(Last updated on January 9th, 2023)

Mint or QuickBooks, which software should you choose in 2023?

Read this ultimate Mint versus QuickBooks comparison to make a smart decision.

If you’re running a small business and also want to manage your own finances, it might be tempting to look at a package that can do both. Wouldn’t it be nice if you could sit at your computer and check, without leaving your accounts app, how your sales are coming along this month, and how your shares in Berkshire Hathaway are performing?

You can’t do that in QuickBooks. QuickBooks Online is designed to run your business accounts – but it won’t run your personal budget.

But the same firm that sells QuickBooks also produces Mint, an app that’s geared towards running your personal budgets and investments but could also be useful for freelancers and solopreneurs to keep on top of their business accounts.

So how do the two compare? Which one is right for you? We’ve looked at the specs, tried out the software, and read through heaps of user reviews to come up with our verdict.

Let’s get started!

Comparison At a Glance

1. Features

Winner: QuickBooks. Mint has some great features for personal budgeting, investment tracking, and aggregating your financial accounts. But QuickBooks has a robust double-entry accounting based application, easy invoicing, and business reports that will help you move your business onwards.

2. Pricing

Winner: Mint. Mint is free. QuickBooks has a tiered pricing structure that delivers increasing functionality (and more users) as price tag rises.

3. Ease of use

Winner: Mint. QuickBooks has double-entry wired into the deep structure (so your accountant will love it). Still, you don’t need to be an accountant to use it – carrying out basic tasks like invoicing, paying bills, and chasing receivables is simple. However, Mint has been designed for households rather than business use, and its simplicity makes it even easier to use.

4. Mobile Apps

Winner: Mint. QuickBooks lets you invoice and scan receipts on the go, but its mobile apps don’t deliver the full power of the app. Mint, on the other hand, is easy to run at full power on any device, wherever you are.

5. Integrations

Winner: QuickBooks. Mint hardly gets off the starting blocks in this category. It doesn’t even integrate with QuickBooks. On the other hand, QuickBooks offers hundreds of different integrations with software from e-commerce apps to CRM.

6. Customer Support

Winner: QuickBooks. Mint doesn’t offer a whole load of support. QuickBooks users often complain its support is a bit patchy, but whether it’s live chat, phone support, online video tutorial, or webinars, there’s an awful lot of it around!

7. Setup

Winner: Tie. Both these applications are easy to set up. Being cloud-native, they don’t have to be installed on your desktop; you just run them in the browser. QuickBooks lets you load just the bits you want to use, so you don’t spend time setting up functions you don’t need.

8. Reports

Winner: QuickBooks. No contest here. Mint has fairly limited reports. QuickBooks has reporting in real depth.

Short Verdict

If you are running a business, unless it’s a pretty limited side hustle, or if you’re a freelancer using a platform company, you’ll probably find Mint doesn’t provide you with enough business functionality. Invoicing, e-commerce integrations, and payments are all areas that you need, and it won’t cover off.

QuickBooks, on the other hand, offers huge functionality, and it’s really scalable – if you grow your business from ‘stuff I do in the garage’ to a moderate size company with dozens of employees, you can just move on up the pricing structure, and the application can continue to support you.

That does come at a price, of course. But for the cash strapped small business owner, a free app like Wave might be more appropriate than trying to use Mint as an accounts program.

1. Features

Mint has some good features aimed at helping you manage your finances. One of its big pluses is that it lets you aggregate transactions from all your different US financial institutions, so your broker, bank, 401K, and credit card accounts can all be fed into one global overview.

Mint’s net worth report gives you quick answers to questions like “how much did you make?” and “how did you invest it?” or “how did you spend it?” It also lets you budget for the future by showing your spending trends and alerts you to pending bills.

Mint has some investment tracking tools, too. If you’re a buy-and-hold investor, they will be enough for you, though they probably wouldn’t support a more active trading philosophy.

It also lets you monitor your credit score, and can suggest ways to minimize transaction fees based on the trends it analyses. It will alert you if you’re getting close to an overdraft limit, so you can move funds from another account to cover the gap.

