(Last updated on January 9th, 2023)

FreshBooks or QuickBooks, which software should you choose in 2023?

Read this ultimate FreshBooks vs. QuickBooks comparison to make a smart decision.

Both FreshBooks and QuickBooks Online are well regarded, market-leading accounts apps for small business. They both offer a cloud computing environment – QuickBooks also offers desktop versions – and have similar functionality in many areas.

But each of these applications has different strengths and weaknesses. We have a good look at the software, customer reviews, and product specifications to pick the right software for you. And with these two applications, it’s very challenging to find a winner – therefore, we’ve awarded a tie in many categories.

Let’s take a look at the comparisons.

Comparison At a Glance

1. Features

Winner: Tie. Both applications come with most of the basic accounts functionality a small business needs. Each has its strengths – QuickBooks for businesses with inventory and physical assets, Freshbooks for project management and time tracking.

2. Pricing

Winner: Tie. Both applications have a tiered pricing system, Freshbooks tiered by the number of billable clients, QuickBooks by the number of users.

3. Ease of use

Winner: Freshbooks. Both systems are easy to use and don’t require any accounting knowledge, but Freshbooks is more intuitive.

4. Integrations

Winner: Tie. Both apps have numerous integrations working well-covering functions such as payroll, CRM, and marketing.

5. Mobile Apps

Winner: Freshbooks. Both apps let you create invoices and enter expense items on your mobile device, and sync with all your other devices. But Freshbooks also enables time tracking and highlights recent transactions in the mobile app.

6. Customer Support

Winner: Tie. Both of these apps have great customer support. Freshbooks is a bit more responsive on the phone, but QuickBooks has a huge amount of training and help resource on the web – articles, webinars and video tutorials.

7. Setup

Winner: Tie. QuickBooks lets you set up just the functionality you need, and add to it later on if your needs change. Freshbooks, on the other hand, provides excellent in-app help the first time you use any feature, flattening out the learning curve.

8. Reports

Winner: QuickBooks. This is a crucial category for us. QuickBooks wins it very convincingly, with up to 60 standard reports and extensive customization potential. If you want to use accounting reports strategically to drive your business forward, Freshbooks just doesn’t quite cut the mustard with just 14 reports.

Short Verdict

These two applications have been designed for different target markets. QuickBooks is an excellent program for general small business use, particularly for businesses that have significant inventories. Freshbooks is intended more for services-based businesses and self-employed professionals, particularly those working on a project basis or on the basis of billable hours.

That’s why it is very difficult for us to find a winner. They both do the job they intend to do extremely well. But Freshbooks loses marks for its sketchy reporting function. QuickBooks, which has a really great set of standard reports plus extensive customization, wins by a country mile in this category, and that gives it the overall win.

1. Features

The main features offered by the two applications are very similar, covering basic accounts functions such as

- invoicing

- recurring bill payments

- managing receivables and payables

- reporting

- connection to your bank, with bank reconciliation

- expense entry and tracking

- support for credit card payments

- contact management

- basic accounting and financial reports.

Both provide revenue tracking and automatic payment reminders and allow you to analyze past due receivables to make sure you’re not giving bad paying customers a free ride. (QuickBooks’ receivables reporting is more in-depth, by the way.)

Neither will run your payroll. You’ll need a third-party integration to do that – though QuickBooks plays well with Intuit’s Payroll product.

Where QuickBooks does well is in having a full inventory function. For instance, whenever you issue an invoice, it will automatically update your inventory levels (as long as you’re using the top-priced ‘Advanced’ package). It provides full balance sheet support, so if you invest in business assets such as machinery, premises or vehicles, it will handle the depreciation and tax deductibles for you.

FreshBooks doesn’t offer any asset or inventory management functions. True, its target users, service companies and professionals, probably don’t have much tied up in assets, and sell their time rather than selling physical products.

QuickBooks has great banking and automation features. It automatically imports and categorizes your transactions (Freshbooks doesn’t categorize them, so you’ll have to spend time doing this yourself). Bill pay and bill management are functions that Freshbooks doesn’t have. And QuickBooks shows you the chart of accounts, so you can decide what types of expense you want to show, and categorize them however you like.

The customer and supplier management features are strong, letting you manage shipping and billing addresses, and even change language preferences and attribute a currency to each customer (in the higher-priced packages) – great for exporters.

