(Last updated on January 9th, 2023)

QuickBooks or TurboTax, which software should you choose in 2023? Is there a clear winner between the two?

Read this ultimate QuickBooks vs. TurboTax comparison to make a smart decision.

Two things in business life are certain – accounting and taxes. As a small business owner you need to do both. But do you need two different software applications, one for tax and one for accounts?

We’ve just taken a look at two programs that do the heavy lifting in these two areas. QuickBooks Online is a full featured accounting system that’s delivered over the cloud and will handle all your accounting tasks. TurboTax is cloud software that will turn your raw accounts into a tax filing – in much less time than it takes to do it manually.

We kicked the tires, we read the manual, and we visited forums and review sites to find out how users had got on with the software and whether they were happy with their experience. It’s an interesting comparison – a little bit apples and pears, to be honest, since the two programs address different needs and do different things.

We should note that TurboTax will do your personal tax filing if you’re self-employed. If your business is incorporated or set up as a partnership, its corporate tax liability isn’t something TurboTax can help you with – though your own tax on dividends, salary, and any other remuneration you receive from the business, definitely is. For the purposes of this article we’ve assumed you’re self-employed.

QuickBooks Vs TurboTax: Comparison At a Glance

1. Features

Winner: Tie. Both programs are full featured. QuickBooks gives you everything you need to do your accounts – in fact, probably rather more than you’ll need! TurboTax will do your tax return professionally and ensure you don’t pay too much tax.

2. Pricing

Winner: Tie. It’s really difficult to compare these programs. TurboTax is a one-off, once a year payment. QuickBooks runs on a monthly subscription. Both are among the higher priced applications in their spheres but that reflects their high functionality.

3. Ease of use

Winner: TurboTax. Accounting and tax are dry-as-dust but both apps succeed in making the user experience painless. However, TurboTax does that bit more – it’s almost a pleasure to use.

4. Mobile Apps

Winner: QuickBooks. TurboTax offers a smartphone app but we weren’t able to install it on any of our two smartphones or three tablets, and user reviews are poor. QuickBooks’ mobile apps let you invoice and file expenses on the go, and they work just fine.

5. Integrations

Winner: QuickBooks. TurboTax has a single integration: QuickBooks. On the other hand QuickBooks integrates with a huge number of other software applications from inventory management and project management through to ERP and CRM.

6. Customer Support

Winner: TurboTax. QuickBooks has great online resources and live support during business hours. But TurboTax goes the extra mile with live video support and reassuring hand-holding, at least if you pay for the Live package.

7. Setup

Winner: TurboTax. Both applications are delivered via the cloud so there’s no installation to do. Both are easy to install, but TurboTax is far more approachable with its Q&A format.

8. Reports

Winner: QuickBooks. TurboTax is light on reporting features, because its job is about just producing a single faultless report, your tax filing. QuickBooks on the other hand gives you all the reports you’ll ever need, and then some.

Short Verdict

We don’t have a winner! Both these applications are impressive, but they address different needs. In fact, choosing one would be like saying “I want a pizza, and I don’t want any cheese on it.” If you have a business, you need to do your accounts, and you also need to do your tax filing. So you need both!

