(Last updated on January 9th, 2023)

Is QuickBooks Online better than Wave? Read this ultimate Wave vs. QuickBooks Online comparison to make a wise decision.

Wave and QuickBooks Online (which is what we’ll be talking about when we say ‘QuickBooks’ in this review) are at opposite ends of the scale when it comes to small business accounting software. QuickBooks is the dominant competitor; it’s not cheap but it is feature-rich and can do practically everything for your office except make your coffee. Wave is a disruptor, with some targeted support for freelancers and consultants but stripping out a few levels of other functionality to come in at a bargain price – free.

Both are cloud-based. Both are intended for non-accountants to use (though under the hood they pack a double-entry accounting system that your accountant will respect). But which one is right for you?

We looked at the software, read through the support forums, asked a couple of accountants, and tried out the packages. And the results are interesting. Let’s get started!

Comparison At a Glance

1. Features

Winner: QuickBooks. Both these packages do all the basics for a services business. But QuickBooks does a lot more – and will support retail and manufacturing businesses too.

2. Pricing

Winner: Wave. Free is the best price you’ll ever get. And even if you add on the payroll option, at $20 a month it’s still cheaper than QuickBooks.

3. Ease of use

Winner: Wave. QuickBooks does its best to be user-friendly but Wave cuts the complexity. It’s simpler and easier and doesn’t have the same steep learning curve.

4. Mobile Apps

Winner: QuickBooks. Wave only offers very basic functionality in its two mobile apps. QuickBooks doesn’t give full access to the accounts with its apps, but they do have a bit more functionality.

5. Integrations

Winner: QuickBooks. Wave has a limited number of direct integrations, though it offers over 500 Zapier web apps. QuickBooks has 500 direct integrations.

6. Customer Support

Winner: QuickBooks. Wave supports customers well for an initial period, but after that there’s no live support. QuickBooks has huge online resource and offers live chat, email and phone support in business hours.

7. Setup

Winner: Tie. Both systems are easy to set up. QuickBooks lets you choose exactly what functionality you need right now – set up other functions as and when they become useful.

8. Reports

Winner: QuickBooks. Frankly, if you want advanced reporting, for instance to analyze where your most profitable sales are coming from, or profit per sales channel, you’re going to want QuickBooks. Wave is pretty limited though it does give you all the basic reports you need.

Short Verdict

QuickBooks has more functionality, more integrations, better support, and better reports. It really is the better specification system and the tiered pricing structure of QBO plus desktop and enterprise versions of QuickBooks give you an upgrade path that can keep supporting your business as it grows over the years.

That said, if you’re a freelance professional or a have a small side hustle, Wave probably does deliver most of what you need – at an unbeatable price!

1. Features

Both QuickBooks Online and Wave do all the basics. You can

- create invoices

- record your expenses

- manage customer details

- reconcile your accounts to your bank statement

- automatically import transactions from your bank

- get reports of your profit and loss account and balance sheet items.

Both packages will connect to your bank automatically, or allow you to enter transactions manually if you prefer to do so.

Wave is good at invoicing. You can customize your invoices, and you can issue recurring invoices, for instance if you charge a retainer or a subscription. It will handle your sales tax. A neat drag-and-drop feature makes it super easy to add line items to an invoice.

Wave also emails your invoices to your customers automatically, and it will tell you when your invoice has been viewed. It will also let you include a link to an online payment option in the invoice, when you set up online payments in Wave. Checkouts in Wave gives you a basic e-commerce function, so if you sell online, you have everything you need

Wave has full multi-currency support, and automatically calculates exchange rates to your home currency.

There are other neat features, too.

- Wave lets you add multiple users. You can add unlimited team members, which is great if you have multiple collaborations.

- You can run multiple businesses using your single account.

- You can customize the categories in the chart of accounts. For instance, you can decide how to categorize your costs.

But there are also a few features we’d expect to see that are missing. For instance, Wave doesn’t appear to have a bill payment function (though apparently it’s working on this), so you will have to pay bills via your banking app. Your payments will then, of course, show up next time you sync to your bank account, but that’s one extra step you don’t need.

