(Last updated on January 9th, 2023)

GnuCash or QuickBooks Online, which software should you choose in 2023?

Read this ultimate GnuCash vs. QuickBooks Online comparison to make a smart decision.

Sometimes, as a small business, you don’t know which way to turn for your business software. Should you go for the high end, enterprise specification application that offers you all you need – plus a whole load that you don’t need yet – and pay the cost, or should you go for a basic, functional system that may have a few weaknesses but doesn’t have the cost or the steep learning curve?

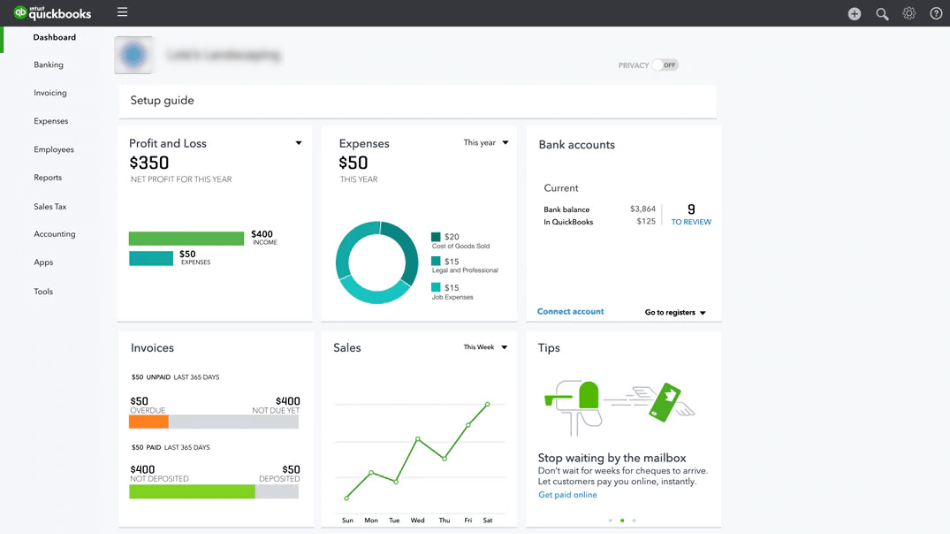

That’s the kind of decision we’re looking at in this comparison review. QuickBooks is a gorilla of SME accounts software, offering multiple price packages and a huge range of functionality as a cloud-delivered service. Your accountant will love it – but will you?

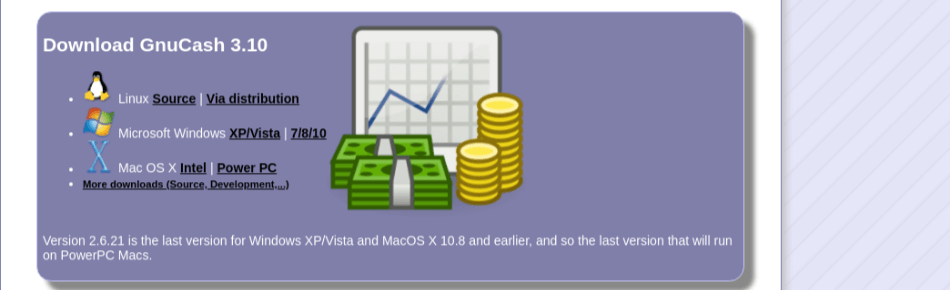

GnuCash, on the other hand, is an open-source, installed desktop application that started life as a personal finance app dedicated to running household budgets. It has now added small business capabilities as well – but is it serious enough for your business?

We’ve looked at the technical specs. We’ve tried out the programs. We’ve listened to what users have to say. And we have found a winner…

Let’s just summarize the areas we considered in ding our research.

Comparison At a Glance

1. Features

Winner: QuickBooks. GnuCash has come a long way from its original personal finance mission and has added some strong new features over the past few years. But it still has a few gaps – no tax features and little support for inventory management. QuickBooks, on the other hand, has every feature you’d ever want to use, and then some.

