(Last updated on January 9th, 2023)

Sage Intacct or QuickBooks? Which accounting application is better in 2023?

Read this detailed Sage Intacct vs. QuickBooks Online comparison to make a smart decision.

In this article we’re taking a look at two accounting applications which could suit the mid-sized enterprise. Both are provided over the cloud, and both offer a fully-feature accounting package.

However, their sweet spots are different. Sage Intacct is intended mainly for larger businesses which need a more advanced accounting system, while QBO is a small business accounting package that will scale up to a mid-size business. They do have an area of overlap, though, where mid-size enterprises are concerned.

Sage Intacct has greater functionality and a lot more flexibility in deployment. However, this comes at a cost; implementation is time-consuming, and the software has a steep learning curve. On the other hand QBO can be used straight out of the box, though users who want to can customize it quite extensively.

Users who are ready for Sage Intacct might find QuickBooks Desktop Enterprise Edition a more interesting comparison, particularly in its industry-specific versions. However, it’s not available as a cloud application.

Sage Intacct vs. QuickBooks: Comparison At a Glance

1. Features

Winner: Sage Intacct. QBO is fully featured, but the entry level packages are a little short on functionality for asset based business. Sage Intacct packs a powerful punch in depreciation and inventory management as well as workflow.

2. Pricing

Winner: QuickBooks. Sage prices by quote and generally will cost a multiple of what you might lay out on QBO, even if you’re taking the top-priced QuickBooks package.

3. Ease of use

Winner: QuickBooks. No one enjoys grappling with the Sage Intacct learning curve, though many users say afterwards that they feel it was worth it. QuickBooks is much more intuitive and easy to use.

4. Mobile Apps

Winner: QuickBooks. Both applications provide mobile access, but QuickBooks’ app appears better designed if more streamlined.

5. Integrations

Winner: QuickBooks. Sage Intacct provides a development sandbox for organizations that want to do their own job of integration, but has fewer standard integrations. QBO has hundreds!

6. Customer Support

Winner: QuickBooks. This is an area where both companies come in for a bit of criticism. QuickBooks provides more resource, and its training is also better targeted.

7. Setup

Winner: QuickBooks. Implementation of Sage Intacct can be long and stressful, and needs an IT team working with the finance department. QuickBooks Online can be installed in just a few minutes – and it’s tweak able later.

8. Reports

Winner: Tie. Sage Intacct has more flexibility but it’s difficult to set up the reports the way you want them. QuickBooks has rather less slice-and-dice ability, but comes with many useful reports as standard, and is easily configurable.

Short Verdict

For businesses that are growing fast and beginning to need a full enterprise system, Sage Intacct has more functionality and will scale up to big business requirements. However, it’s clunky and expensive if you’re a nimble start-up, particularly if you run with a minimal finance department or in-house IT support.

QuickBooks Online is much easier to install and use, while it has more than adequate functionality. It also comes at a much more modest price. We think that for most mid-sized businesses ease of use trumps the advanced features of Sage Intacct – unless you really need consolidation capabilities or highly sophisticated reporting.

1. Features

Both Sage Intacct and QuickBooks online are fully-featured accounting systems delivered over the cloud. Both offer all the basic accounting functions including

- automated bank reconciliations

- invoicing and customer records

- bill payment and vendor management

- accounts receivable and payables

- inventory

- fixed asset recording

- production of profit and loss account, cash flow and balance sheet

- reporting

- budgeting

- multi-currency support.

Both also offer functionality that moves into the ERP space with functions such as inventory management, but Sage Intacct goes further.

Sage Intacct has significantly more flexibility in deciding how deployment and reporting is structured. It has excellent automation features, so that users can streamline and automate tasks, reducing the amount of data entry that has to be done. If you’re struggling with closing the month end accounts, Sage Intacct can make a huge difference, more than halving the time used for some customers.

Sage Intacct also allows sales and costs to be analyzed in different, overlapping ways. Revenues and costs can be attributed to a given project, but that project can also be analyzed in terms of different departments’ contributions to a project. This is the kind of thing larger businesses need – but it may be a step too far for mid-size businesses unless their operations are particularly complex.

Another area where Sage Intacct is strong is in providing a multi-entity environment, with the ability to balance inter-company accounts and consolidate subsidiaries. For any enterprise that’s reached the stage of putting different areas of business into separate subsidiaries, this is really crucial functionality, and it’s functionality that QuickBooks does not provide. (In fact, you can only have one accounting entity in QBO; if you want to run two companies, you’ll need two subscriptions, and there’s not a robust consolidation function.)