1. Features

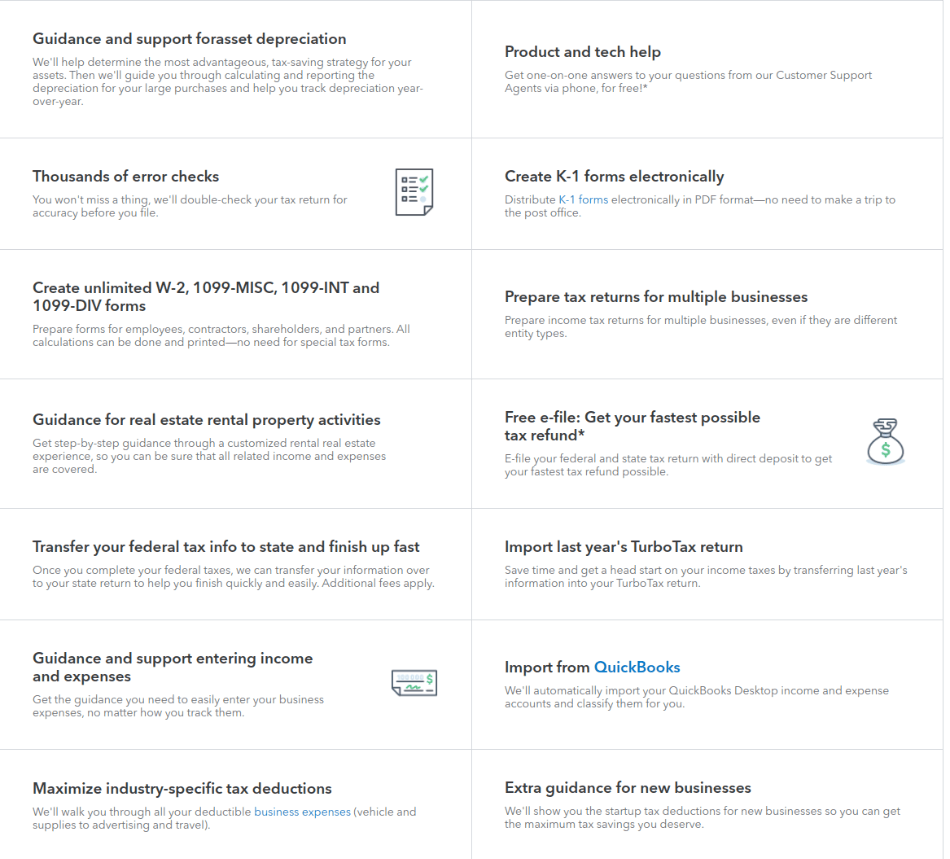

TurboTax takes you through the process of completing your tax information and has various features which are aimed at making the process easier.

- ItsDeductible (included in all paid-for packages) quickly finds the value of donated objects to set against your tax bill.

- The Self-Employed version offers good expense tracking through QuickBooks.

- Electronic tax filing.

- Auto-import for investment income.

- Automatic tax deductions for rental properties.

- Industry-specific tax deductions.

- Expense, mileage and job tracking with free QuickBooks Self-Employed subscription.

- 1099 smart scan feature.

- For ‘Live’ packages, access to advice from a CPA or other tax advisor throughout the process, from within the app.

TurboTax is highly focused not just on getting your tax filing done, but on maximizing your deductions and minimizing your tax payments. Users who have run other tax software in parallel found that TurboTax delivered them the largest tax refunds.

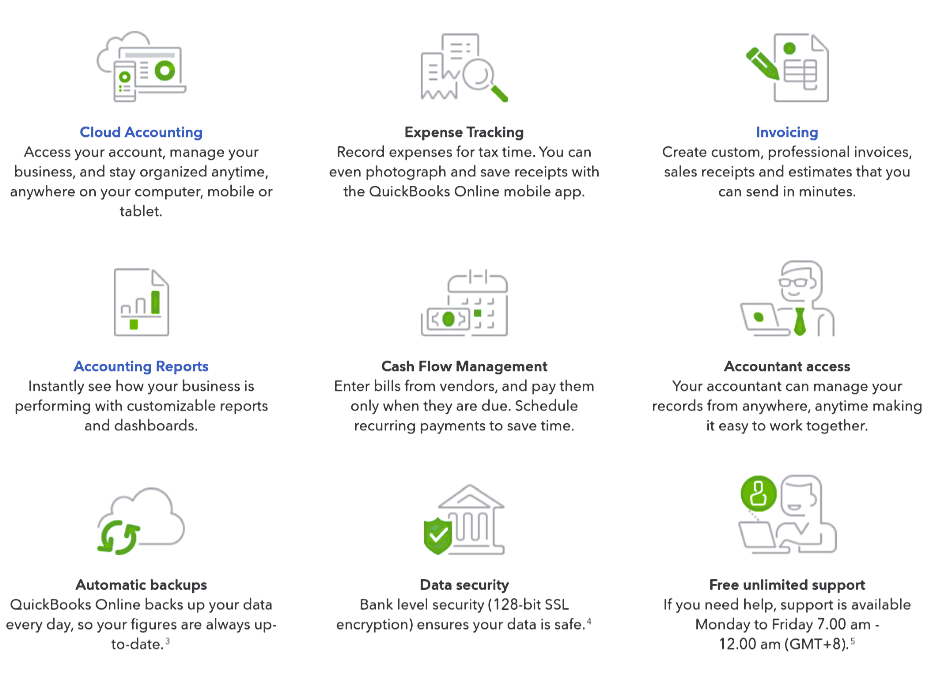

QuickBooks aims to manage your business accounting. It is a full double entry accounting system (your accountant will be happy with that) and offers all the functions you need to run your business, including

- customizable invoicing, support for sales tax

- expenses, recurring bill payments, expense tracking

- bank reconciliations

- automatic categorization of transactions

- financial reporting

- support for credit card payments

- budgeting

- payables and receivables management

- multi-currency support

- support for time and project tracking (in higher price packages)

- 1099 forms and payment to contractors

- asset accounting and depreciation

Although there are limitations on functionality in some of the lower priced packages, at the top level QuickBooks is an all-singing all-dancing accounts system which leaves no book-keeping stone unturned. That gives it a steep learning curve if you don’t have a finance or accounting background, but means whatever your business type or complexity, it will deliver the functions you need.

