(Last updated on January 9th, 2023)

Expensify or Receipt Bank? Which expense management application is better in 2023?

Read this in-depth Expensify vs. Receipt Bank comparison to make a wise decision.

Expense management is a huge job that can sneak up on you when you’re growing your business. When you start out, just popping your receipts in a shoe-box will work just fine, though once in a while you (or your accountant) will have a day or two ruined by trying to read months-old receipts and work out what the cost relates to, and if it’s tax deductible.

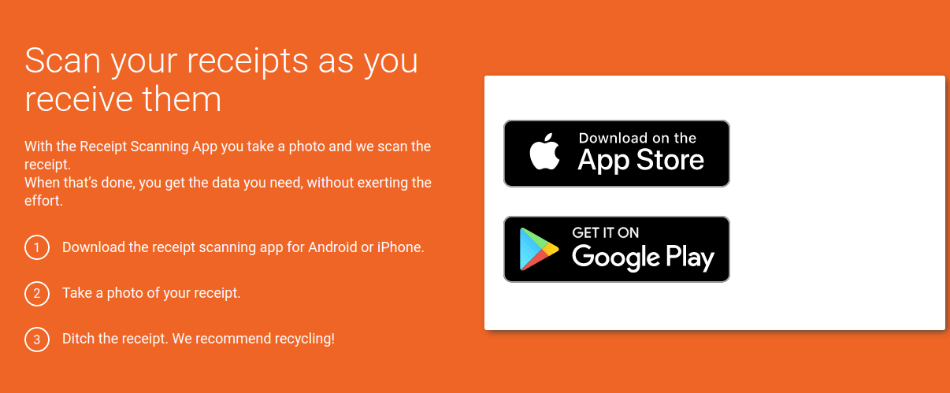

Once you’ve got a few people working for you, it gets steadily more difficult. That’s where applications like Receipt Bank and Expensify come in. They’ll accept scan, email, or photo input for receipts, read the information through a sophisticated OCR (Optical Character Recognition), and in many cases automatically post the data to your accounting system. That takes a lot of work off your back.

But Receipt Bank and Expensify have slightly different approaches to the job. And you may find you get more mileage out of one than the other. So we’ve compared the two, to get a feel for how they tackle turning your receipts and bills into transaction data, and what added value they offer.

Read on to find out how they stack up.

Expensify vs Receipt Bank: Comparison At a Glance

1. Features

Winner: Expensify. Receipt Bank not only turns paper receipts into digital data, it can also aggregate your bills from utilities and other vendors. But Expensify goes further to manage your entire expenses process, from policies and approvals to reimbursement.

2. Pricing

Winner: Tie. Both applications offer a number of different packages with tiered price and functionality.

3. Ease of use

Winner: Tie. Both Expensify and Receipt Bank are easy to use both for the administrator or manager, and for individuals inputting their receipts and other expenses.

4. Mobile Apps

Winner: Expensify. Mobile apps are a strong point for both contenders – simple and well designed apps which do what it says on the tin. But Expensify adds some extra functionality, such as time and mileage tracking.

5. Integrations

Winner: Expensify. You’ll get good integration with many accounting systems from both of these applications. Expensify adds receipts integrations, taking data from apps like Uber, Lyft, and Hotel Tonight. Frequent travelers will get a lot out of these integrations.

6. Customer Support

Winner: Receipt Bank. Both companies offer customer support within the application. Receipt Bank gets better reviews from its customers, so we award it this category.

7. Setup

Winner: Tie. Neither application is difficult to set up, though a little attention needs to be paid to creating user rules and ensuring the integration with the accounting system works well. Once you’ve set up the system, mobile apps work out of the box.