Wave doesn’t support check payments – you can’t use it to print out a check. And it doesn’t have inventory management as part of the accounts system, so if you are in retail or manufacturing you’ll need to pay for a separate inventory management system.

More surprising, given its target market, Wave doesn’t track billable hours. And it doesn’t track mileage – a 54 cents a mile tax deduction per business mile traveled is worth having, but it’s worth automating it as well!

However, underneath the simple interface is real double-entry software, which your accountant will love.

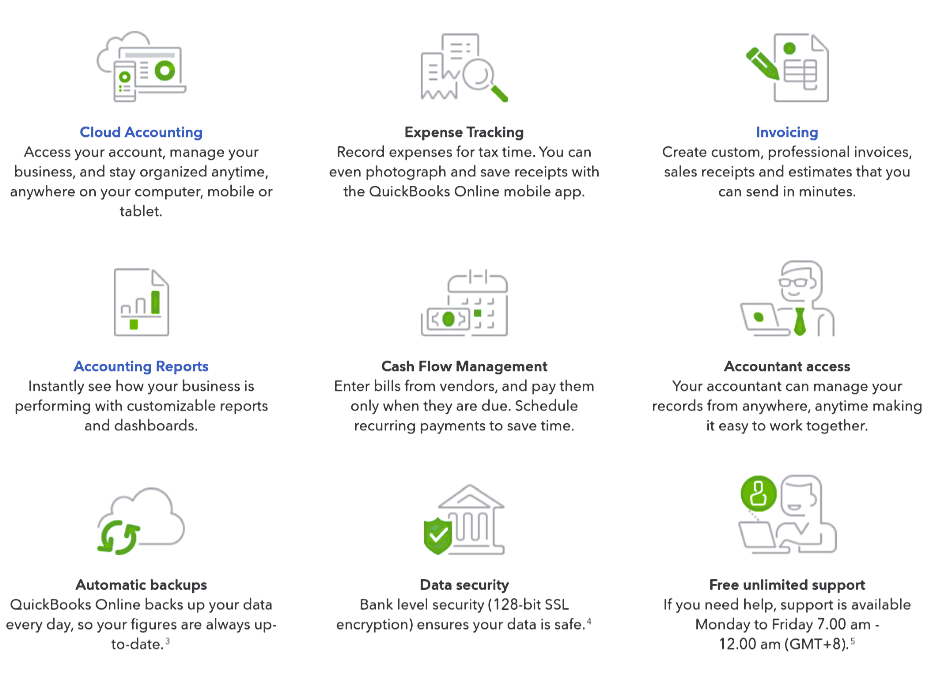

What does QuickBooks have that Wave doesn’t?

This depends on the price package you decide to purchase, as functionality in the lower priced packages is more limited. However, even at those levels QuickBooks is a feature-rich package. There are a few really basic things it adds that Wave doesn’t do – for instance you can print off checks to pay your suppliers. Given that sometimes, your suppliers might not be set up for internet payments, that can be useful.

Let’s focus on the areas where QuickBooks has functionality that makes a really big difference. Budgeting is one. Wave just doesn’t really do budgets. In QuickBooks, you can easily make up your budgets either using historic accounts figures and adjusting them for expected growth or changes in your product mix, or using your market forecasts. You can then track your out-turn against budget using the reporting function.

For a self-employed freelancer or someone running a ‘hobby’ business as a side hustle, the absence of budgets might not particularly matter. But for a small business that wants to get bigger, budgets are the way you’ll want to drive your business forward – and QuickBooks gives you what you need.

QuickBooks also has better support for tax. While Wave will calculate your sales tax, it isn’t much help when it comes to tax on your net income. Which is odd, since, last we heard, freelancers and consultants weren’t tax-exempt. QuickBooks not only supports you within the application, but exports to TurboTax for doing your filings. That takes a lot of work off your hands.