2. Pricing

Winner: GnuCash. GnuCash is free. QuickBooks costs money. Easy to find a winner here.

3. Ease of use

Winner: QuickBooks. Neither of these two applications is particularly easy to use. You’ll really need to get to grips with double-entry accounts to use GnuCash, while QuickBooks offers so much flexibility and functionality that you’ll have a steep learning curve. But QuickBooks does offer a good multi-user and remote user experience.

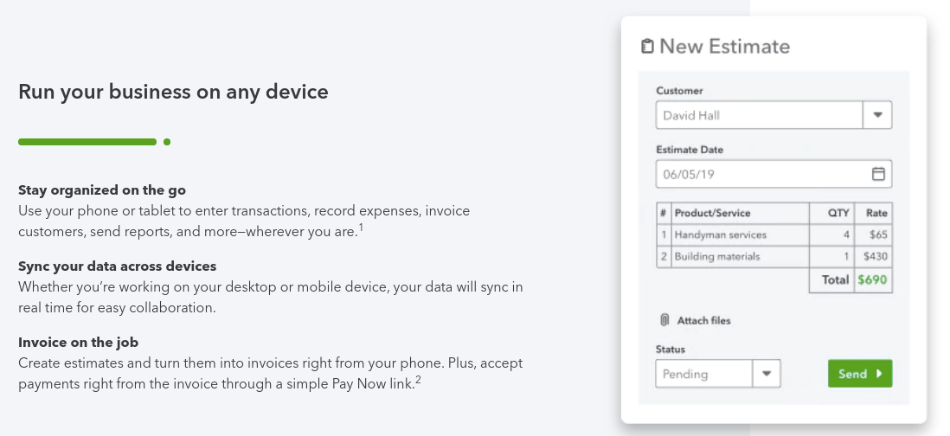

4. Mobile Apps

Winner: QuickBooks. GnuCash doesn’t have an integrated mobile app. QuickBooks does. If you want to manage your accounts on the go, there’s only one choice.

5. Integrations

Winner: QuickBooks. GnuCash integrates only with one software, Quicken. QuickBooks integrates with hundreds.

6. Customer Support

Winner: QuickBooks. GnuCash doesn’t offer a support package. QuickBooks does. It also has a huge amount of online resources – education, FAQs, video tutorials, and how-tos.

7. Setup

Winner: QuickBooks. You can set up QuickBooks relatively easily on any computer that runs a browser. GnuCash needs to be installed on your machine first, and it can be tricky to configure it right; if you’re not a geek, you may find it frustrating.

8. Reports

Winner: QuickBooks. This isn’t a surprise. QuickBooks is really, really good at reporting. GnuCash has a way to go to compete.

Short Verdict

Our big winner is QuickBooks Online. It does everything that a business needs and it can keep growing alongside your business, adding integrations or a higher functionality package as and when you need it.

But if you’re really strapped for cash, GnuCash might fit the bill. It is genuinely free and it offers enough functionality to keep your business accounts shipshape.

1. Features

Both these programs are built on top of a double-entry accounting system. You won’t see it in QuickBooks unless you look under the hood, but it’s more visible in GnuCash. While it’s possible to keep simple business accounts without double entry, we think you need double-entry – and your accountant will probably tell you so too.

But in terms of the functionality offered, GnuCash and QuickBooks are rather different. Let’s look at GnuCash first.

GnuCash is very simple. Its original mission was to compete with Quicken as a personal finance management system, but it has expanded its scope to include business features as well. So you’ll find it can handle your brokerage accounts, home loan, and investments, as well as invoicing and expense tracking. It also offers multi-currency support.

Until just a couple of years ago, GnuCash wasn’t a contender in business accounting. But it’s added more and more features, and it’s done so quite fast.

It can link to your bank account and do bank reconciliations, saving you the hassle. And it’s quite good at invoicing and managing customers; you can add credit limits to each customer, give them discount rates on their orders, and so on. The program will also help you calculate the appropriate sales tax. You can track quantities of items sold and adjust pricing levels within the program, too.