In particular, retailers and manufacturers will find QuickBooks does a good job for them. Many small business accounting packages are great for services businesses but don’t handle inventory or fixed assets very well.

2. Pricing

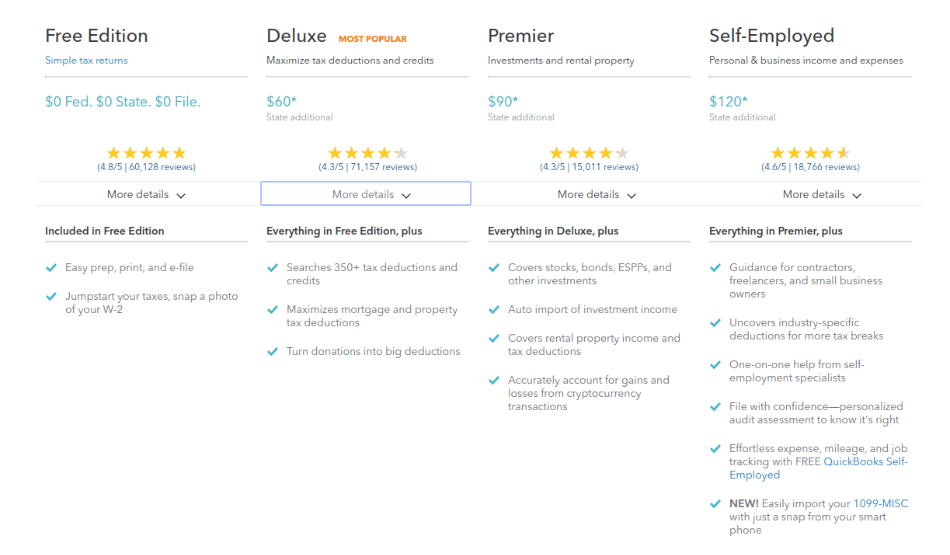

TurboTax offers a number of different levels of pricing, and at each level, you can choose a completely DIY package, or you can choose a Live support option which gives you advice from a CPA and live guidance from within the app. TurboTax lives in the real world and knows that you’ll be burning the midnight oil or blocking off a weekend to do your tax, so that’s 24/7 advice.

| Plan | Price federal/state DIY | Price inc. Live support | Limitations |

| Free | $0 | $90/$50 | No tax deductions. Won’t work for business. |

| Deluxe | $70/50 | $130/55 | Doesn’t include Schedule C business expenses, Schedule D capital gains, Schedule E rental income |

| Premier | $100/50 | $180/$55 | Includes support for investments and business income |

| Self-employed | $130/50 | $210/$55 | Includes one year subscription to QuickBooks Self-employed |

While many individuals will find other packages work for them, if you’re self-employed you’ll need the highest priced package. It automatically gives you QuickBooks Self-employed (though make sure to check the end date on the package as after that, unless you use TurboTax again or pay a separate subscription, you’ll be without your account software).

QuickBooks packages are tiered by the number of users; functionality also increases as you move up the tiers. So for instance if you want time tracking and project management you’ll need to get the Plus or Advanced package, as they’re not included in the two lower priced packages.

QuickBooks packages

| Plan | Price per month | Users |

| Simple start | $25 | Single user |

| Essentials | $40 | Up to three users |

| Plus | $70 | Up to five users |

| Advanced | $150 | Up to 25 users |

QuickBooks offers a 30 day free trial. Alternatively you may access 50% discounts for the first three months. This gives you a good opportunity to try out the software before you decide to stick with it.

The comparison isn’t an easy one. You’re going to use TurboTax once a year so once a year, you’ll pay $200 for it. QuickBooks you’ll use all the time and you’ll pay a monthly subscription. There’s not really a winner here.