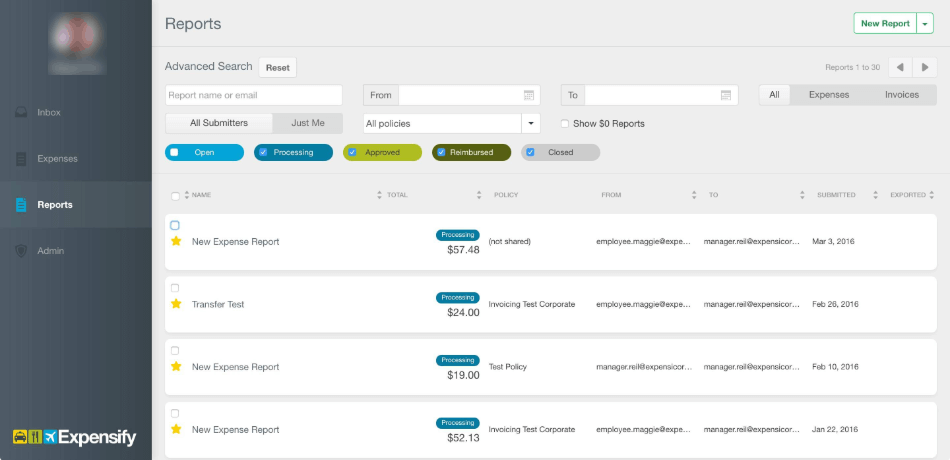

8. Reports

Winner: Expensify. Receipt Bank is really there just to pass through the data to your accounts system, where you’ll be able to get your report. Expensify provides more reports within the application, though configuring custom reports can be tricky.

Short Verdict

Receipt Bank is good software. It does exactly what it says on the tin and can save you a lot of time spent on manual data entry. However, it’s not a fully-fledged expense management application.

Expensify offers extended functionality. You can administer policies and multi-level approvals using the application, as well as enabling employees to log their expenses. For growing businesses which haven’t got as far as having an HR department, this takes a lot of weight off managers’ shoulders.

Expensify also integrates to numerous travel applications and can import receipts directly, whether from an Uber ride or from a hotel room or air fare booked through one of the integrated operators. For road warrior business owners this can be a real godsend. There’s only one thing better than being able to input a receipt via your smartphone, and that’s not needing to input at all!

That’s why we choose Expensify. It just goes the extra mile.