One big difference between Sage Intacct and other accounting packages is that instead of simply having a hierarchical chart of accounts, the General Ledger has eight ‘dimensions‘ such as customers, cost centers, and projects. A transaction can be seen in several different dimensions; for instance a single sale can be seen as belonging to a product line, a project, a customer, or a division of the business. This allows much more flexibility in slicing up your business for reporting purposes.

While QBO has all the basic accounting features, it does have limitations when it comes to asset management. For instance, depreciation isn’t automatic, and full inventory management is only available in the top priced package. (QuickBooks Desktop offers superb functionality here, with industry-specific versions supporting retail, construction and other verticals, but it only comes as a desktop installed package, not on the cloud.)

QBO has a bit of an edge for services business, though. Any business that works on the basis of billable hours will get good value out of QuickBooks, which offers unlimited free users for its time tracking function – though total accounts users are limited to just 30. Project management features are also robust.

QBO also offers more robust multi-currency support. While Sage Intacct does enable multi-currency working, it’s not 100% effective. For instance, if you have one business entity (say a foreign subsidiary) working in another currency, consolidation will be glitchy. For true multi-currency support, QBO is the right choice.

Winner: Sage Intacct

2. Pricing

Pricing for Sage Intacct is quote-based. You’ll have to go through the sales process, specify exactly what is required, and wait for a quote. That will reflect the exact functionality required, as well as the number of users. Some features are an add-on. For instance, rather annoyingly, budgeting functionality costs extra. However, the modular build-up of pricing does allow users to choose what functionality is crucial for their organization, and omit features that don’t work for their particular vertical.

Entry level appears to be around $7,500-10,000 a year for a single entity company, up to $40-50,000 for a larger, multiple-entity business. Sage Intacct will support an unlimited number of users. It also has different pricing for different types of users – managers, project managers, or employees entering data.

QuickBooks, on the other hand, is capped at 30 total users (except for the time tracking app, which is unlimited). Its pricing model is more transparent, with the top level costing $150 a month or $1800 a year – though most companies will need to add payroll (another $500-600) and possibly some other integrations to ensure their transactional and reporting needs are completely covered.

Only the top level, Advanced, is at all comparable with Sage Intacct.

| Plan | Price per month | Users |

| Simple start | $25 | Single user |

| Essentials | $40 | Up to three users |

| Plus | $70 | Up to five users |

| Advanced | $150 | Up to 25 users |

QuickBooks gives you more users with each step up. It also includes more functionality in each successive package; for instance it’s not till Plus that you’ll get project management functions.