And you can organize all your expenses and investments into business and personal categories so that you can clearly see how your business is doing. It can also suggest areas where you might make savings, and by showing regular bills, gives you useful clarity over the expenses side of your business.

However, it won’t help you budget variable costs or plan your business revenues or give you a product breakdown.

One really glaring omission is that it won’t help you with your tax filing. It can’t merge data with TurboTax accounts, so you have to do this manually. That is a royal pain in the nether regions, and really, Mint ought to sort it out.

What Mint won’t do:

- bank reconciliation

- accounts dashboard

- billable hours tracking

- billing, invoicing

- budgeting

- email integration

- project tracking

- inventory management or tracking

- multi-currency

- sales tax automation

- expense tracking

That’s all stuff that QuickBooks will do for you.

QuickBooks is a full business accounts application. It does all this stuff, though some functionality (like billable hours, project management, and inventory management) is only available in its higher-priced packages. It not only lets you invoice customers but also automatically works out your sales tax – that can be a huge time saving for most businesses.

In particular, QuickBooks has good accounts receivable functionality. For several small businesses, it’s not selling that’s the problem; it’s getting paid – QuickBooks lets you see which invoices haven’t been paid, and which customers are the problem. That’s something you won’t get with Mint.

Although you won’t see it unless you delve under the hood, QuickBooks comes with a full double-entry accounting system. That means you can hand over the books to your accountants, and they’ll be happy with the data – QuickBooks has special access built into the software specifically for accountants.

Like Mint, QuickBooks will automatically connect to your business bank account and file your transactions in the right places. It will run a reconciliation with the invoices and bills you’ve already filed, automatically, saving you time and effort.

What QuickBooks won’t do -is let you run personal accounts. It won’t help you budget your food shop or plan your retirement fund. You’ll need another program if you want to do that.

Winner: QuickBooks

2. Pricing

Mint is free. Its freemium pricing model is based on building up a huge user base and selling anonymized aggregate data to finance providers who want to know about the average American’s financial habits or about major trends. It also operates a referrals scheme; if you take up its recommendation of moving to a cheaper insurer or brokerage, it gets a percentage.

For you? That means free. Free, gratis, zip, nothing, that’s the price.

On the other hand, you’ll have to pay for QuickBooks Online. It has four different pricing levels, which are tiered by the number of users and by increasing levels of functionality. As you move up the tiers, more functions are provided, and the application will also deliver more different in-depth reports. However, there are absolutely no limits on the number of transactions or number of contacts (customers, vendors) in any of the packages.

QuickBooks packages

| Plan | Price per month | Users |

| Simple start | $25 | Single user |

| Essentials | $40 | Up to three users |

| Plus | $70 | Up to five users |

| Advanced | $150 | Up to 25 users |

Inventory management, tracking billable hours per customer, budgeting, and 1099 functionality for paying contractors is included in Plus and Advanced, but not in the lower-priced packages.

Adding the QuickBooks integrated payroll service will cost another $35 a month. (Mint doesn’t support payroll at all.)

QuickBooks currently offers a 50% discount on the package prices shown in the table for the first three months, plus a 30-day free trial.

Winner: Mint

3. Ease of Use

Mint is designed so you can see everything clearly. It has a clean, user-friendly interface, with lots of clear, well-spaced graphics so you can see at a glance what you need to know. It also offers useful alerts. It’s easy to see what you need to fill in, or where to click to get a particular report or function. We score it highly for ease of use.

However, users report issues with synchronization not working as well as it should. That means it’s not pulling through data from all your accounts, and if it’s not syncing, you can’t do anything. There’s no manual override, and that can really spoil the user experience.