1. Features

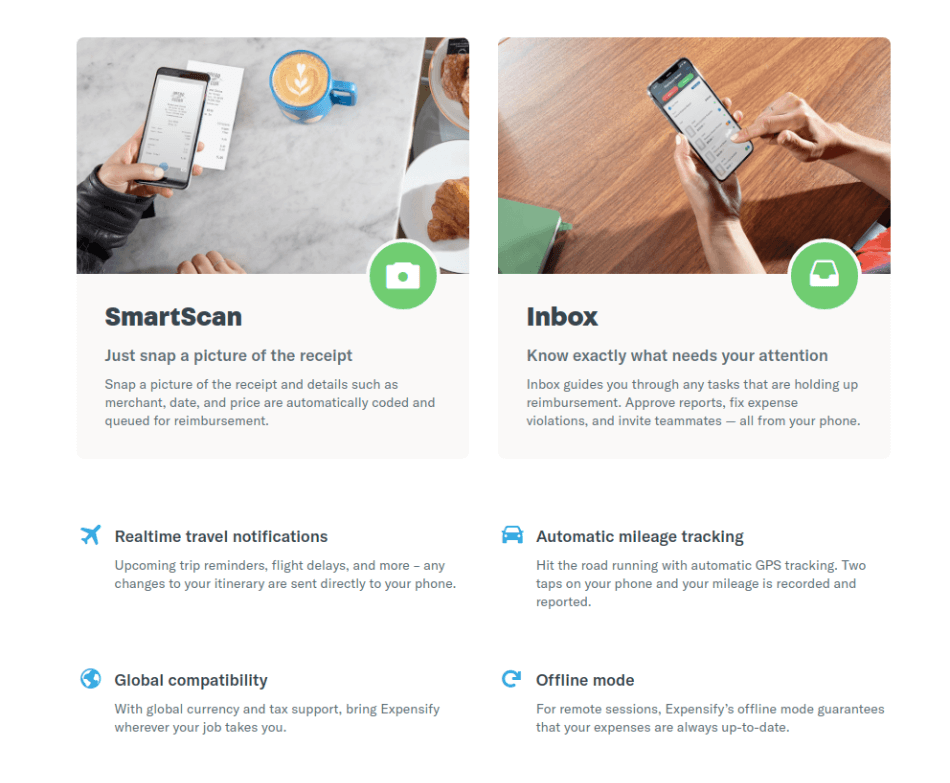

Expensify has a huge number of input methods. It can synchronize with your corporate credit cards to capture transactions; receipts can be scanned into the system via smartphone. It will also pick up transactions in travel apps like Uber and Trainline.

That’s pretty much all the pre-accounting data input sorted. But there’s a lot more to Expensify than that. It lets you set up policies and administer approvals – as well as tracking any violations of your expenses policies. It also allows you to reimburse employees by direct deposit, automatically. That can free up your time if you’ve previously been writing checks or making individual one-off payments.

Expensify also uses machine learning to improve its efficiency. It learns where particular vendors’ invoices or receipts need to be filed, for instance, and matches receipts automatically to the correct transaction categories. It can automatically spot duplicate receipts, if someone has filed a receipt twice in error. Automation is one of the application’s major strengths.

It also enables time tracking, which is great news for businesses that use hourly paid contractors. You can administer per diem limits, track mileage and hours,and even organize travel itineraries within Expensify.

And it supports multiple currencies.

