(Last updated on January 9th, 2023)

Quicken or QuickBooks, which software should you choose in 2023? Read this ultimate Quicken vs. QuickBooks comparison to make a smart decision.

Quicken and QuickBooks are two of the big names in finance software. Both provide accounting support for small businesses, but they come from slightly different angles. Quicken is a personal finance application that grew into the small business space, whereas QuickBooks is an accounting application that is targeted at the small business owner or manager.

We should note that we’ve only looked at Quicken Home & Business – the most highly-priced of Quicken’s packages. Its lower-priced versions don’t include the business accounting features. And we’ve compared it to QuickBooks Online, the cloud version of QuickBooks. (QuickBooks is also available in a number of desktop versions.)

Which of the two is better for you? We took a look at the two applications, comparing the packages extensively under a number of headings, trying out the software, and looking at user reviews to answer this question.

Comparison At a Glance

1. Features

Winner: QuickBooks. Although Quicken offers some unique features for rental real estate and personal budgeting, in every other area, QuickBooks has the edge.

2. Pricing

Winner: Quicken. It’s a deal cheaper than QuickBooks. However, if you’re aiming to grow your business, particularly if you’re going to add employees, QuickBooks does offer far more for the money.

3. Ease of use

Winner: QuickBooks. Because it has a single focus – just your business, not your personal budget – it’s easier to use. And it seems a bit slicker all round.

4. Mobile Apps

Winner: QuickBooks. As a cloud-native app QuickBooks is highly portable, and it adds iOS and Android support. Quicken’s mobile app doesn’t give full access to your accounts.

5. Integrations

Winner: QuickBooks. QuickBooks provides integrations for business software such as CRM, direct mailing, payroll and project management. Quicken is much less happy to play with other software. Plus, if you run Linux or have a Mac, you’re out of luck – the Home & Business version of Quicken is Windows-only.

6. Customer Support

Winner: QuickBooks. Both QuickBooks and Quicken have extensive online support and good live support during office hours. QuickBooks has a slight edge – its live support has longer hours, and it has a treasure trove of online resources for users.

7. Setup

Winner: QuickBooks. QuickBooks gives you the flexibility to set up just those features you need right now, and add others later. Because it’s cloud-native, it’s easy to set up.

8. Reports

Winner: Tie. Quicken has unique features, such as tracking for personal investments. If you want reports on your total net worth, Quicken can deliver. But if you want fully customizable business reporting that will help you optimize your business, QuickBooks is the package you’ll need.

Short Verdict

QuickBooks is the winner by a long way for most businesses, though it’s fair to note that you will pay substantially more for the application even if you take a lower-priced package. But Quicken is still good for two specific types of user; rental property owners, who’ll find its real estate support useful, and those with a small side hustle businesses that don’t justify the expense of a full accounts package.

1. Features

Looking at the basics, both Quicken and QuickBooks provide you with good small business accounting. Both have good invoicing functionality and allow you to synchronize your accounts with your bank or credit card account. Transactions can be downloaded from your bank, so you don’t have to enter them manually.

Both are intended for non-accountants. You won’t need to understand double-entry book-keeping to use them – all the ledger entries happen behind the scenes.

You can manage payables and receivables, create financial statements, and facilitate online payments with both applications. Both of them will perform bank reconciliation so that you know what’s in your bank account is in line with what you entered into your accounts. Both can automate recurring bill payments and other transactions. And both can help you with your annual income tax statement and with sales tax.

So far, they’re pretty similar in functionality. But let’s look at the differences.

What QuickBooks does that Quicken doesn’t

QuickBooks has more advanced features for small business. For instance, it can link to payroll and timesheets, and it will process 1099 forms and payments to contractors, which aren’t supported in Quicken. It also supports merchant services through Intuit credit card processing and links to Intuit’s Payroll services if you have employees.

Growing businesses will also appreciate the fact that QuickBooks’ higher-priced packages support role management and access management. For instance, you can allow sales personnel to enter invoices and receipts for their expenses without giving them access to the whole system.

There’s also a workflow management function which again can be very useful as you grow the size of the business and different people are involved in working on the accounts.

What QuickBooks won’t do is support your household budgeting or your personal investments. You can’t run separate personal and business accounts on it. And it doesn’t have great support for property rental businesses.

What Quicken does that QuickBooks doesn’t

Quicken allows you to run separate personal and business budgets. Recurring payments and bills are easy to automate in Quicken, and it automatically identifies payments that qualify for business deductions. It provides support for PayPal, which is good for businesses that sell online, for instance, through eBay or Etsy.