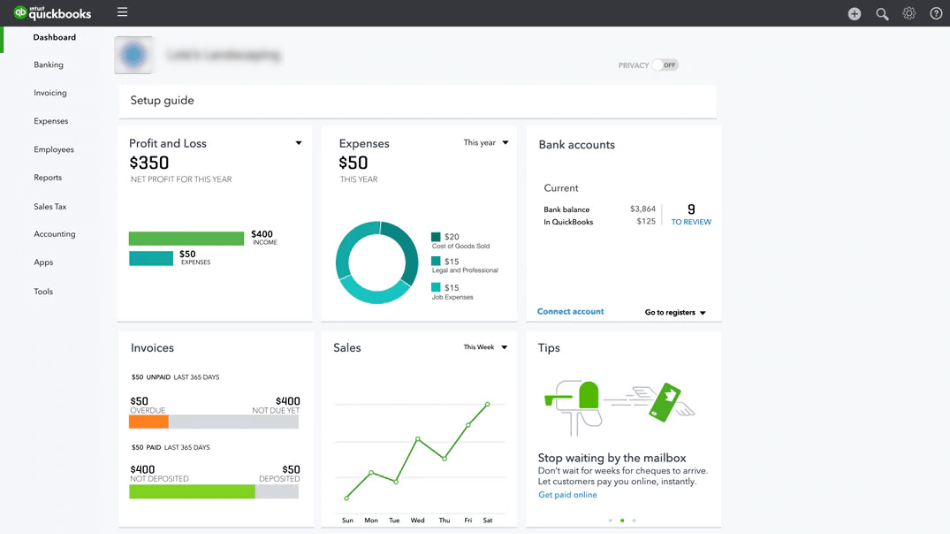

QuickBooks takes a bit of getting to know. Even though it’s designed for the non-accountant, it is a full-function bit of accounting software, and that means it’s got a certain amount of complexity built into it. That gives it quite a steep learning curve. However, the most common functions can be handled in minimal keystrokes, so once you know where everything is, using it becomes quick and efficient.

QuickBooks does make life relatively easy for you by being centered on a dashboard that shows you the basic information you need. A left-hand side menu lets you access functions like invoicing, reporting, or inventory management. But occasionally, you’ll find you need a few extra keystrokes; for instance, creating recurring invoices needs an extra step (create the invoice, then mark it recurring).

Winner: Mint

4. Mobile apps

Mint, because it’s designed as consumer software, and consumers want mobile apps, has gone with the flow and has some great mobile apps – not just for iPhone and Android smartphones, but even for the Apple watch. Most of what you can do on the desktop, you can do it on your phone.

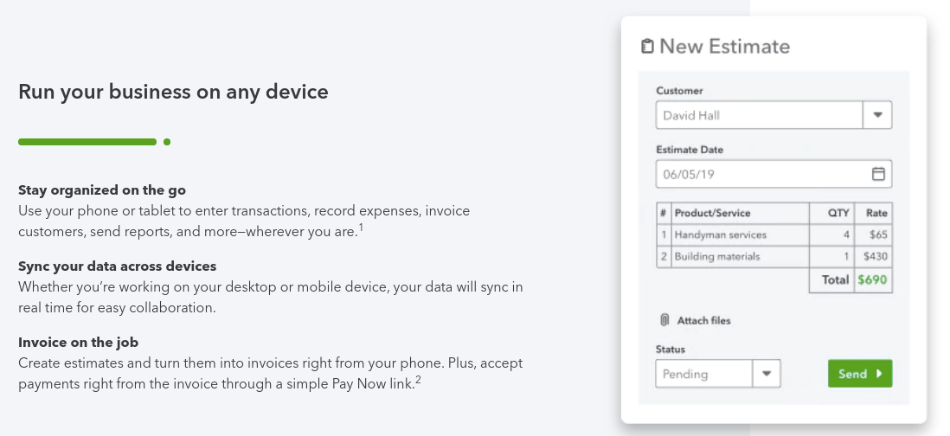

QuickBooks is designed for a less mobile-orientated business environment but offers mobile functionality where it counts. You can scan in receipts, and it will automatically enter them to expenses. You can send invoices from your phone – really useful if you work on client premises, sell from your car or truck, or simply spend a lot of time on the road. But you won’t get the full functionality using the app.

Winner: Mint

5. Integrations

Mint offers one integration: Bitium, a password manager. That’s it.