On the expenses side, GnuCash has robust functionality. You can print checks out from the program, and track your expenses under various headings. It even sends you bill payment reminders.

Accounts receivable and accounts payable (customers who owe you money, and bills you need to pay) are well managed. That’s often where small businesses need a helping hand – if you’re focused 100% on marketing and sales, it’s easy to forget that as well as closing the sale, you need to collect your money.

It also offers recording and tracking for employee costs, though it doesn’t offer a full-service payroll system (practically no account software does). And it handles backups well, so as long as you don’t trash your hard disk, you’re never going to lose your data.

But GnuCash has a downside. One that will exclude it from consideration by many freelancers and service businesses is that it doesn’t include time tracking or billable hours. It also doesn’t have full support for inventory; though it accounts for inventory items, it won’t let you track how much inventory you have on hand.

Because it’s a desktop installed software, you don’t get multi-user or remote capability. And the killer? There’s currently zero tax support. If you’re a small business owner or freelance, the last thing you want is to have to do your accounts all over again when it comes to tax time. Given GnuCash’s origins in personal finance, we would have expected it to do better here.

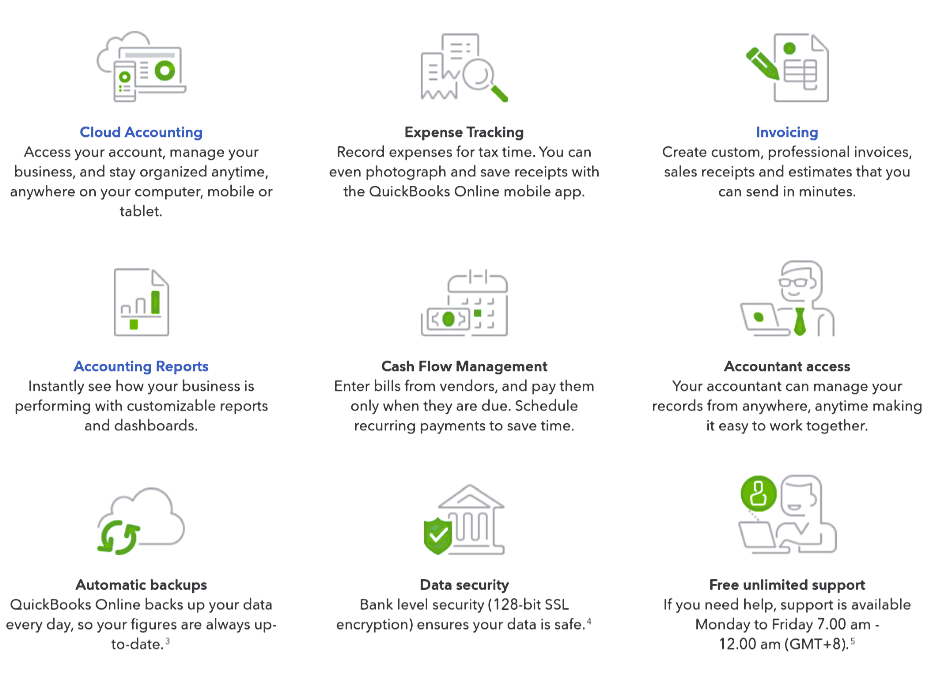

Compare QuickBooks, and you find that almost all the gaps are filled, though to get the full functionality, you may need to move up to one of the higher-priced packages.

QuickBooks is much better at asset accounting. For instance, if you have fixed assets used in the business, it will handle depreciation. With the higher priced plans, it also offers really good inventory tracking and management, a godsend for retailers, e-commerce, and manufacturing companies.

QuickBooks also integrates your payments with your accounts system. For instance, it will process credit card payments from your customers, or it can connect to Paypal. That’s a feature well worth having. It also supports recurring payments and invoices, though the way it forces you to create the transaction first as a one-off, and then label it recurring, is a bit clunky.