There’s also an accountant option which gives your accountants the view they’ll need to audit your accounts or produce financial figures.

Freshbooks has some extra bells and whistles

While Freshbooks is missing some basic functionality that retail and manufacturing businesses need, it’s got some great features for a service-based business.

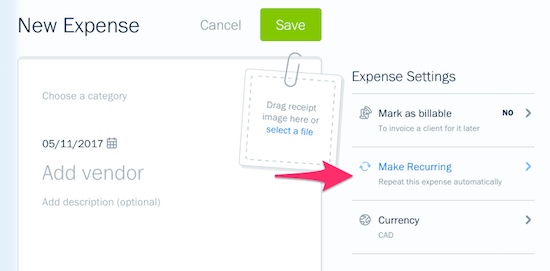

For instance, Freshbooks allows you to add late payment fees automatically. It’s much easier to create recurring invoices, too, for instance, if you offer subscriptions or a maintenance package – there’s a ‘make recurring’ tab on every invoice you create. In QuickBooks you have to go back to make a one-off transaction first, then mark it as recurring – several extra steps. Freshbooks’ invoicing function also allows you to save customers’ credit card data for future use.

Freshbooks offers tracking and billable hours in all plans (QuickBooks gives this functionality only in the higher-priced packages). There’s even a built-in timer in the app for you to record your hours, then enter them into the system for billing. Freshbooks has evidently really thought through how to provide the best support for consultants and professionals who charge their customers by the hour.

Another feature that is great for professionals is that you can send a pitch or proposal, and, if it’s accepted, easily convert it to an invoice when the time comes to bill your client.

Freshbooks also lets you ‘invite’ contractors and employees to contribute to projects. They can log their hours, and you can pull those hours straight through into an invoice. At the same time, Freshbooks gives you access controls so you can let stakeholders see only those parts of the system they need to use.

You can also track due dates and milestones. The project management functionality is deeper and richer than in QuickBooks – if you have a project management background, you’ll feel at home with Freshbooks, for sure.

Winner: A tie.

2. Pricing

Both QuickBooks and Freshbooks have tiered plans, but the plans are very differently structured.

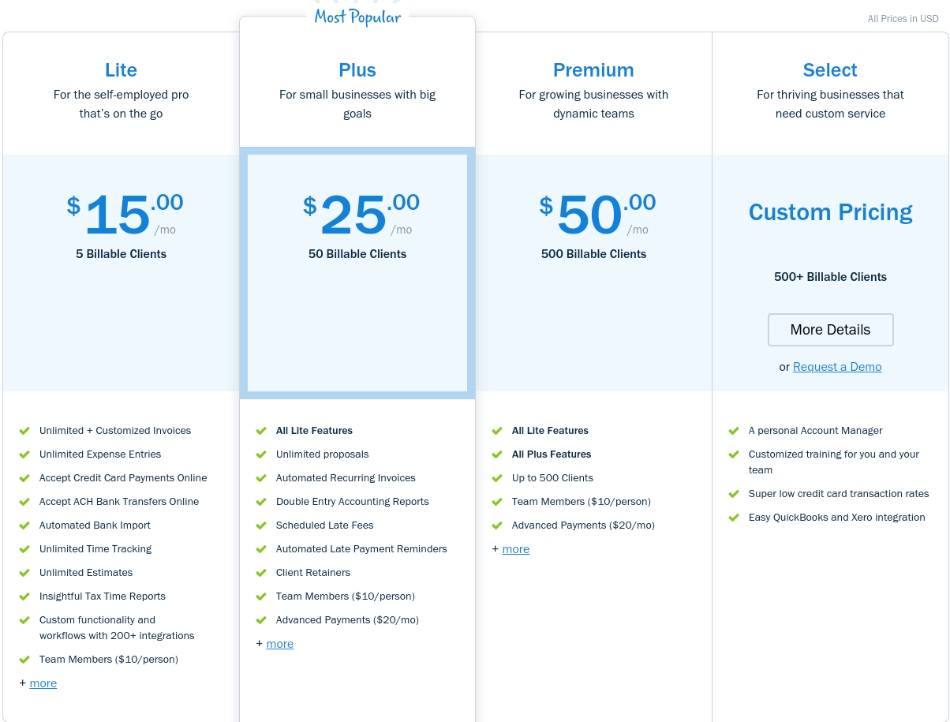

FreshBooks is tiered by the number of billable clients. If you work for a small number of regular clients, as many self-employed consultants, graphic artists, and technical writers (for example) do, then the Lite package gives you good functionality at a low price, with five billable clients. Features include credit card payments online, unlimited time tracking, estimates, tax reports and bill payments.