Other good features in QuickBooks include

- more in-depth customer tracking,

- link to payroll software,

- support for inventory and fixed asset management,

- better support for cash flow accounting,

- more robust access controls for members of your team,

- a special Accountant access style.

Support for inventory and fixed asset management is particularly important if you’re a retailer or manufacturer, or if you provide services but have to invest in fixed assets such as business vehicles or high tech equipment. If assets – whether materials, finished goods, or buildings and plant – are important to your business, QuickBooks will provide you with the tools you need to report the figures accurately and manage the assets efficiently.

Basically you’ll get more depth with QuickBooks, and it will adapt if your business grows in size.

Winner: QuickBooks

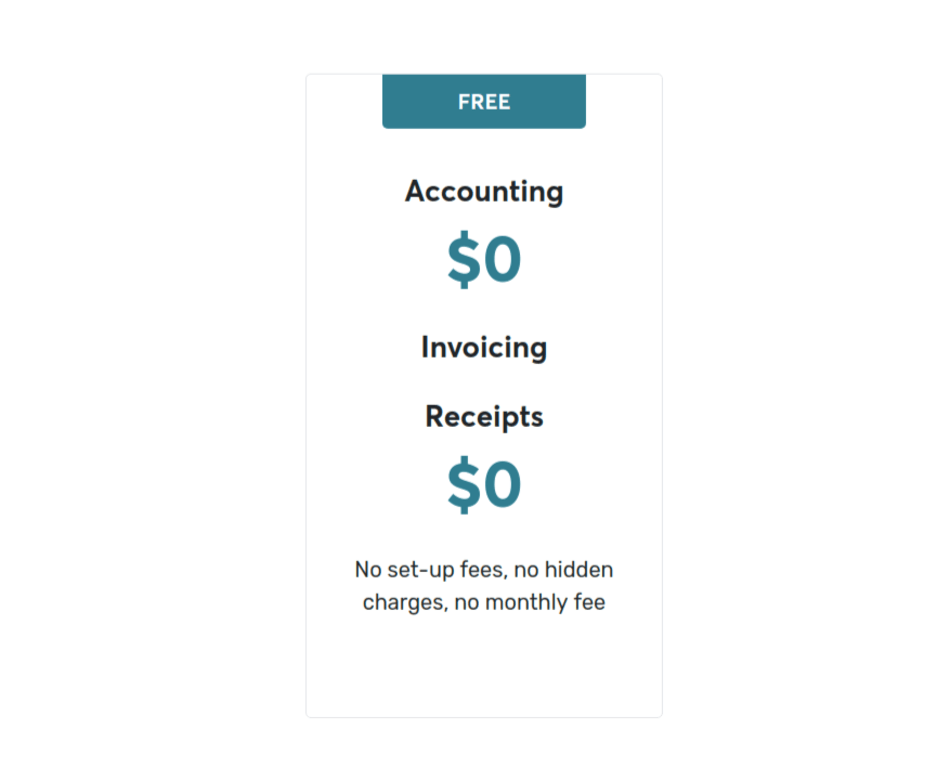

2. Pricing

Wave is free. Genuinely free. And unlike some software which has major restrictions on the lowest level of the package, what you get for free is fully functioning, with no limitations. It includes unlimited contacts and transactions and you don’t even need to give a credit card number to sign up.

Wave makes its money in two ways. First, it charges for payments. Credit card payments are charged at 2.9% plus a 30 cent per transaction charge, or 3.4% for Amex. This is in line with what QuickBooks charges (2.9% plus 25 cents). ACH transactions are charged at 1%, whereas QuickBooks handles them for free.

Secondly, it charges for a payroll service. This will cost $20 a month self-service, or $35 a month in those states where full-service payroll is offered.

QuickBooks Online has four packages which are tiered by the number of users, and which also provide increasing levels of functionality as you move up the tiers. However, there are no limits on how many contacts or how many transactions you can handle.

QuickBooks packages

| Plan | Price per month | Users |

| Simple start | $25 | Single user |

| Essentials | $40 | Up to three users |

| Plus | $70 | Up to five users |

| Advanced | $150 | Up to 25 users |

You can add $35 a month for payroll if you use the QuickBooks integrated payroll service.