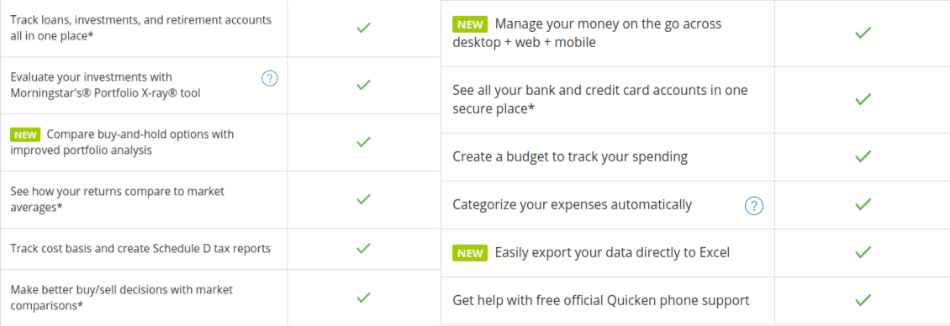

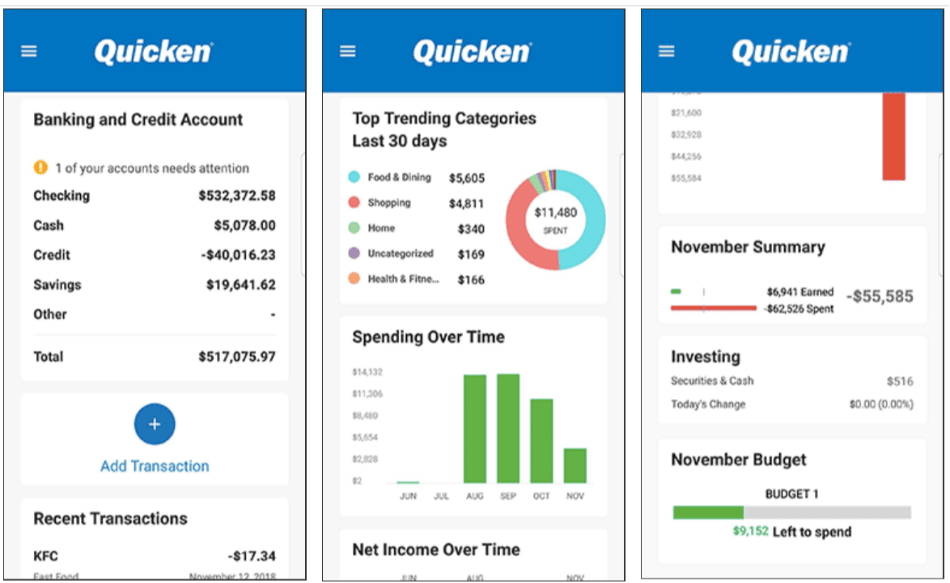

Quicken also allows you to track your investments, whether that’s a 401k, a bunch of ETFs, or an actively traded stock portfolio. It will let you assess performance, check how fees affect your net return, and prepare your tax filing. You can analyze your portfolio against benchmarks, or look at your funds through Morningstar’s X-Ray tool (for Windows systems only).

Where Quicken is limited

On the other hand, Quicken doesn’t include payroll support or inventory tracking. If your business has got to the stage of hiring employees, or your inventory is big enough that you need a management system, you’re going to want a more feature-rich application. Quicken also doesn’t have accountant access – one of the key features of QuickBooks.

Quicken doesn’t require you to have an asset register. In QuickBooks, if you buy – say – a sewing machine for your crafting side hustle, you’ll have to worry about capitalization, depreciation, and what your balance sheet looks like. In Quicken, you just pay the bill, and that’s it. However, if you’re setting up a business that will eventually have plant, premises, and other major assets, you’ll want QuickBooks’ more in-depth accounting support.

Finally, Quicken is a single-user application. That limits its usefulness if you intend to grow your business past the sole trader stage.

Being a single-user application literally make Quicken ineffective if you intend to grow your business past the sole trader stage.