While the lowest price level of QuickBooks is limited to a single user, you can add as many extra users as you need for $10 a month each on Freshbooks.

Functionality increases with each level. Some of the best time-saving features, like recurring payments and automated late fees, aren’t available in the basic package. The Plus plan adds automated recurring invoices, scheduling of late fees, and automated late payment reminders.

Freshbooks also gives a 10% discount if you pay annually, rather than monthly.

Freshbooks packages:

| Plan | Cost per month | Limits |

| Lite | $15 | 5 billable clients |

| Plus | $25 | 50 billable clients |

| Premium | $50 | 500 billable clients |

| Select | Custom pricing |

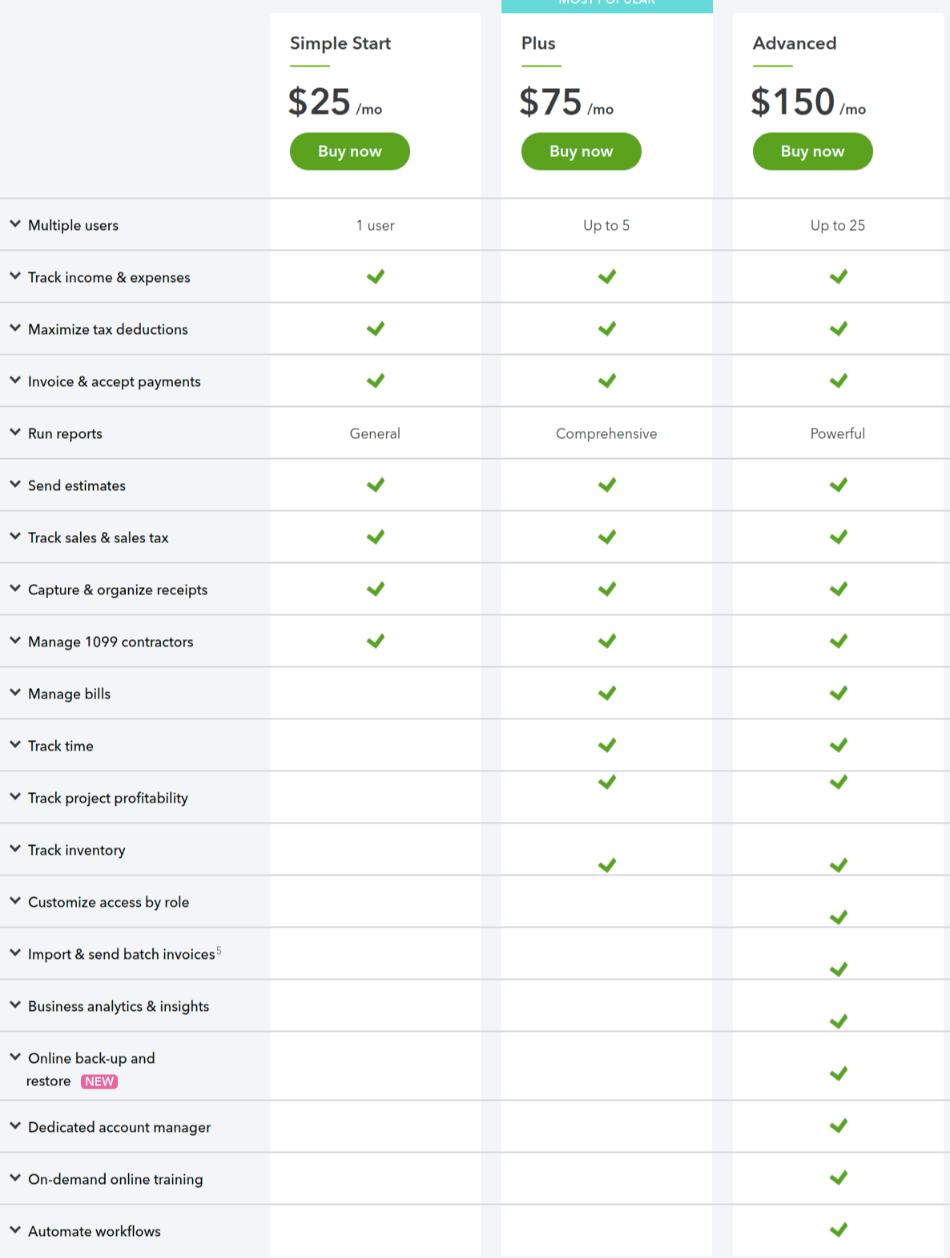

QuickBooks is tiered by the number of users. As with Freshbooks, the basic levels don’t have all the functionality of the top-level – notably, bill payment is missing from the Simple Start level, and project management and time tracking don’t appear till Plus. There’s no limit on the number of clients or transactions.

QuickBooks packages:

| Plan | Price per month | Users |

| Simple start | $25 | Single user |

| Essentials | $40 | Up to three users |

| Plus | $70 | Up to five users |

| Advanced | $150 | Up to 25 users |

Both applications offer a 30-day free trial and are currently offering a 50% discount for the first three months on all new business.