Budgeting is a strong feature with QuickBooks. You can make monthly budgets for up to five years, and the system will track your performance against budget. This is full business budgeting, which you can use to drive your business forward – while GnuCash offers a budgeting function, it’s still struggling to emerge from a household budget style that focuses on your regular outgoings.

And thank goodness QuickBooks has full tax support, including suggestions for maximizing your tax deductibles and tax reports for your accountant. It may have helped that QuickBooks’s owner Intuit also owns leading tax software TurboTax – and the two integrate directly, which can save you lots of time when you need to file.

GnuCash continues to build in new functionality. But because it’s open-source, how fast new functionality arrives depends on how many developers feel impelled to add it. There’s no centrally driven strategy, so you can’t depend on features being implemented. Of course, if you happen to work in IT and you fancy implementing them yourself, you’re very welcome to do so!

Winner: by a country mile – QuickBooks

2. Pricing

GnuCash is free. That’s it!

You have to pay for QuickBooks. It charges a monthly subscription, with four different levels of pricing depending on the number of users you want to be able to access the system and the functionality you need. The simple start is intended for single-user businesses, and limited to 250 accounts; if you want the advanced inventory and job profitability functions that make QuickBooks so powerful for managing businesses, you’ll need to leapfrog up to the Plus level at $70 a month.

QuickBooks packages

| Plan | Price per month | Users |

| Simple start | $25 | Single user and limited to 250 accounts doesn’t include bill pay, multi-currencies or sales quotes |

| Essentials | $40 | Up to three users doesn’t include inventory management or job/project profitability tracking |

| Plus | $70 | Up to five users plus your accountant |

| Advanced | $150 | Up to 25 users |

In normal times, QuickBooks has usually given a 50% discount for the first three months of a new contract. Under lockdown, that’s just increased to 70%. There’s a 30-day free trial, too, so you can test the system and see if it earns its keep.

Winner: GnuCash – you can’t argue with free.

3. Ease of Use

In our view, this is an area where GnuCash does poorly. Open it up, and it looks just horrible. The user interface is a step up on a command-line interface, but frankly, it feels distressingly dated. It has the feeling of not being far removed from an Excel spreadsheet. Unlike many systems, it tends to use accounting terms rather than talking business, and it doesn’t feel particularly intuitive.

It’s not exactly difficult to use, but let’s say it doesn’t give you many hints or tips. Budgeting, in particular, is quite tricky to do, and the fact that the double-entry accounting is up close and personal means you’ve got quite a steep learning curve to cope with. Compared to market-leading accounts software, a lot more manual steps are required, for instance, categorizing your transactions – there’s some automation, but it’s not faultless.

However, GnuCash is a pretty robust solution. Earlier versions were buggy and crashed frequently, but the software is now reliable and does exactly what it says on the tin, every time.

GnuCash’s big downside for some businesses will be that it’s limited to a single user. That’s part of the design, so there’s no getting over it. On the other hand, with QuickBooks Online, you can move up from single-user to a multiple user package very easily. Because QuickBooks is a cloud service, you can get access to your accounts from any computer that has internet access and runs a major browser.

QuickBooks, like GnuCash, has one of the steeper learning curves in the business. However, that’s partly because it has really incredible functionality. More choices mean more steps. If you want a no-frills system that just lets you issue invoices and pay bills, there are easier ways to do it.

But QuickBooks is very customizable, so once you’ve set it up the way you want, it will play nice.

To be honest, if you’re looking for software that’s really easy to use you should look at Wave, Zoho Books or Freshbooks. These are two apps that will take time to learn.

Winner: QuickBooks.

4. Mobile apps

GnuCash has an app for Android users, available through the Google Play store. But if you own an iPhone, you’re out of luck. And the Android app isn’t as useful as it looks, because it was a separate project, not an integral part of GnuCash – it simply lets you record transactions on the go, and export them in a format GnuCash could understand.