Annoyingly Mint doesn’t integrate with TurboTax or with QuickBooks – despite the fact they’re part of the same company. So you can’t put your earnings figures from Mint straight into your tax filing – you’ll need to export the relevant figures to an Excel spreadsheet and then fill in TurboTax, which takes time (and is boring). And you can’t feed your business earnings from QuickBooks straight into Mint, either.

QuickBooks, on the other hand, is a past master at integration, both with in-house apps like Intuit’s Payroll, and with third-party software from e-commerce basics like Shopify and PayPal to CRM, direct mail, inventory and timesheet apps like Method, TSheets, MailChimp, and BigTime. Over 500 integrations are available, including specialized job costing and industry-specific apps.

Even if you’re not using all those integrations right now, you might want to upgrade in the future as your business grows. QuickBooks will let you do that – Mint won’t.

Winner: QuickBooks

6. Customer Support

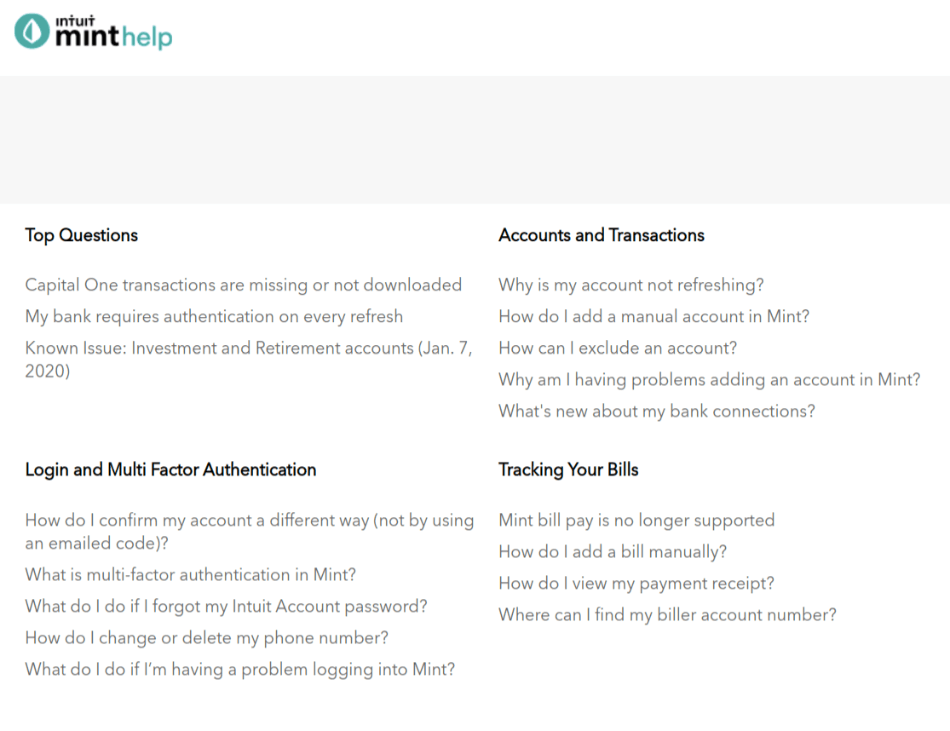

To be honest, you’re not going to get a whole load of help with Mint. There are FAQs, and there’s a user forum, and there’s a pretty reasonable support function on the website using live chat, but you won’t get a phone number to call. You can email – but you may need to wait a little while for a response. If you’re using Mint, you need to be happy that you can manage without any hand-holding. (That said, it’s straightforward software. If you can play Super Mario, you can handle it.)