It’s tricky to compare the pricing structures because they are so different, and a lot depends on how many users you want to give access to the system. You’ll need to do the math to see which is best for you. Below, we show one comparison. Freshbooks comes in either very slightly cheaper or a third more expensive, depending on which level of pricing you pick (which will be driven mainly by the size of your client base).

| Plan | Base price | Extra users, price | Total price |

| QuickBooks Plus, 5 users | $70 | – | $70 |

| Freshbooks Plus | $25 | 4 x $10 = $40 | $65 |

| Freshbooks Premium | $50 | 4 x $10 = $40 | $95 |

Winner: A tie

3. Ease of Use

Both systems have been designed for non-accountants to use. They don’t use accountancy jargon, and they’re set out in a user-friendly way that relegates double entry and complex accounting to a behind-the-scenes role.

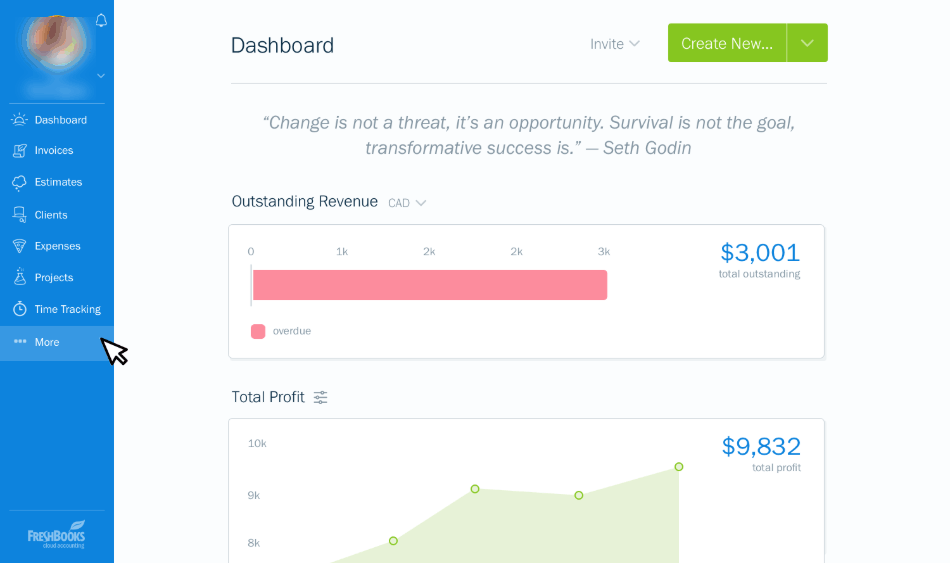

Freshbooks designers have put real thought into making it easy to carry out basic functions. For instance, you’ll take fewer steps to set up a recurring payment or pay a bill. The interface is crystal clear and navigation is easy; pages are open and uncluttered.

The opening dashboard shows a summary of the business, but it also flags up recent transactions and/or users, which is a useful touch for distributed businesses or for professionals working on multiple projects at the same time.

