in your reports menu, so if there are a couple that you check all the time, you’re saving yourself a good few keystrokes.

Winner: Xero

Final Thoughts

These are both good and highly usable programs, but Xero is by some way more comprehensive. Its functionality is more advanced, particularly where inventory management and project tracking are concerned, and its reporting is much better. It’s also more scalable – if you have a small business, but you hope in a few years it’ll be a mid-sized enterprise, Xero will grow alongside you. Wave won’t.

In particular, freelancers and professionals who work on the basis of billable hours or in collaborative projects will find Xero has the right tools to support them.

However, Wave is free – that’s a big plus – while remaining a good quality, useful application. Freemium, in this case, doesn’t mean they cut any corners in development. If you are running your business on a shoestring, Wave will give you all the basic functionality you need, plus a bit more. For instance, the way it handles invoicing and payments is really neat – well designed, smart, and effective.

So, it’s up to you. Free, basic, and effective – or moderately priced, scalable, and function-rich? You know what your business needs, and that will be the key driver for any decision.