We would observe, though, that both these programs charge towards the high end compared to their competitors – and do so because of the impressive functionality that they provide. Both TurboTax and QuickBooks also tend to put up their prices on a regular basis, and up-sell customers of lower priced packages fairly actively, which can be annoying.

Winner: Tie

3. Ease of Use

TurboTax welcomes you with a Q&A approach that’s almost like having a chat with an accountant or tax expert. You don’t have to know what to do next – the software will handle that for you. It even takes care to explain basic principles as you go along. That can be useful, as sometimes, tax is quite counter-intuitive.

But while TurboTax has set out a basic path for you to follow, you don’t have to follow a linear progression. If you have all your information ready for one section but you need to track down some data for another, you can skip around and fill in the easy bits, then log off and go to hunt up the remaining information that you need. The system will flag up where you’ve left sections incomplete.

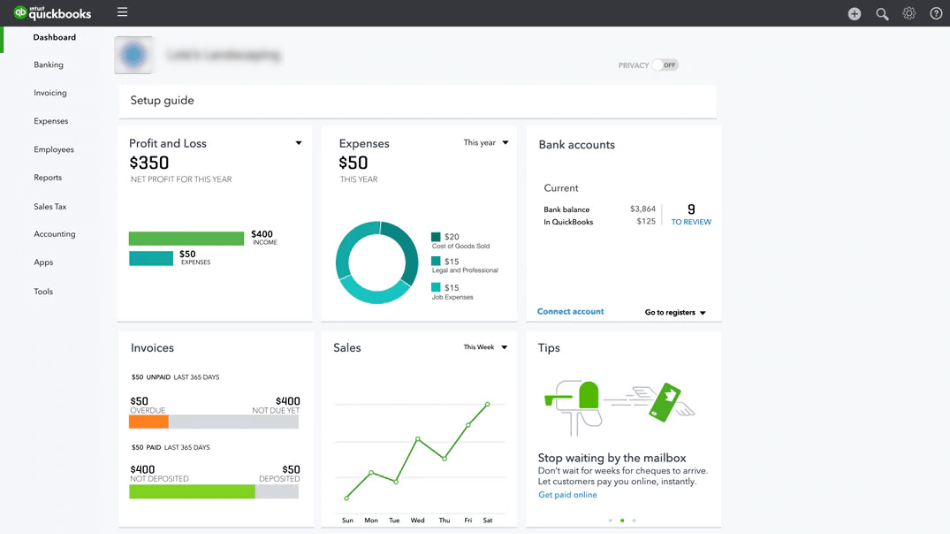

QuickBooks does a good job of concealing the ledgers and journals and double entry book-keeping, so you can say “I want to create an invoice” and get that done simply and quickly. QuickBooks will take care of the double-entry stuff in the background.

It opens up on a dashboard which shows you a financial snapshot of your business in a number of charts. A left-hand menu and a series of tabs give you access to different functions and reports. It’s a clean, modern interface which doesn’t have so much information you’ll get lost in the detail.

However, because QuickBooks offers such a lot of functionality and so many choices, it’s got a steep learning curve. So although it does pretty well, we have to give the prize for this section to TurboTax.

Winner: TurboTax

4. Mobile apps

TurboTax does have iPhone and Android apps. However, when we attempted to download the Android app we were told it was not compatible with any of our five different devices. Users reviews are poor, with a common complaint being that you simply can’t see enough data on a single screen, and that screens aren’t saved if you need to take a step back to check a figure.

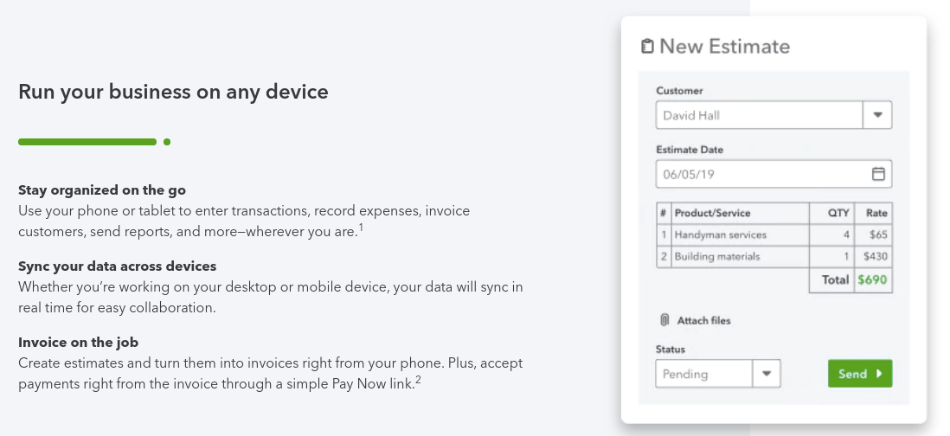

QuickBooks‘ mobile apps don’t give you access to the full accounting functionality. But they let you invoice and file expenses on the go, and check your numbers – and they work just fine. In particular, being able to scan in receipts is really useful if you’re a road warrior – just scanning the coffee, taxi receipt, and hotel bill saves so much time.