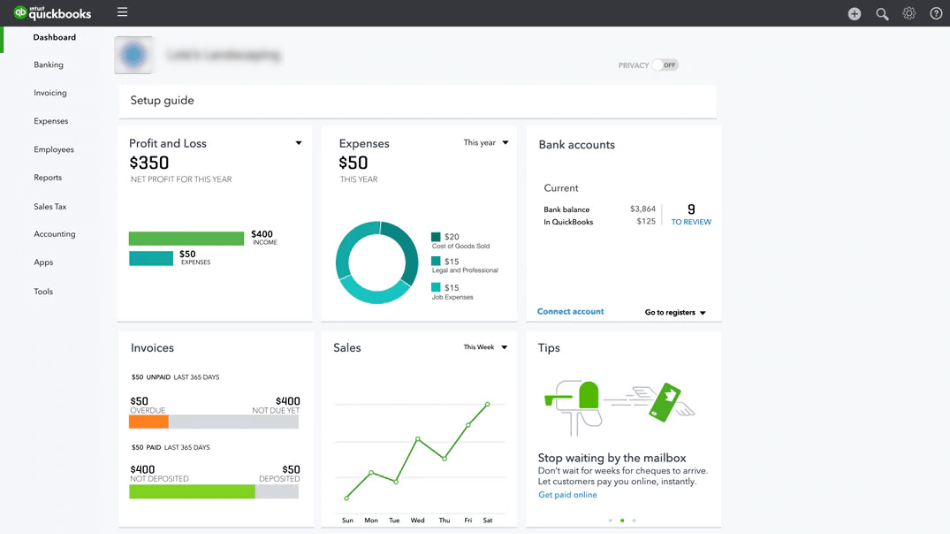

QuickBooks is well designed, and similarly, shows the dashboard as your opening screen. From there, you can go to any systems function. But the dashboard is rather full, with a lot of information that can be difficult to take in at a single view. And some functions are hidden away; for instance, you need to know that the reporting function is under ‘tools’. That increases the learning curve a bit.

Workflow in QuickBooks is less intuitive, and sometimes multiple steps are required to perform a process that’s just one click in Freshbooks, such as creating a recurring invoice.

We should be honest though; one of the reasons QuickBooks is a bit harder to use is that it has more complex built-in, and has more underlying accounting support. For instance, if you buy long term assets, it does the whole job of creating your balance sheet, doing depreciation, and working out tax allowances, and that’s quite intensive. The learning curve, consequently, is steeper for a good reason, because if you’re going to end up running a much bigger business, you’ll need all that stuff.

Still, Freshbooks has also gone the extra mile in making its application super slick for the users, so it’s a deserving winner here.

Winner: FreshBooks

4. Integrations

Both applications offer hundreds of integrations. FreshBooks has over 200, such as Gusto Payroll, CRM, and inventory management apps – you’ll need one if you deal in physical goods, as Freshbooks itself doesn’t support inventory management. E-commerce applications include Stripe, for online payments, and you can also add web apps through Zapier.

All these integrations can be used from within Freshbooks.

QuickBooks has over 600 integrations. It supports Stripe, as well as Bill Pay for QuickBooks, Intuit Payroll, and numerous CRM and project management applications. Direct mail can easily be integrated using Mailchimp. These integrations are all well thought out, and as with Freshbooks, most can be used from within the QuickBooks application.