Winner: QuickBooks

3. Ease of Use

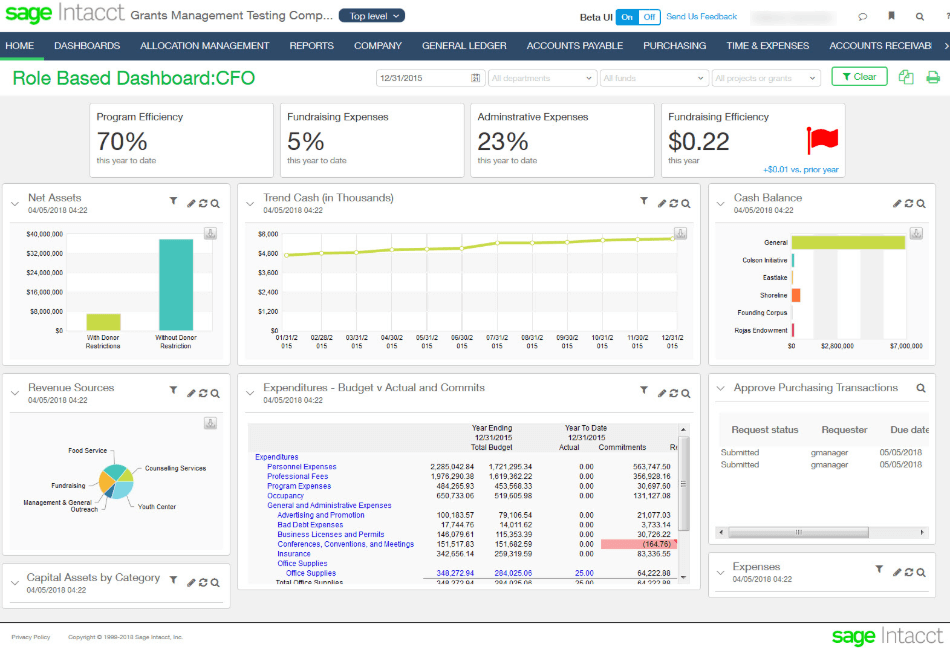

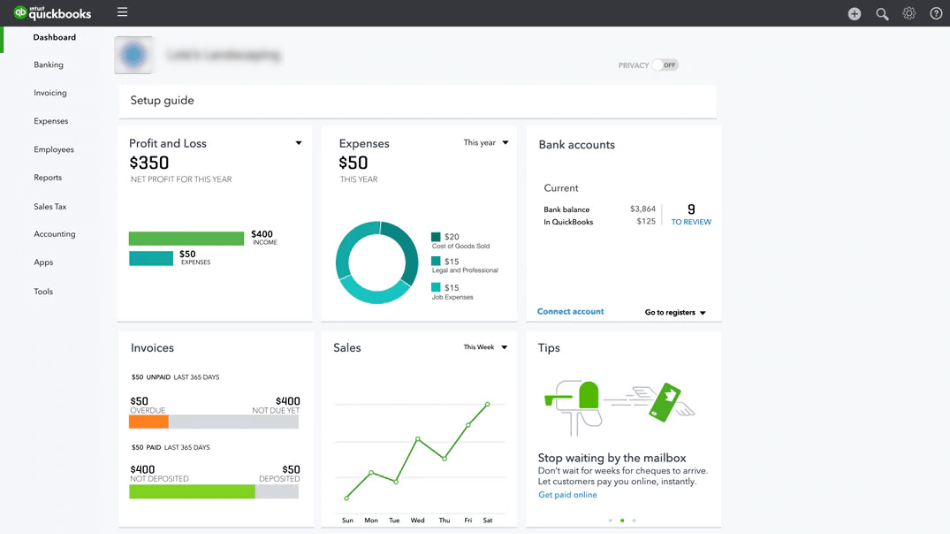

Both applications are focused on a dashboard which acts as an entry point to the system, showing basic overall data. Tabs and menus lead to different areas, such as reporting and invoicing.

However, QBO is much more user-friendly. One of its great advantages compared to Sage Intacct is a search function that allows users to look for particular clients, invoice numbers, or products. By comparison, Sage Intacct has a poor search function, and that can lead to wasted time trying to track down a given transaction.

Another feature of Sage Intacct that many users find frustrating is the fact that it uses various different modules like fixed assets, prepaids, and purchasing, which don’t always play well together. And basic functions can be over-complicated; for instance paying off credit cards, check production and even invoicing can be more difficult than they need to be. Vendor and customer functions are not as good as in competitors like Netsuite or QuickBooks.

Those who have transitioned from QuickBooks state that while Sage Intacct offers more advanced functions, it’s difficult to get used to and there is a steep learning curve. It can be quite clunky, particularly with add-ons like the fixed asset module.

QuickBooks has more of a learning curve than the simplest small business accounts software, but compared to Sage Intacct it is more intuitive and often more streamlined. The interface is also less busy than Sage Intacct’s, presenting information in smaller chunks.

Winner: QuickBooks

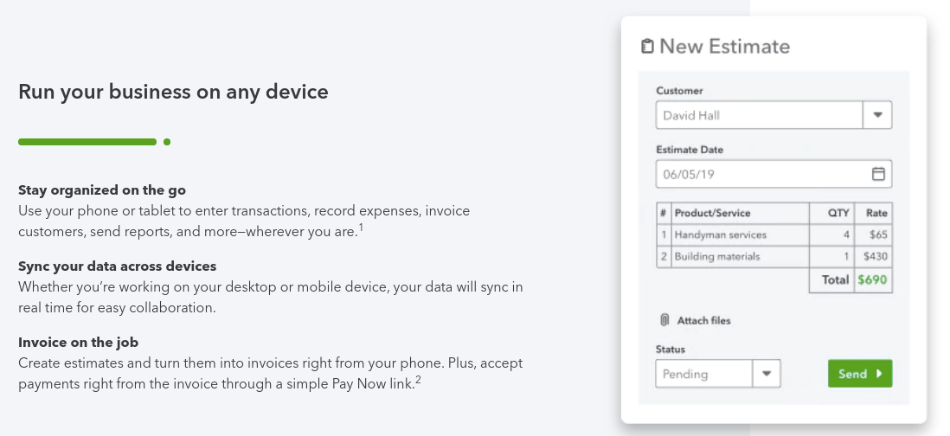

4. Mobile apps

QuickBooks‘ mobile app allows fast invoicing and scanning of receipts. It’s great for the given function, particularly for mobile workers and road warriors. However, it doesn’t deliver access to the full functionality of the accounts package.