There’s no cloud access to GnuCash, either. You could put your data on Dropbox or another file sharing service and use it from other computers, but you can’t have two GnuCash instances running the same file at the same time – your files will be locked.

So if you’re a road warrior or want your accountant or other team members to access your accounts remotely, that’s tough. You’ll have to go back to the pre-1990s world of paper print-outs and Excel spreadsheets.

QuickBooks has mobile apps for both Android and iOS. They don’t offer the full functionality of the application, but they let you issue invoices and scan in expenses receipts on the go. They’ll automatically be filed in the right place in your accounts.

Winner: QuickBooks.

5. Integrations

GnuCash does cover most of the basis in terms of the operating systems it supports: Windows, Mac, Linux, and Solaris. But in terms of integrations, it’s really disappointing; it has just one – Quicken.

If you want to track your time or manage your inventory, you’ll need to use a separate application, and then export the data or copy it over. And that’s the sort of system where mistakes start to happen.

QuickBooks, on the other hand, is the past master of integration. It integrates with other Intuit products like Payroll (though using TurboTax requires a little workaround), and with hundreds of other software applications such as inventory management, project management, CRM, and direct mail. That’s not just useful to you now, should you want or need to integrate a particular software, but it gives you a strong element of future-proofing if at some stage you decide you need to up your game.

Winner: QuickBooks.

6. Customer Support

Open-source software isn’t noted for its strong customer support, and GnuCash s no exception. Support is limited – there’s a wiki, there are a number of tutorials, and there’s a concepts guide, together with in-application help. But if you hit a problem, you’re on your own.

A number of external sites feature help on using GnuCash, but they’re not maintained by the GnuCash developers and could be out of date.

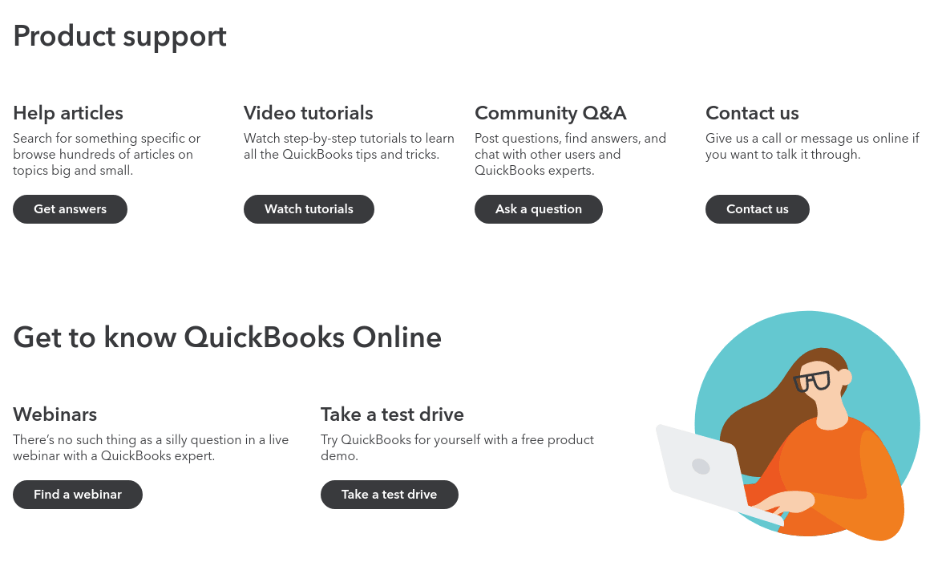

QuickBooks, on the other hand, like any major software company, has a plethora of support resources. Part of what you’re paying for is live support during extended business hours (not 24/7, but it is open at weekends), by phone, chat or email. There’s also a huge user community, including trainers, accountants, and bookkeepers, and loads of online resource hosted by QuickBooks.

Video tutorials, webinars, FAQs – you name it, you’ve got it with QuickBooks.

Winner: QuickBooks.