QuickBooks offers a 50% discount on the package prices shown in the table for the first three months, plus a 30 day free trial.

Wave doesn’t have a free trial. Because it’s free however long you decide to use it.

Winner: Wave

3. Ease of Use

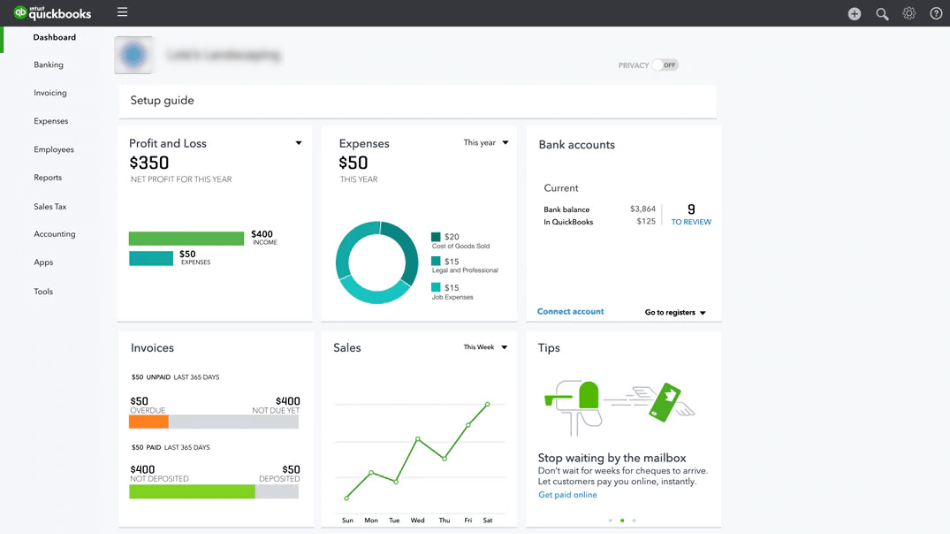

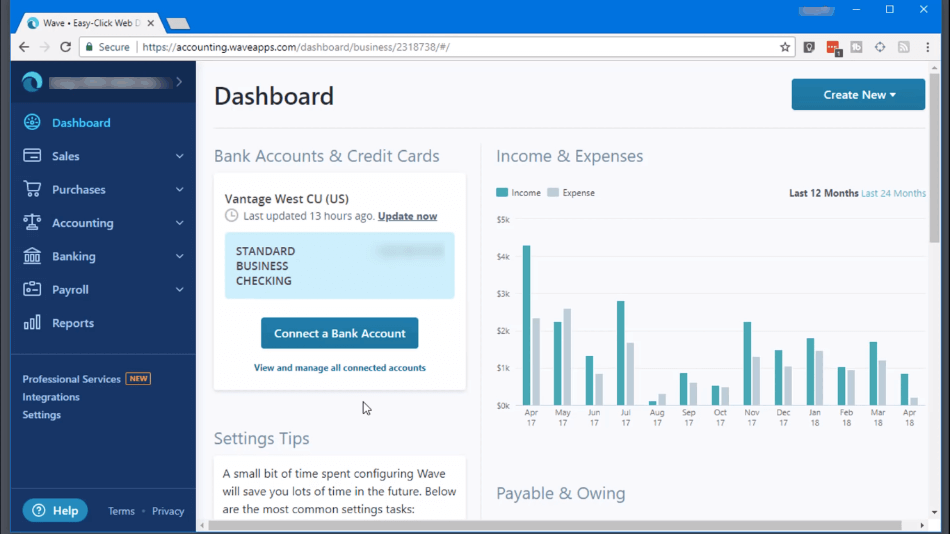

Both applications are centered around a dashboard that shows you in graphical form the most important data for managing your business, with a menu that gives you access to different functions. However, we found Wave somewhat easier to use.