Sage Intacct doesn’t appear to have made much of its mobile app, though the ability to approve purchase orders or bill payments by mobile is very useful.

Winner: Tie

5. Integrations

Sage Intacct has a good number of integrations including Salesforce CRM, Expensify, Paychex payroll,QStock Inventory, ADP Workforce Now, and others. However, many users will end up spending time and effort on integration, as Sage Intacct seems to have fewer standard integrations than QBO.

QBO has several hundred standard integrations, as well as offering others through Zapier. These include its own Payroll, as well as inventory, project management, CRM, direct mail and cost analysis integrations. Integrating with QBO is much less work than with Sage Intacct.

Both packages integrate with POS systems. But while QBO focuses on SME oriented systems like Lightspeed, Shopkeep and Vend, Sage Intacct also has heavy-duty integrations like QSROnline, MarginEdge, with a particular sweet spot in the restaurant and hospitality sector.

Winner: QuickBooks

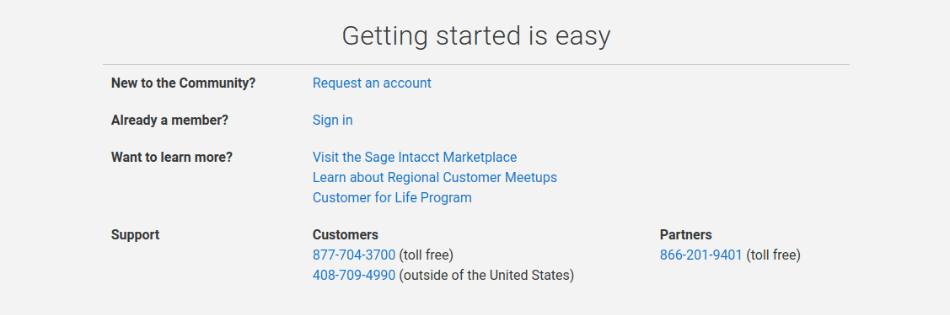

6. Customer Support

Neither Sage Intacct nor QuickBooks appears to fully satisfy its customers with regard to support. When we looked at customer reviews, we found a number of customers quite unhappy with Sage Intacct, in particular, which in some cases is simply unable to resolve issues. It seems not to organize its support team well; staff sometimes don’t have a record of what has been said in a previous call, and ask for information to be provided again.

There is also something of an issue with Sage Intacct’s training. It’s good quality, but because the basic system is almost always modified, whether by a third party implementation consultant or in-house, a generic training program is not always particularly useful.

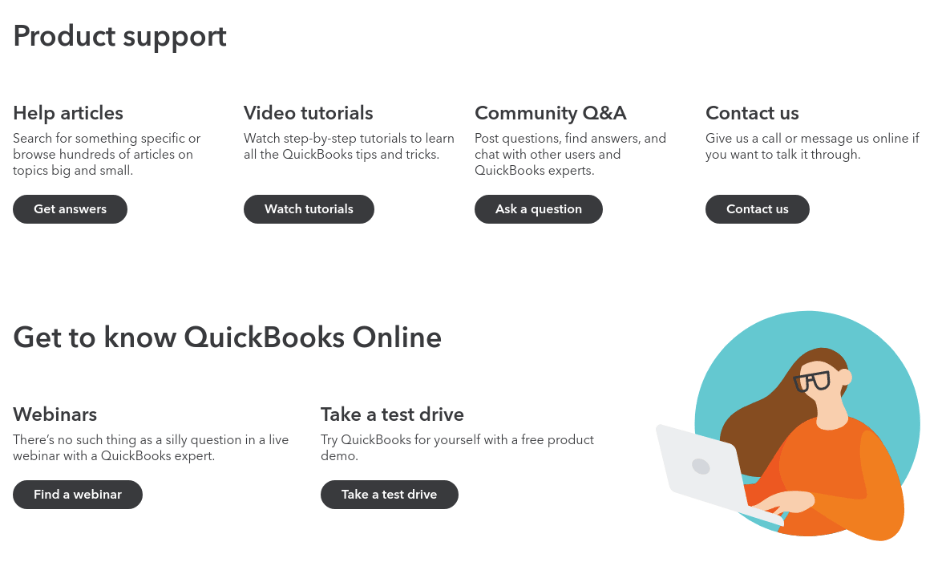

QuickBooks also comes in for some criticism, but though response can lag a little, it seems to have a better success rate of solving customer problems once the team is engaged. There’s also a huge amount of online resource available for users, as well as an active user forum with QuickBooks staff often present to help.