Winner: A tie

5. Mobile Apps

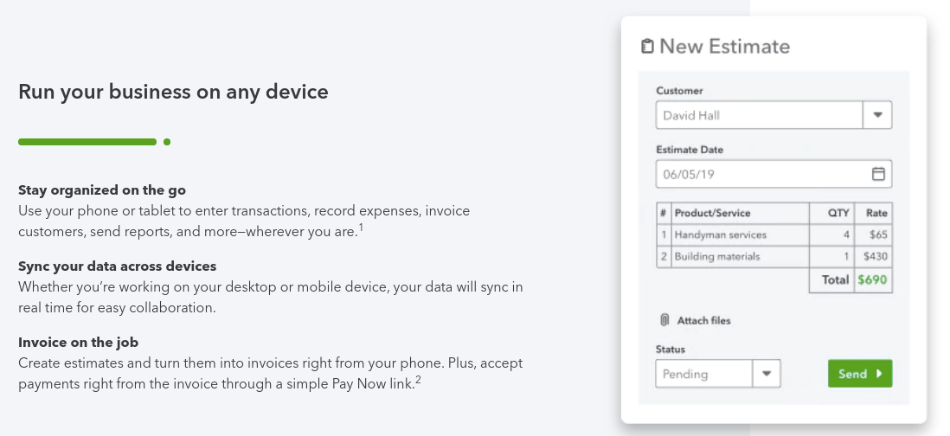

Both QuickBooks and Freshbooks have iOS and Android apps available from the Apple App Store or Google Play. The mobile apps don’t allow you to do everything that you could do in the full system, but they do have quite a lot of features and can be really useful if you’re on the road a lot. They also sync the data across all your devices automatically.

In QuickBooks, you can enter expenses simply by scanning a receipt, and you can send invoices from your mobile, too. But you should note that the mobile app only supports the features offered in the Simple Start package, so you won’t get time tracking and other advanced functions.

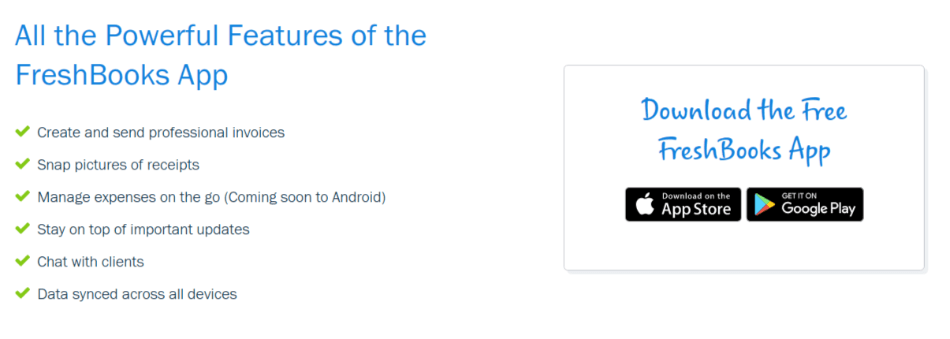

FreshBooks offers expenses management on the mobile app as well as invoicing and expense entry. Time tracking is available on the Freshbooks app, which makes it useful for anyone who regularly works on clients’ sites. There’s also a feature that lets you chat with clients, and the app shows up any invoices as they’re paid or become overdue – in the latter case you can take appropriate action.

Freshbooks clearly have an employee who is highly smartphone orientated and has produced a real phone-native app. It’s definitely the winner in this category.

Winner: FreshBooks

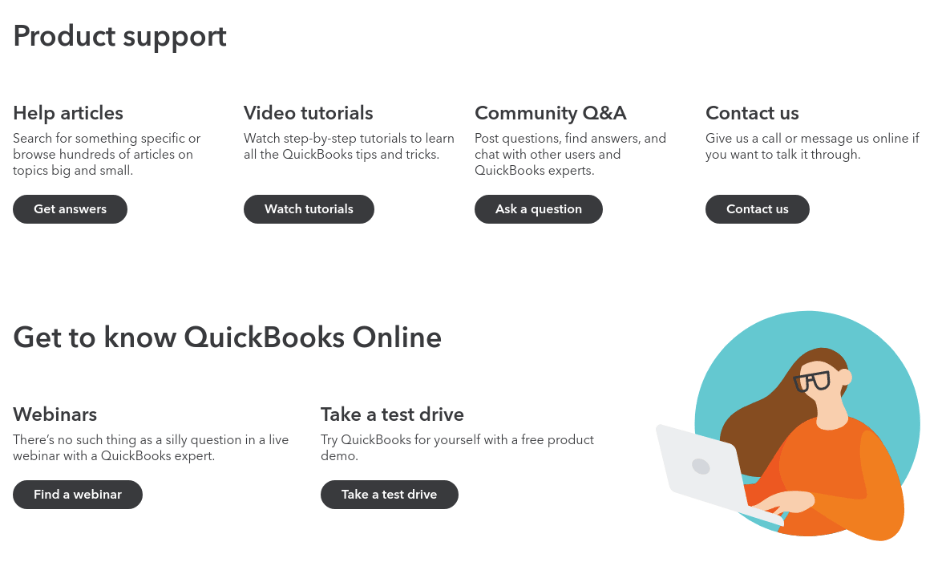

6. Customer Support

There’s not a lot to choose between the two applications here. QuickBooks offers phone, E-mail, messaging and phone support for extended business hours. It also has in-product help, and a massive online resource of articles, webinars, and video tutorials. There’s a big user community, too, which means you may get a practical answer from another user on the support forum.