QuickBooks is a fully featured accounts package. Even though it’s designed for non-accountants to use, and hides the double-entry away beneath a dashboard format, it’s not the easiest software to get used to. There is definitely a learning curve, and some transactions take a number of different steps rather than being handled in a single window. Some of the screens are quite cluttered, making it difficult to navigate around them.

Wave is generally a bit simpler and easier on the eye. Where it scores is in simplifying the most basic business functions, such as invoicing and expenses payment. It makes payment really easy for your customers, too.

Winner: Wave

4. Mobile apps

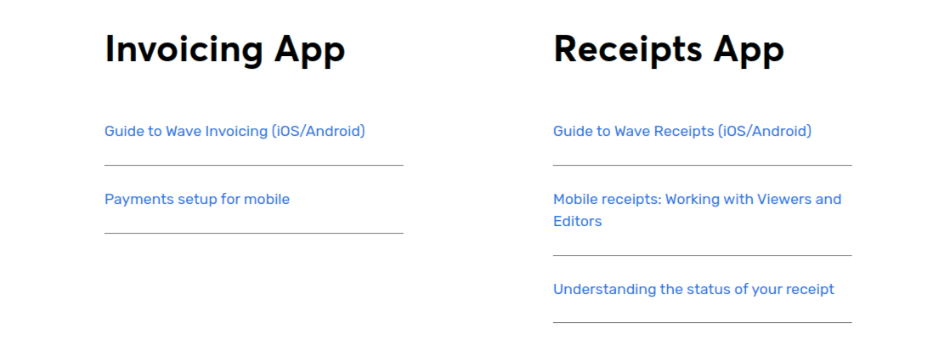

Wave has two apps on iOS and Android, Receipts by Wave and Invoice by Wave. They’re rather limited in function, and it’s an odd decision to have made each a separate app; if you’re at a client’s premises, want to issue an invoice for the work you’ve just delivered and also enter your taxi receipt as a travel expense, you’ll need to open each app separately. In QuickBooks and most other accounting systems you’d just do the work in the accounts app.

Still, invoicing on the go and receipt scanning are useful, and the apps sync automatically with your accounts. But they’re not fully featured. You can’t see all your accounts from your smartphone so if you need for instance to know what you last billed this client and whether they’ve paid, you won’t have that information on the app.

QuickBooks‘ mobile app (available on iOS and Android) might be clunkier, but it has more functionality – even though it still doesn’t give you the full capabilities that the browser based software possesses. And you only have the one app to install.

Winner: QuickBooks

5. Integrations

Wave integrates easily with a lot of basic e-commerce and payments providers such as Shopify, PayPal, ShoeBoxed, Etsy and Stripe. It also connects to Google Sheets, which is useful for those who use the Google suite of products to collaborate with clients.

But it only has a handful of direct integrations, though over 1,000 web apps are available for integration through Zapier. QuickBooks, on the other hand, has over 500 direct integrations available – because it’s the gorilla of accounts programs, with millions of users, every CRM, project management and inventory system has it first on the list as the app they really must integrate with.

Major apps that QuickBooks integrates with include Stripe, PayPal, Expensify, and numerous HR, time tracking, project management, and CRM applications. They can be integrated without using Zapier and all the apps can be used from within QuickBooks.

Plus, QuickBooks Online integrates with its parent company Intuit’s Payroll, and with other QuickBooks editions (giving you an upgrade path).

Winner: QuickBooks

6. Customer Support

Both Wave and QuickBooks have plenty of useful resources online and get high customer satisfaction ratings. Wave has a strong user community, and forums that are active and useful with strong support from the company. But after the first 60 days, you won’t get live support unless you use one of the paid-for services, Wave Payments or Wave Payroll. Free users only have email support.