QuickBooks also has a huge base of third party training and consultancy providers as well as accountants and bookkeepers. If you use QBO you won’t lack for readily accessible expertise. Sage Intacct is a less well known application.

Winner: QuickBooks

7. Setup

There’s no installation involved with either application, since they work in the web browser. However, configuring the applications can take time, and that’s particularly the case with Sage Intacct.

You can forget about using Sage Intacct straight out of the box. It’s impressively customizable, but configuring it at the start is a lot of work. Many users decide to implement it using a third party reseller/consultant rather than using in-house resource.

Implementation can be stressful, and that’s not helped by the fact that customers often don’t understand quite what they want or how it can be provided until after the implementation has started. Specifying the precise system required is a major piece of work that needs to be completed before setting out on purchasing and implementing the application.

QuickBooks on the other hand can be set up in minutes, and will work perfectly well with the minimum modification by the user. It’s possible to set the application up for only the functionality needed on setup, and then to add other features as and when needed.

However, users who spend a little time customizing QuickBooks will get more out of it. At a very basic level, customizing invoices can help promote your business branding and include specific terms of business; going into the software more deeply, customizing the chart of accounts and setting up customized reports is well worth while.

Winner: QuickBooks

8. Reports

QuickBooks has plenty of standard reports, but at the higher price points it’s also possible to customize reports. The top package, Advanced, includes business intelligence from Fathom that gives advanced analytics and big data capabilities to the reporting function. Reports are very clearly presented, making it easy to see trends, and you can drill down from the report into the base data quite easily.

Sage Intacct has much more flexibility, though. Because of the ‘dimensions’ we mentioned earlier, you can slice and dice the data in different ways, to gain a granular and detailed view of how each part of the business is performing. Users who have spent time configuring the reports say they have gained valuable insight into their operations and been able to make quantifiable improvements in their businesses.

However, reporting is complex to set up, and some users say the process was initially frustrating.

Getting the best out of Sage Intacct is time-intensive; you don’t get anything simple and standard. Unless you want to put a lot of work into specifying custom reports, QuickBooks is more likely to give you what you want up-front.

Winner: Tie

Final Thoughts

Sage Intacct is a highly flexible system with incredible reporting functionality. For organizations which are growing and whose operations are becoming more complex, it’s an excellent choice. However, it’s relatively difficult to implement, and the learning curve is steep.

If you have a fully staffed accounting department and in-house IT for integrating other software into Sage Intacct, you’ll be able to benefit from its scalability. However, we feel at this level it may also be worth looking at Netsuite – it’s a powerful competitor for ERP, though its reporting functions aren’t quite as in-depth.

For most mid-size businesses, we’d recommend QuickBooks online, specifically, the top level ‘Advanced’ package. It’s easier to set up, and requires less configuration, while still allowing plenty of flexibility and delivering powerful functionality. The learning curve is much less steep than with Sage Intacct, and the software is more intuitive.

QBO also streamlines the basic tasks such as invoicing, which can be clunky in Sage Intacct. We like the fact that its integrations are practically seamless, too – particularly with payroll, where QuickBooks payroll fits inside the system and only requires the user to activate it.

For those businesses which are outgrowing QBO, particularly those which are asset-based (retailers, manufacturers, wholesalers) or in construction or hourly services, we recommend taking a look at QuickBooks Desktop. Its industry-specific versions are configured to provide the maximum accounting and resource planning support, and at the top level it’s a really powerful system for the mid-size business.

It’s also worth noting that QuickBooks has kept improving its higher tier products and moving them further up the value chain. QuickBooks Online Advanced was introduced in 2018 to provide a further, higher level of accounting package for larger mid-size businesses. While we have heard nothing definite, we would not be surprised to see further improvements pushing QBO further up into the mid-size ERP space.

FAQs

There is a process for moving data from the Online package to a Desktop implementation. But it’s not perfect, and there are issues if you use multi-currency functions. You’ll also need to put some time into learning Desktop – it’s not just a client/server version of QBO, but a completely different system.

While Sage Intacct is first and foremost an accounting system, it includes significant elements of ERP (Enterprise Resource Planning) functionality that can help boost business productivity and streamline work processes.

Both QuickBooks and Sage Intacct hold your data on the cloud. However, they both allow you to export your data should you wish to migrate to another accounting or ERP package.