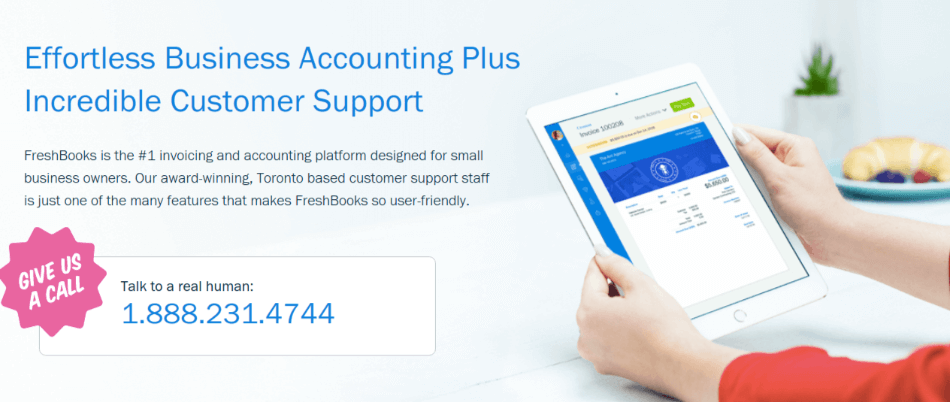

FreshBooks offers a similar support service through E-mail and phone over extended business hours. It has a toll free phone line to call, or you can message from within the application. The software’s user-friendly nature extends to having really great and well-targeted in-product help, and there’s a searchable knowledgebase giving you lots of answers.

While we don’t think Freshbooks has quite as much online resource, it gains points for very reactive support. Freshbooks suggests trying phone call first if you have a problem, whereas QuickBooks prefers you to try other support media first.

Winner: A tie

7. Setup

QuickBooks lets you set up just the modules you need right now in its easy setup process. If you don’t need support for particular functions, that’s fine – install the basics. You can always add further functionality later on if you need it.

However, getting started has a learning curve as QuickBooks is a complex product. It can be hard to learn your way around.

Freshbooks, on the other hand, prefers you to install everything right from the start (though you can still get by with basics). But the setup process is relatively easy, and what we like most about getting started with Freshbooks is the excellent help provided in the program.

If you are using any feature for the first time, you’ll see arrows and hints pop up to show you what’s what and where to click. The workflow is very user-friendly, as we already mentioned, but even so, this helps get you up to speed even more quickly.

Winner: A tie

8. Reports

QuickBooks – as so often – is the winner in the reporting category. Even in the lower-priced packages, it has a big bundle of reports, and there are up to 60 in the higher-priced packages. You can easily customize them, by dragging and dropping columns, for instance, and it’s easy to manipulate the data.

So, for instance, you could create and save a report showing your operating margin by-product, or slice your profitability by customer.

Compared to up to 60 reports, Freshbooks has just fourteen. That’s a really significant shortcoming. And Freshbooks doesn’t produce a balance sheet, only a profit and loss account. That’s partly explained by its target market – but even so, you’d think it would produce a basic financial statement.

Winner: QuickBooks

Final Thoughts

This has been a cutthroat competition. Both QuickBooks and Freshbooks are full-blown applications offering top-notch features. However, QuickBooks wins for two reasons:

- It’s a system which can grow with your business to a much greater extent than Freshbooks, and

- Many of its reports give you a great insight into your business.

If you have stock, whether you’re a manufacturer or a retailer, QuickBooks is your go-to software. It has good inventory management functions, and its automated stock calculations can simplify your life to a far greater extent.

But if you have a service business, or you’re a self-employed professional, you may find Freshbooks more relevant. Its time tracking and billable hours functions together with classy mobile apps are just made for the Solo-E. So even though QuickBooks is a deserving winner, if you’ve read this review and got the feeling that Freshbooks is in your sweet spot – then it probably is.