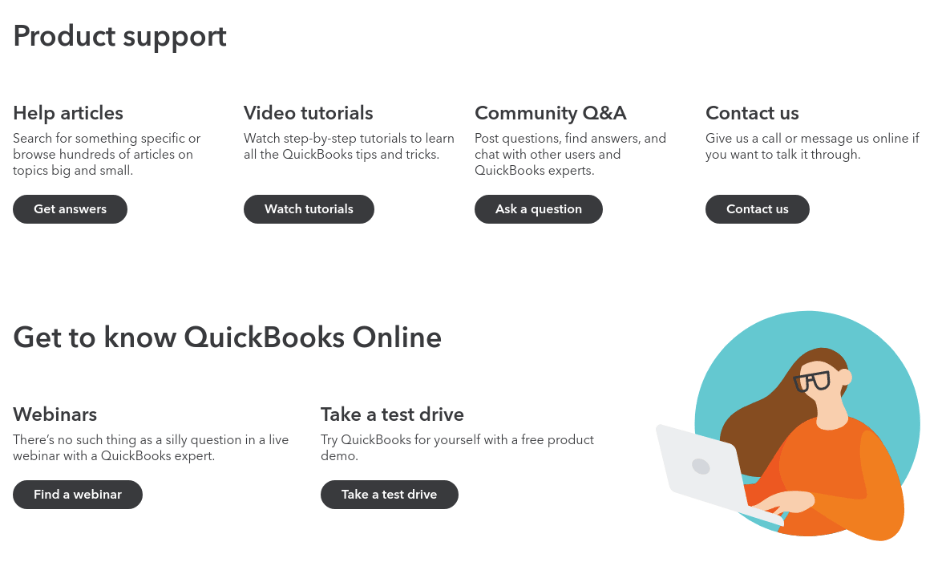

QuickBooks, on the other hand, offers real-time support during business hours, through messaging, email and phone. It also has loads of resources online, including webinars, video tutorials, and articles.

QuickBooks also has a great support ecosystem consisting of QB-certified accountants and bookkeepers, and third party training companies who provide both online and classroom training.

Winner: QuickBooks

7. Setup

With cloud computing, it doesn’t matter what operating system or what type of device you’re using, as long as you can launch a web browser and have an internet connection. So both these packages will work as long as you have a reasonably modern computer.

Wave has a simple launchpad. You choose what functionality you want to set up, and you’re guided through the process. You only need to enter the information necessary for what you want to do – other functionality can be added later. Set-up can take just a couple of minutes. You can import information using a CSV file – for instance your contacts list.

QuickBooks can import from CSV files or Excel spreadsheets, and like Wave, allows you to install only the functionality you’re interested in to start with. It also pre-populates your system with data from a sample company if requested, so you don’t have to input your own data to try it out and see how it works.

The learning curve is a lot quicker on Wave. QuickBooks is a more complex product and you’ll need to put more effort into learning your way around. But most people who have put in the effort feel it was worth it to get the benefit of QuickBooks’ additional features.

Winner: A tie

8. Reports

Wave produces reports that an accountant will be happy with – a profit and loss account with relevant breakdowns, cash flow, a balance sheet, and sales tax breakdowns. These can all be exported to CSV or PDF files, but they are not very customizable.

Wave gives you 12 reports. QuickBooks gives you 50 plus as standard. That’s a big difference. They’re also extensively customizable and you can save that customization so that every month, you get the regular reports that are most useful to you.

There’s no doubt who is the winner here.

Winner: QuickBooks

Final Thoughts

QuickBooks is our overall winner. Wave isn’t a bad program, but it’s got a sweet spot and it doesn’t perform well outside it.

The sweet spot for Wave is the microbusiness. If you’re a freelancer, run an Etsy business, or have a small business with fewer than ten employees, Wave could make sense for you. If you have a side hustle that doesn’t make a whole bundle of money, as many part-time craftspeople do, then Wave is great for you, particularly if you sell on Etsy.

Your invoices will look professional, it will deliver the basic financial reports and keep your accounts in order. All for free.

But Wave is a highly simplified solution and it won’t necessarily scale up to a larger business. If you have a more complex business, employ more staff, or have inventory that you need to manage, you’re going to want QuickBooks. If you want reports that you can use to analyze your business and drive it forward, you’ll want QuickBooks. And if you want the security of live support, and the ability to integrate with best in class CRM and operational management systems, you’ll want QuickBooks.