7. Setup

QuickBooks‘ setup process is actually one of the easiest processes to carry out. You can choose to set up only the parts of the system that you actually need to use. Because it’s cloud-based, no installation is required – you simply need to enter your company information and make a few choices about how you want the accounts to work.

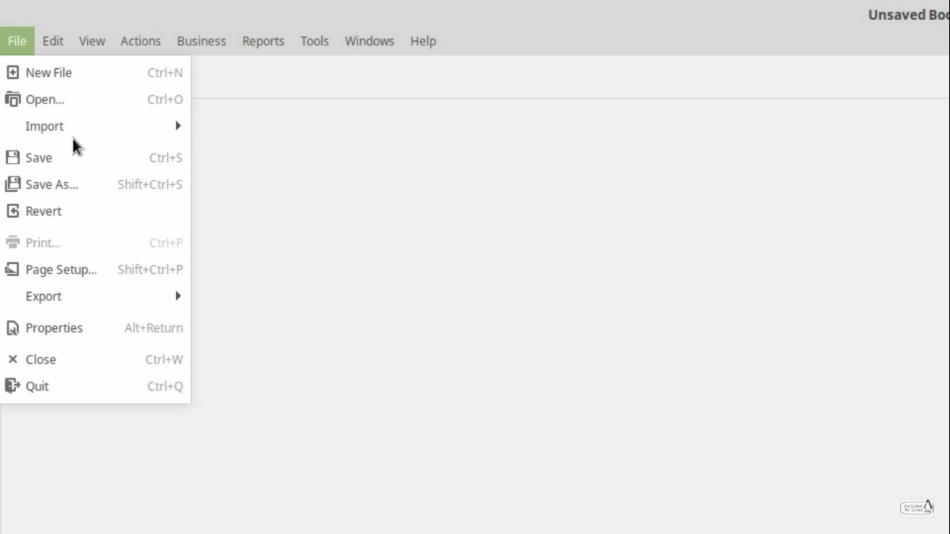

GnuCash, on the other hand, has to be downloaded and then installed on your computer. The process is rather fiddly, particularly if you run Linux. You can import data from Quicken QIF files, but while this helps personal finance customers, it’s less useful for business accounts.

An assistant helps you through the process, and there’s a default chart of accounts which you can modify later. But it all takes time, and you’ll also have to set up separate accounts receivable and accounts payable categories yourself, as they’re not automatic.

Winner: QuickBooks.

8. Reports

GnuCash used to be terrible at reporting for business. It has got a lot better; more than 60 reports now let you get a lot of top-level business information out of the system. It’s actually a lot better at this most other free or even low-priced accounting apps.

But oddly, though you can export to PDF or HTML, there’s no Excel option. And customizing reports isn’t easy – in fact, you may need to hack the system a bit to get what you need.

QuickBooks remains one of the best accounts packages when it comes to reporting. You’ll get more reports with the higher-level price packages, but even starting at the bottom level, it has robust functionality and a large number of reports. You’ll get profit and loss and balance sheet reports, aged receivables, job profitability, unpaid bills detail, banking reports, and reports for your accountant.

Winner: QuickBooks.

Final Thoughts

GnuCash is trying hard and has really made some progress in the last few years, but it’s still a system with a lot of gaps and provides a clunky user experience. It has to be installed on a single machine and has no single user or remote access capabilities, and it doesn’t deliver functionality like billable hours or project management.

Lack of integrations also makes it hard for you to fill the gaps by using other software programs.

It would be easy to be churlish and say, “You get what you pay for”. GnuCash is free, but it does deliver a system that works. Unfortunately, we think only a minority of small businesses will be happy with it – though some undoubtedly are.

QuickBooks, on the other hand, offers everything a growing business needs – though you do have to pay for it. Unfortunately, although GnuCash makes a good effort, it simply can’t compete with QuickBooks, particularly when it comes to mobile access, reporting, and – really crucial for many small business owners – fast, responsive support.