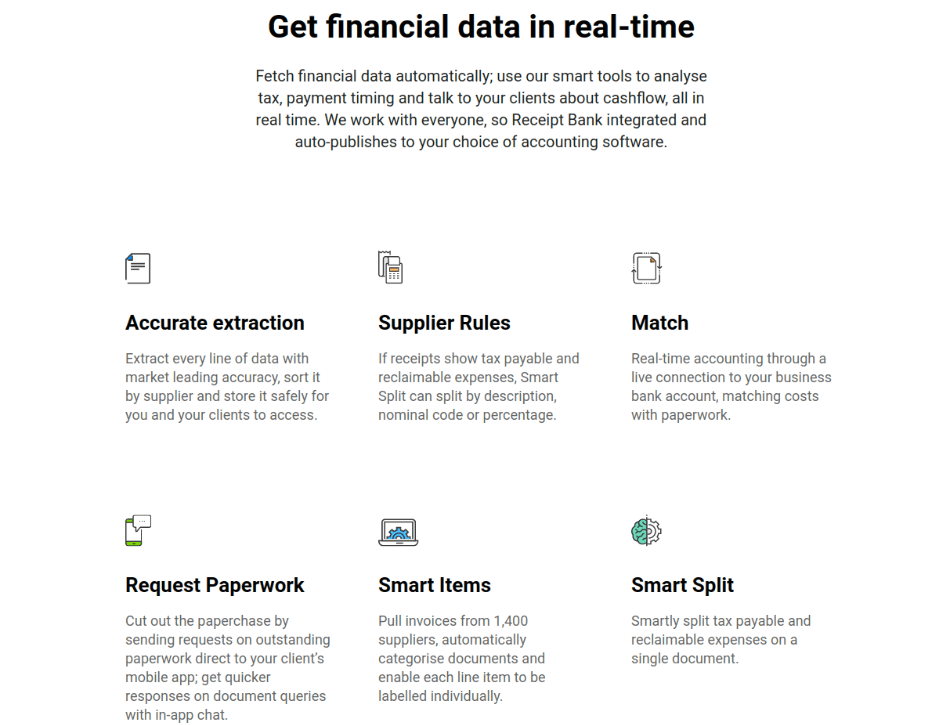

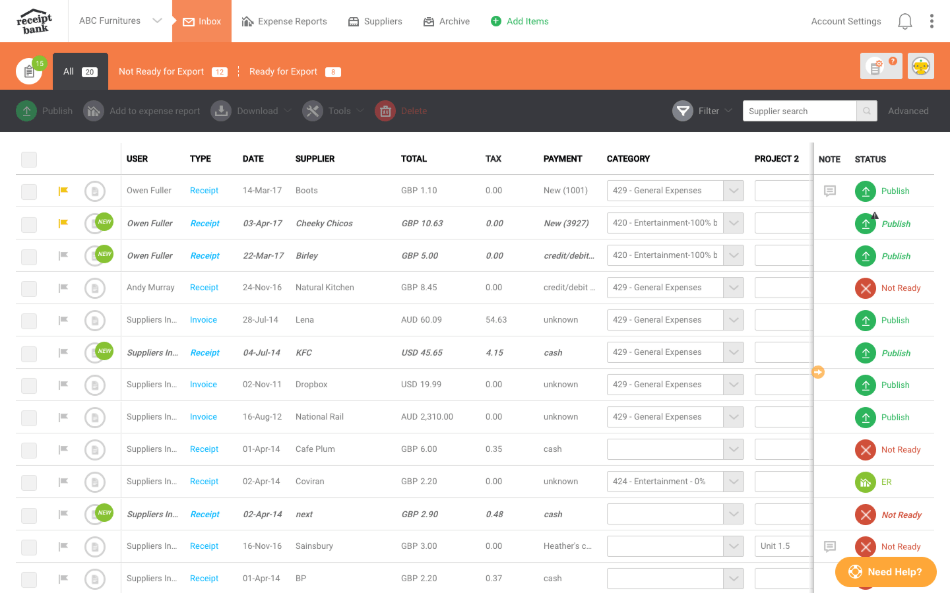

Receipt Bank offers similar input capability, and adds automatic data extraction from bank statements (with the higher priced plans) as well as drag-and-drop to the browser. It has a sophisticated line-item extraction feature so that you can split a receipt, which is useful if receipts contain items for different projects or in different tax categories. You can add splits and labels before exporting (‘publishing’) to the accounts software.

That said, high quality OCR and machine learning enable Receipt Bank to perform much of its job automatically. Spend a little time on setting up your supplier rules, and you’ll be able to get up to 80% of receipts automatically processed.

Like Expensify, Receipt Bank works with multiple currencies. It also links to Tripcatcher to get automatic mileage – Expensify has a mileage calculator on its mobile app. And while Receipt Bank doesn’t do reimbursement, it integrates with Gusto payroll to handle the task.

Receipt Bank can also help you import your bills from utilities, telecoms and other providers. Simply integrate your account with Receipt Bank and it will do the work automatically. This is really quite neat – you can use Receipt Bank as a sort of aggregator, bringing all your bills together, and you never need to log on to your vendor accounts separately. (This is one function Expensify doesn’t have.)

You can manage approvals through Receipt Bank, too, using Expense Approver. But it’s not so helpful where building your expenses policies into the system is concerned.

Receipt Bank doesn’t deliver travel integrations the way Expensify does, although it does link to Tripcatcher. It’s more limited to the pre-accounting job of transforming bills and receipts into accounts-ready data. You’ll have to carry out all the clever stuff in your accounting software.

One factor that’s important with this kind of software is user permissions. Both these applications offer flexibility so that you can give users only the functionality they require, while reserving top-level reporting and approvals to business managers.