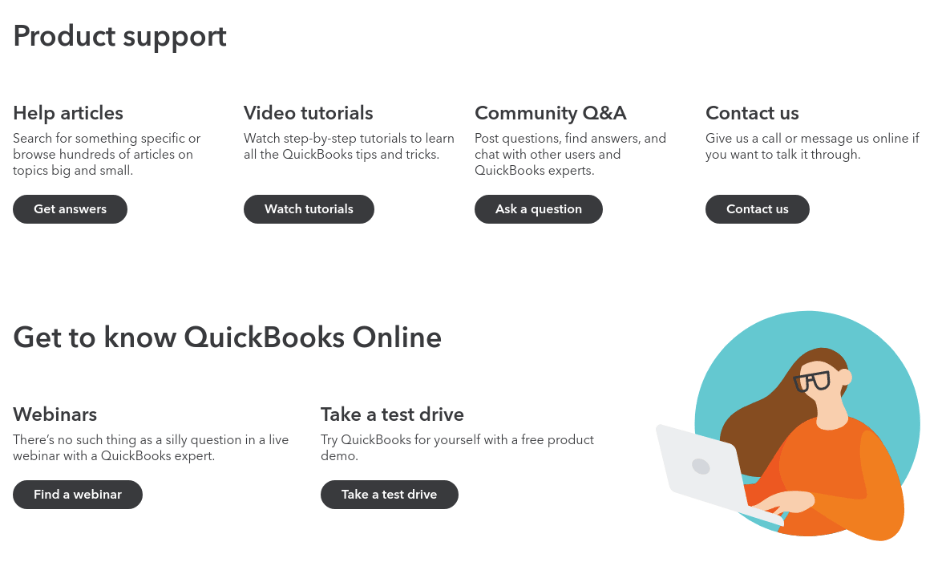

QuickBooks, on the other hand, offers a plethora of different support. There’s a phone line and chat support, open extended business hours, there is a huge knowledge base, and lots of video tutorials and webinars open to subscribers. That’s in addition to the user forum, which is very active. And of course, QuickBooks has thousands of certified bookkeepers, accountants, and training houses who can help meet your accounting and support requirements with the application.

Winner: QuickBooks

7. Setup

To set up Mint, you’ll need to spend a little while adding all your accounts with their passwords. You need to get organized before you start. But the process itself is fairly painless. Mint will then automatically classify transactions; you can’t change the top-level categorization, though you can add subsidiary categories. Mint remembers repeating transactions, so they’ll always go in the same filing box, so to speak.

Setting up QuickBooks, you’ll need to link it to your business bank account. As a cloud app, you don’t have to worry about installing it on your desktop or laptop – it runs in the browser. You’ll need to give basic info about your business. (But if you just want to try it out, you can run it with pre-populated data from a fictional company, so you can see how it works without loading your info.)

QuickBooks also lets you load up only the functions you need right now. You don’t have to load up all the fixed asset support, for instance, if you don’t have any money invested in fixed assets. That’s a big help for start-ups that want a usable app right now, but not to get involved in filling in stuff that isn’t useful.

Winner: Tie

8. Reports

Mint gives you a good net worth report – it even syncs with Zillow to show the value of your home. Its budget reports are clear and useful. However, you won’t get reports on customers or suppliers, or on inventory, because it’s not aimed at supporting business.

QuickBooks tracks pretty much everything: aged receivables, customers, vendors, inventory, sales by product type. Reports are customizable, so if there are particular figures that you use to run your business, you can build them into your reports and get them in a single click.

Granted, if you have a side hustle selling cross stitch samplers on Etsy, you might be happy just being able to track your sales income and the occasional batch of fabric you buy – and you can label those transactions in Mint. But if you have a serious business, QuickBooks would be a much better choice here.

Winner: QuickBooks

Final Thoughts

Out of these two applications, QuickBooks is going to be the choice for 99% of small business owners.

It handles the big jobs for you – invoicing, sales tax, and preparing your tax filing. It lets you produce financial accounts for your business. It gives you the reports you’ll need to grow your business further, and it’s scalable so that if you grow the business, you can simply spring for a higher spec QuickBooks package – you don’t need to learn a new app or port your data across.

But Mint might be right for a few people.

- If you have a tiny side hustle, a hobby business, or you sell at two crafts shows a year.

- If you work on platforms like Upwork or freelance.com, which handle all of your invoicing.

- If you have a couple of rental properties with regular rental income and regular bills going out.

In these cases, you’re not really going to need all the functionality that QuickBooks offers, so why pay the price? But you might also look at Wave, another free account package that offers you more business functionality than Mint.