Winner: QuickBooks

2. Pricing

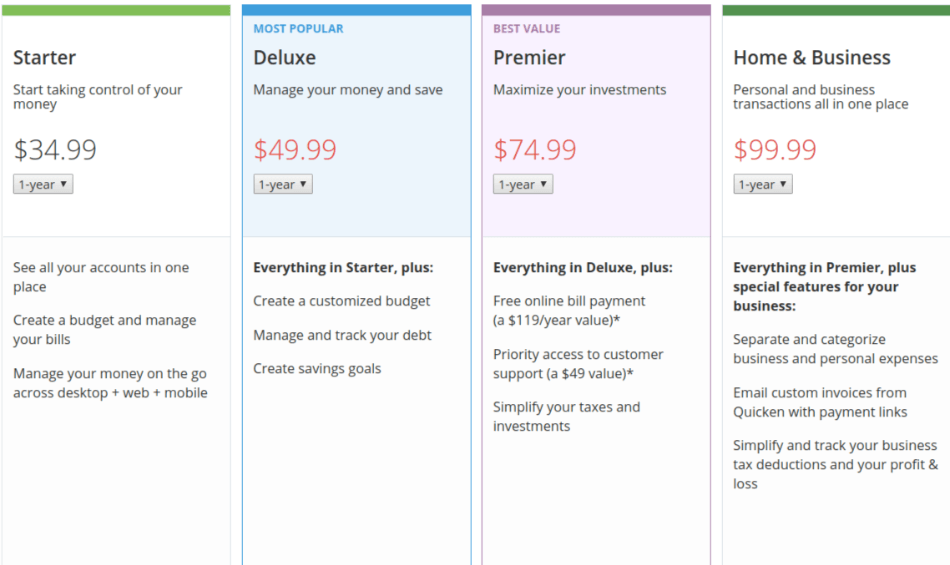

Quicken was originally sold on the basis of a one-off software license; it’s now an annual package and you’ll pay $99.99 for the download, plus any service updates.

QuickBooks, on the other hand, is a cloud-based SaaS with monthly subscription fee ranging from $25 a month for the simplest, single-user version to $150 a month for up to 25 users. That adds up to an annual fee from $300 to $1,800.

For the single-user business, Quicken is cheaper by a long way. But it doesn’t scale up, so if your business grows and you bring in a partner or hire employees, you’ll need to change the system.

Winner: Quicken

3. Ease of Use

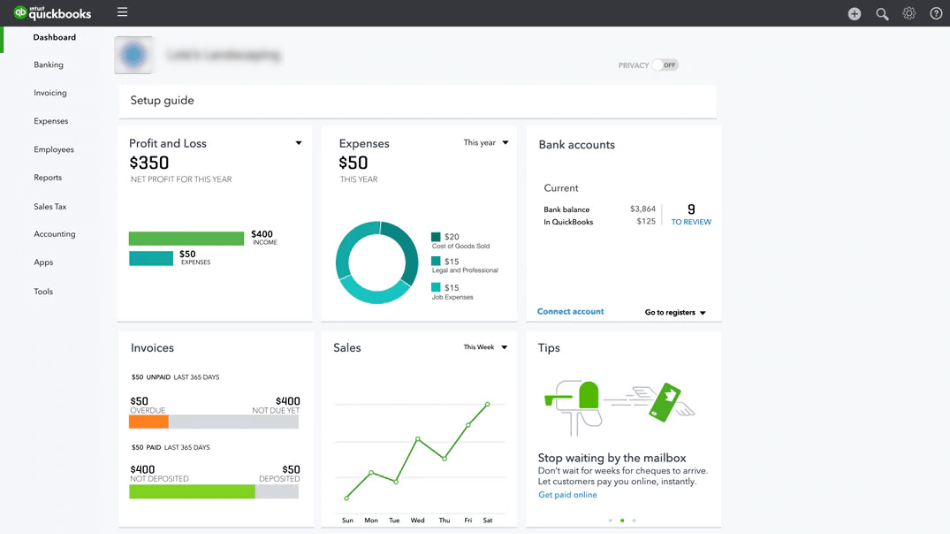

Both applications use a visual dashboard as the launching pad for the system. However, most users find QuickBooks easier to use. That’s partly because since it doesn’t cover your personal budgets, there’s no need to distinguish between the two sets of accounts. But the interface is also straightforward, and the program guides users through the transactions they want to make.

QuickBooks does have a learning curve. If you want to use the advanced features, you’ll need to spend some time getting acquainted with them. On the other hand, it’s been designed to carry out most transactions efficiently and with the minimum manual data entry.

Quicken has some neat features to make your life easier, such as reminders to pay bills. It has some useful wizards for setting up some transactions or features. For users who own rental property, it enables PayPal payments and creates personalized rent reminders. But it also has some difficulties such as having to remember whether you’re in the personal account or business account window.

Accounting automation is limited in Quicken, and that means you could spend more time on your accounts in the long run than you would on QuickBooks, where many transactions and reporting functions are automatic. Budgeting is also more difficult than in QuickBooks, requiring several manual amendments.