Winner: Expensify

2. Pricing

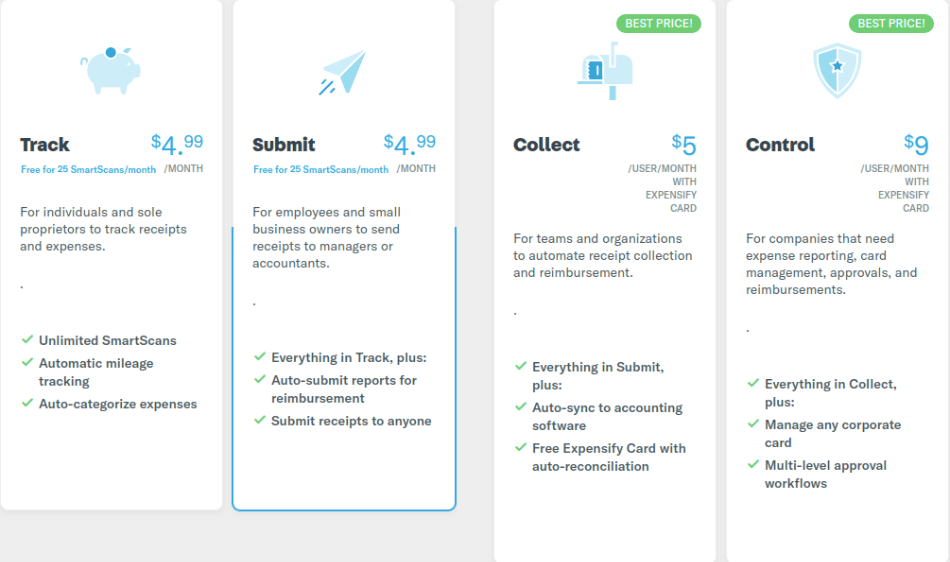

Both Expensify and Receipt Bank have a tiered pricing system that allows businesses to choose the level of functionality that they require. Expensify also offers a limited free plan, that may be of interest for smaller businesses, freelances and solopreneurs.

Expensify also offers a discount on its higher priced packages for businesses which are willing to sign up to the Expensify credit card for their corporate expense payments. ‘Collect’ adds auto-sync to accounting software and full reconciliations, and if you use the card, it costs exactly one penny a month more than the less functional Track and Submit packages. That’s the best penny’s investment you’ll ever make, in our view!

| Plan | Pricing per user per month | Functionality |

| Free | Free | Up to 25 Smartscans/month., other functionality as for Track or Submit |

| Track | $4.99 | Mileage tracking, auto-categorize: freelance or solo entrepreneur |

| Submit | $4.99 | Same as Track but for multi-employee businesses: submits receipts to manager / accountant |

| Collect | $5 with Expensify card $10 unbundled | Adds auto-sync to accounting software, reconciliations |

| Control | $9 with Expensify card $18 unbundled | Adds corporate card management, approval workflows, HR/ERP integration |

To benefit from the bundled fee, 50% of more of spend must be on the Expensify card.