Winner: QuickBooks

5. Integrations

TurboTax is a big loser here. It has one integration – QuickBooks. That integration is getting slicker all the time, but it’s reportedly not quite as easy as it could be. None the less, it does mean you won’t have to fill in all the boxes manually – TurboTax will take your business data straight from your accounts.

But is one integration enough? Okay, you probably don’t want to integrate your tax affairs with your CRM system or your inventory management. But it’s a pity TurboTax doesn’t take data from accounts systems other than QuickBooks. And while it plays nicely with QuickBooks Self-Employed, other QuickBooks imports apparently need a workaround. If you keep your accounts on FreshBooks, Xero, Wave or Zoho, you’ll need to export your data manually. It’s a pain.

QuickBooks takes integration seriously. Whether you want to connect up Stripe for e-commerce payments, use industry-specific software such as practice management systems for legal or veterinary businesses, or integrate CRM and direct mailing software, you’ll be covered. Over 600 integrations mean you get a lot of choice.

Winner: QuickBooks

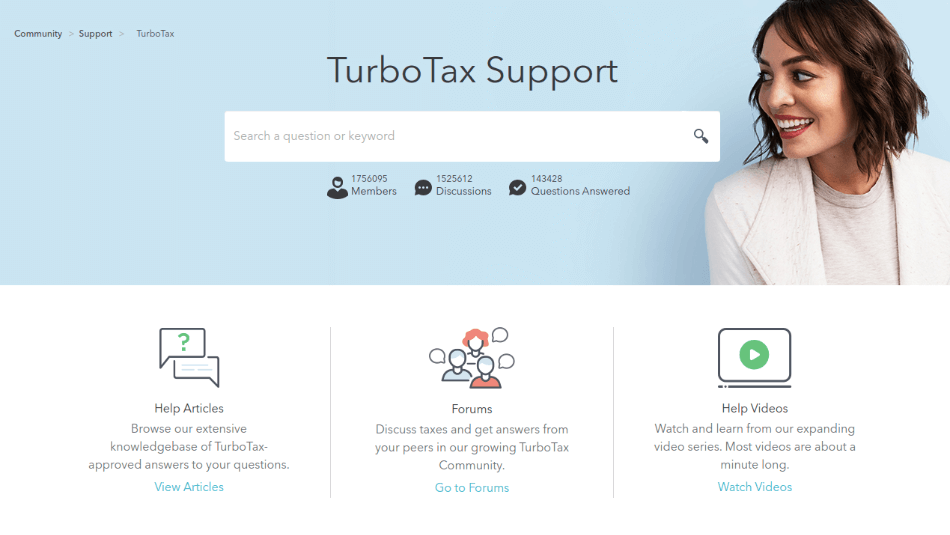

6. Customer Support

TurboTax has a big searchable knowledge base online, as well as forums and video tutorials to get you started. If you pay for the Live support package, you get significantly more hand-holding; you’ll get a one-on-one review of your tax filing with a TurboTax agent or CPA before you file, and there’s no limit on the tax advice you can use.

There’s even live video support (one-way, so if you’re in your pajamas, they won’t know) from within the app. Live support is 24/7, including weekends, so if you’ve holed up in your cabin for the weekend or are burning the midnight oil to get your filing done, TurboTax will help.

In the case of a tax audit, you’ll get guidance from TurboTax whichever package you chose.