Winner: QuickBooks

4. Integrations

QuickBooks Online runs in all the major browsers (Chrome, Microsoft Edge, Safari, Firefox) and has mobile apps in both iOS and Android. It offers integration with a vast number of third party programs including payroll, time tracking, CRM, direct mail and other apps. It doesn’t matter whether you’re running Windows, Mac or Linux OS.

Even if you get the lowest priced package, QuickBooks offers an upgrade route to more feature-rich packages with multiple users. And it offers import/export to Excel or CSV files.

Plus, many third-party software vendors have created vertical-specific business management systems that integrate with QuickBooks as their accounts system. For instance, there are veterinary practice management and project management systems you can buy off-the-shelf ready to integrate with QuickBooks.

Quicken offers only a Windows version – there is no native Linux solution, and the Mac version doesn’t include all the small business functionality of the Home & Business package. It’s a desktop app, and you’ll need to install that before you can enable browser-based and mobile versions. There’s no payroll integration, and support for other apps is limited and reportedly can be glitchy.

On the other hand, it does have one very useful integration since it offers direct export to TurboTax for your tax filings. If your main requirement is to be able to produce your business and personal tax filing on time without too much pain, this is probably your top integration requirement!

By the way, one integration that’s (probably) never going to happen is between the two different applications. You can’t easily convert data from Quicken to QuickBooks, or vice versa. So make sure you make the right choice – it’s going to be difficult to change your mind later on.

Winner: QuickBooks

5. Mobile Apps

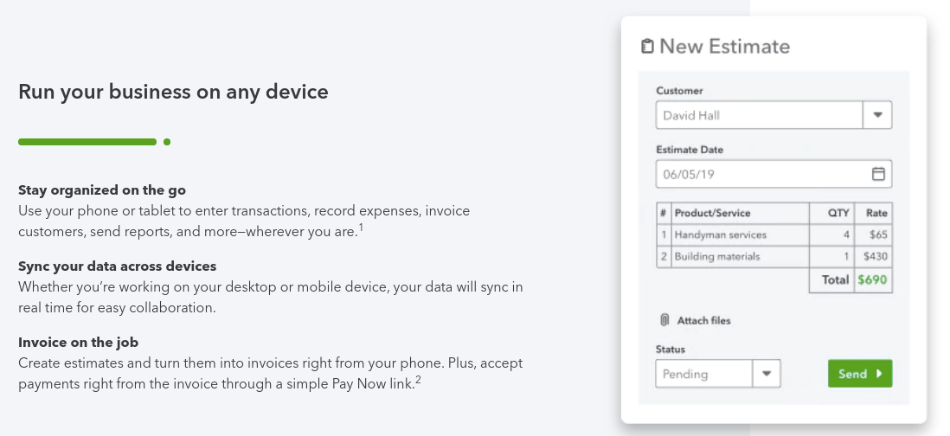

To be honest, mobile apps is an area where accounting software, in general, could do better, and these two programs are no exception. There are shortcomings in both QuickBooks and Quicken as far as mobile support is concerned – the mobile version doesn’t offer the full functionality though there’s enough to be useful to most small business users.

QuickBooks Online is cloud-hosted. Though that’s not specifically a mobile app, it means you can log on from anywhere. It also has mobile apps for Android and iOS. They’re not as fully featured, but you can enter invoices and expense receipts on the go – great for road warriors – and access most of the reports you need.

Quicken is a desktop-based application and you’ll need to opt into mobile apps before you can use them. Some users have found its mobile apps buggy or slow, and we suggest if you’re a person who does a lot of their work on a smartphone, you probably wouldn’t find Quicken the right choice.