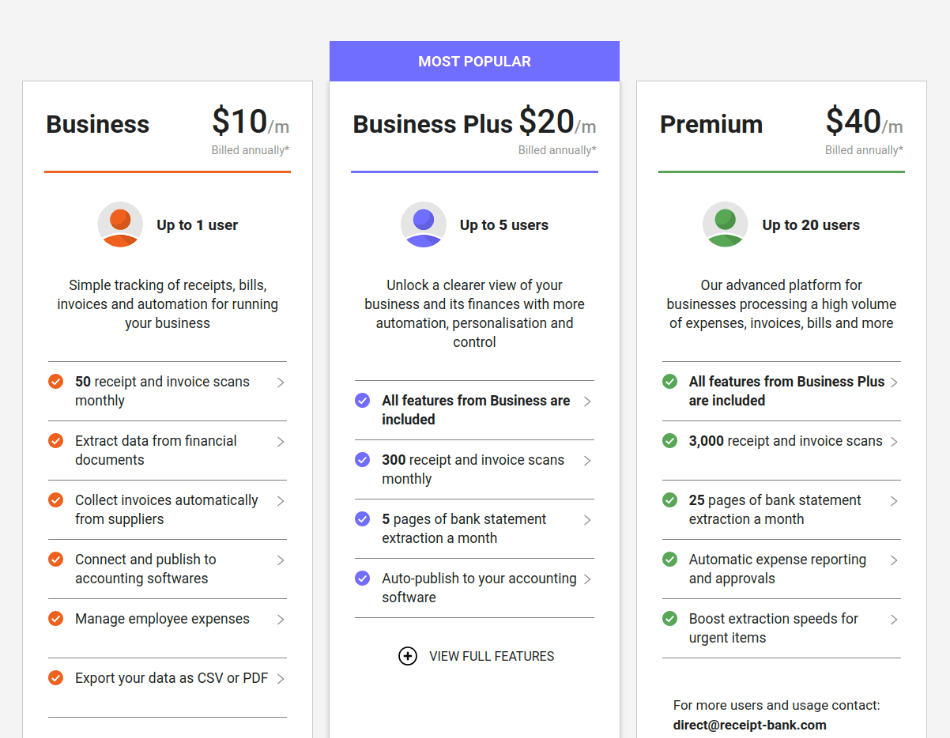

Receipt Bank prices are based on the number of items processed each month as well as the number of users. The ‘Business’ package is quite limited, with a single user, though it offers twice the number of items that you get with the free Expensify package. Businesses which grow above the capabilities of the Premium package don’t have to look for another software application – Receipt Bank will quote an on-demand price.

| Package | Price $/month | Users | Items |

| Business | 10 | 1 | 50 |

| Business Plus | 20 | 5 | 300 |

| Premium | 40 | 20 | 3000 |

Receipt Bank costs in for multiple users – but on the whole we believe Expensify offers better value for money if you need a complete expense management system rather than just a pre-accounting application with smart automation. If you just want to handle receipts and bills, Receipt Bank is your better bet.

Winner: Tie

3. Ease of Use

Expensify’s workflow is very intuitive and easy to use. If you have not needed to administer staff expenses before, and your business hasn’t got big enough to have an HR department, that’s really good news. It’s quite simple to set up policies and approvals.

The SmartScan mobile app makes it very easy for staff to submit their expenses and upload receipts, so you’ll find that when it comes to expense filing, compliance and timeliness improves.

The only issue with Expensify is that the links to banks and credit card links sometimes get out of sync and the whole thing stops working. Customers have reported that it can be quite difficult to get back on track.

Receipt bank opens on a dashboard that makes it easy to see if any receipts need your attention. The summary enables you to export receipts that don’t need your intervention straight through to your accounts package, streamlining your workflow and giving you time to concentrate on the problem items. You can clearly see whether a receipt has already been published to your accounting software, or not.

The mobile app for submitting expenses is really streamlined and simple to use.

Ease of use is enhanced by the machine learning ability of both packages. They will automatically suggest where a given item should be posted, saving you time and effort.

Winner: Tie

4. Mobile apps

Both applications have apps on iPhone and for Android devices.

Expensify’s mobile app is simple to use and the interface is well designed. It offers mileage tracking by GPS, as well as receipt input, and can also be used (subject to the right user permissions) to approve expenses.

The only downside is that it can reputedly be buggy. Users who have tried to upload a lot of reports at the same time are sometimes frustrated with it.

Receipt bank has an even simpler app. It takes just seconds to input a receipt.

However, it doesn’t have the same added functionality as Expensify.

Winner: Expensify

5. Integrations

Expensify integrates with the major accounting systems but also with other business systems such as payroll and time management. It is able to export your data straight into QuickBooks, Xero, Sage, Intacct, or Oracle Netsuite. It can also integrate with Gusto payroll, Workday, and TSheets.

Expensify also possesses a whole batch of receipt integrations, which include hotels (Hotel Tonight), taxis (Uber, Lyft), parking (Parkwhiz) and others. Trainline, Roomex, AirPlus, TravelPerk and Tripcatcher can all be linked to your Expensify application. If your staff use these systems to book their travel, Expensify will catch the expense automatically – and will also check whether the expense is in line with your policies.