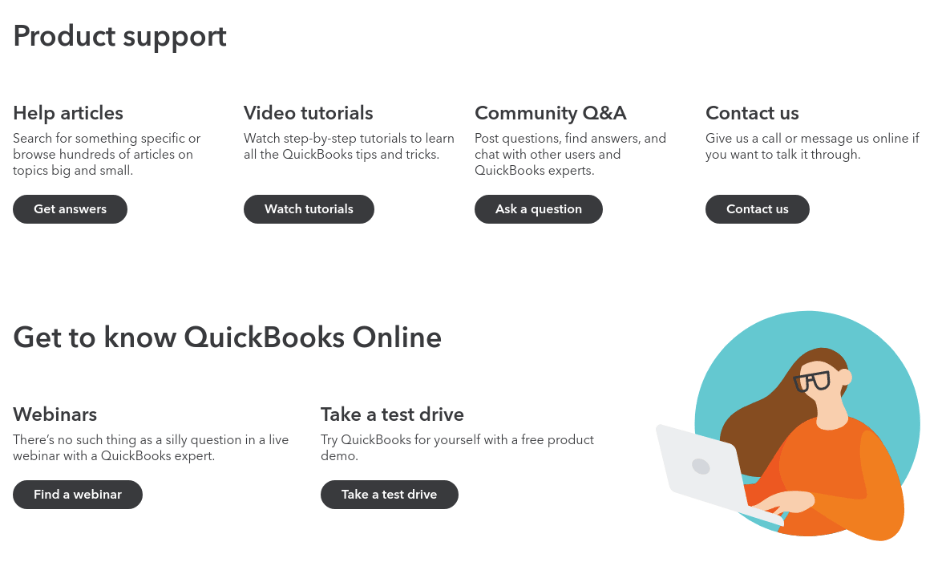

QuickBooks offers a pretty regular package of business support, during extended business hours. Like TurboTax, QuickBooks has a huge amount of online resource including tips articles, forums, video tutorials, and FAQs. Support is provided via web, email or phone.

User reviews aren’t always complimentary. QuickBooks support is pushing users to chat rather than phone, and that can mean a long wait; apparently the chat function can be glitchy, too.

It’s worth noting that as a long-standing major player in its space, QuickBooks has created a huge base of qualified professionals who know the software well. You’ll never find yourself in the uncomfortable position of knowing more about the software than your accountant does! And if you have a regular accountant or book-keeper, you’ll always have another person you can phone if you run into problems or simply want to use a new function.

Winner: TurboTax

7. Setup

Both these programs are delivered via the cloud so as long as your computer runs one of the major browsers in a recent version, it’s easy to get started. There’s no installation to do.

TurboTax takes you through a Q&A style interview so you start right away. Set-up time is practically zero!

QuickBooks will take you longer as you need to set up basic business information. But it’s been planned so that you only have to set up the functionalities you actually need to use. You can always change your mind and set up other functions later if it turns out you need them.

You can also upgrade your QuickBooks price package very easily if it turns out you need functionality that isn’t offered in your current package, or if you need a higher number of users.

Winner: TurboTax

8. Reports

TurboTax only needs to create one report and that’s your tax filing. (Okay, two reports if you have a state filing to do.) It does a darn good job of it.

QuickBooks, on the other hand, delivers well over 60 reports on your business. You get basics like the profit and loss account and total receivables, but you can also look at receivables overdue, by age or by customer, to see where you need to make some effort or perhaps revise your credit terms.

Drill down facilities are good so you can go from the report to specific items. And many reports are customizable, so if there’s a particular ratio that’s important to your business, or you want to track revenues for your top five customers, you can find ways to get the information where you want it.

Winner: QuickBooks

Final Thoughts

There’s no winner this time. Or perhaps we should say that both QuickBooks and TurboTax are winners!

If you’re self-employed it’s quite likely you need both. (If your business is incorporated, as we mentioned earlier, then you’ll need your own TurboTax but your business tax will have to be done separately.) And integration between TurboTax and QuickBooks makes it good sense to use the two in combination.

However you might not need to pay for QuickBooks online. If you buy the self-employed TurboTax package, it will give you a year of QuickBooks Self-Employed for free, up till April 30 of the next tax year. That’s a slightly different version from the full QuickBooks Online, and not as fully featured, but if you have a small side hustle or consulting gig, it may work well for you.

In fact if you’re just starting out in business or currently using a spreadsheet or paper accounts system, it may be worthwhile taking up the QuickBooks Self-Employed offer as a good, free ‘taster’. If you later find that you need the more advanced functions in QuickBooks Online, you can easily upgrade. You’ll also be well up the learning curve for using the higher specification software.

All in all, we have been pretty impressed by TurboTax. A particularly impressive feature is that it offers a money back guarantee that you won’t get more tax deductions or a lower tax bill using one of its competitors. You’ve got to be pretty sure that your software delivers to offer customers that kind of get-out clause!