Winner: QuickBooks

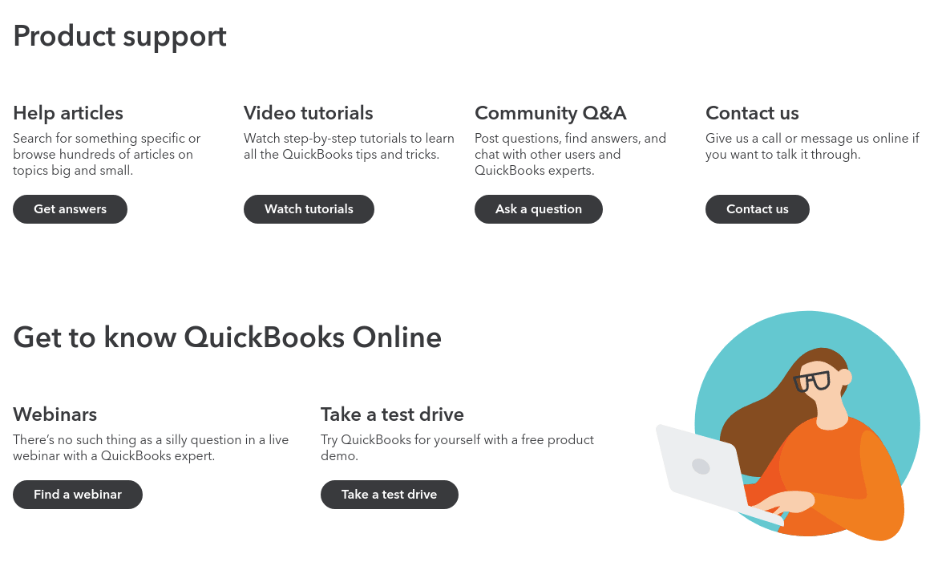

6. Customer Support

Both QuickBooks and Quicken have live support (a choice of telephone or internet chat) during office hours. QuickBooks’ hours are a little longer during the week and include support on Saturdays, which isn’t offered by Quicken.

QuickBooks has great online materials including tutorials, webinars, articles, and videos. Quicken has good online materials for the personal finance features of the software, but we found the accounting features were less well supported.

It’s also worth pointing out that if you use QuickBooks, you’re going to find most accountants who deal with small business will be well versed in how to use the application. That may not be so true for Quicken.

Winner: QuickBooks

7. Setup

Surprisingly, QuickBooks, despite being more full-featured, is actually easier to set up.

That partly comes with the territory when you’re talking about cloud-based software since you don’t have to worry about installing a program on your PC.

QuickBooks also offers the opportunity to choose which features you want to install. For instance, if you’re a solo entrepreneur, you may decide you don’t want features related to employees or contractors at the moment. You can always install them later.

If you want to try QuickBooks out without entering all your data, it comes with data pre-populated for a sample company. You’ll be able to enter transactions, look at reports, drill down, and generally find out if you like the system.

To set Quicken up, you’ll need to download the relevant package first, and then run the installation program on your desktop. You’ll then need to get an Intuit ID, as well as entering your activation code. Quicken will then prompt you to link to your bank and to set up the information you need. It’s quite a long haul compared to getting QuickBooks set up, at least for a single user.

Winner: QuickBooks

8. Reports

QuickBooks‘ business reporting is a powerful feature. The number of pre-installed reports depends on the version you choose, but you’ll get receivables, payables and profit breakdowns as standard. Reports are highly customizable, and you can drill down to see, for instance, which products are making you the most money.

Quicken has good reporting for personal budgeting and investments and is pretty intuitive to use. You can also set up project reports or job reports, which can be particularly useful for freelancers. The full range of business reporting is available, such as receivables, payables and profit and loss reporting. However, we found some of the reports to be difficult to customize.

As you’d expect from a personal finance program, Quicken is relatively good on producing tax reports, giving you exactly the numbers you need to fill in on your tax filing.

But Quicken’s unique selling point is that it has personal finance reports, including reports on your investments. While using online data, it’s easy to run reports looking at how your investment portfolio is performing and check your asset allocation against benchmarks. You can easily see what you have invested, and what you’re being charged in fees. If your investment portfolio is as big as (or bigger than) your part-time business, Quicken makes good sense for you.

Winner: A tie

Final Thoughts

The overall winner is QuickBooks, which delivers everything a small business needs to run its finances. Its reporting functions are top-notch, it’s automated a lot of the grunt work, your accountant can quickly get access to the system through a special portal, and yet it’s all presented in an easy to understand way. You don’t need to understand accounting jargon or double-entry bookkeeping to use it.

We particularly like the fact that QuickBooks can grow alongside your business. For instance, if you start with the single-user version but decide to add staff, you can upgrade to a multi-user package and add time tracking functionality too. You can add integrations such as customer relations management (CRM) software, building it into a much bigger enterprise management system, as well.

But QuickBooks is expensive. You get a lot of functionality, but you do have to pay for it, and the price may be more than your business really justifies. So we’re suggesting Quicken might be the right system for two types of a small business user.

- If you have a small side hustle with comparatively simple accounting needs, Quicken may well be all you need. In fact, the Home & Business Edition is only $15 more than the Premier version, so if you already use Quicken for your investments, you’ll get the business functionality for a bargain price.

- If you invest in residential real estate – and many Americans do – then Quicken is also a great system, with built-in functionality for managing rental houses and apartments, tracking tenants, rental rates and lease terms.