Receipt Bank doesn’t have the same receipt integrations, and that means you can’t automate quite as much of the process. It does integrate with Tripcatcher to catch mileage. As far as accounting integrations are concerned, it has an expansive roster of accounting software that includes QuickBooks Online, Xero, SageOne, and Freshbooks, as well as Gusto payroll.

We think receipt integration is well worth having – and that means we’re awarding this category to Expensify.

Winner: Expensify

6. Customer Support

Expensify provides good support for paid plans in the onboarding phase, but ongoing support is rather limited. There’s an online chat support service, but response can be slow, particularly when you hit the end of the month and all Expensify’s customers are logging on to support at the same time.

As we mentioned, credit card sync can be a weak point and if things go wrong, it’s sometimes difficult to get them fixed – support seems rather hit-and-miss here.

Receipt Bank has excellent customer service – perhaps because it works a lot with accounting professionals and bookkeeping firms who keep it on its toes. Support is provided within the web app and from inside the mobile app as well as on the Receipt Bank website. User reviews are complimentary about the support provided.

Winner: Receipt Bank

7. Setup

You’re not going to have to get your sleeves rolled up to implement either of these programs, but a little thought and time invested in setting supplier rules and getting the integration with your accounts software to work seamlessly will bring greater returns in terms of automation and time savings.

Expensify is very easy to set up and get started if you only want to link up two or three users. If you have more, and want to set up a more sophisticated approvals process, you’ll need to take a bit more thought about how to implement and roll out the application, but Expensify provides help to do this.

In Receipt Bank you’ll also want to set supplier rules so that you can get items from vendors such as gas stations or utilities to auto-publish. Then you won’t have to intervene manually at all for these items; the bills or receipts will automatically go straight through to your accounts system.

Winner: Tie

8. Reports

Expensify has great reporting functionality, but it can be complicated to set reports up the way you want them. For some of the customization that’s available, you’ll end up getting quite close to actual computer programming in order to make it work. But once set up, the package will give you great insight into your expenses trends, and the reporting is really robust.

Receipt Bank doesn’t give you such good reporting features – you’ll need to use the reporting functions in your accounts package to get a sense of trends and be able to drill down. You will get quite robust employee expense reports, though, It’s a pity that Receipt Bank falls down here, as in many other categories it’s treading on Expensify’s tail.

Winner: Expensify

Final Thoughts

While your immediate requirement may be for a pre-accounting package that can get rid of tons of paper receipts and hours of tedious data entry, it’s worth thinking about how you manage your entire expenses process.

For instance, it’s much easier to implement an expenses policy if your software is able to police all expenses, or even deliver bookings that fit your travel policy. And if you can invoke automatic next-day reimbursement, both you and your employees are going to be happier than if you make them wait till you get a chance to go through the paperwork and sign a check.

That’s why we come down on the side of Expensify. Receipt Bank is great at what it does, and it will certainly save you a lot of time and boring manual data entry, but it doesn’t deliver the advanced features you get with Expensify. For instance, Expensify’s receipt integrations, reimbursement capability, and time / mileage tracking features, all give it the edge over its rival.

That said, Receipt Bank has been adding features over the past couple of years, and may end up moving into the expense management space – at which point it could become a much more interesting competitor.

FAQs

Yes, both these apps work with QuickBooks, as well as with other major accounting packages. There’s a little initial setup to do, but after that the majority of your receipts can be automated – freeing up your time for more useful activity.

Expensify makes money through offering a branded credit card to its customers, as well as through subscriptions. That’s why it can afford to offer a free version of the software.

Yes, they can. Because they extract tax information from receipts and pass it on to your accounting system, they will help you maximize your tax deductions. That will reduce the amount on which you are assessed for taxes.